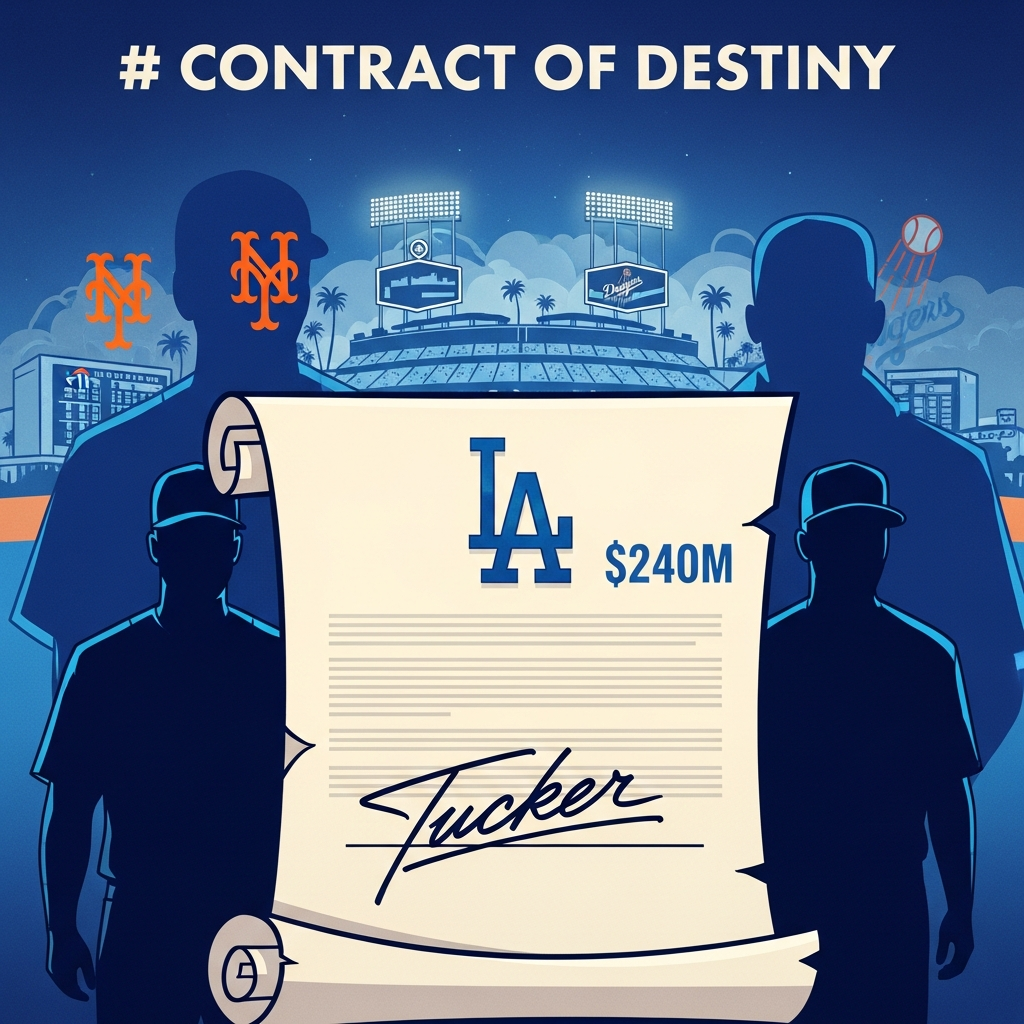

The high-stakes world of MLB free agency recently saw one of its biggest prizes, star outfielder Kyle Tucker, sign with the formidable Los Angeles Dodgers. This blockbuster move came despite a significant bid from the New York Mets. While the Mets reportedly tabled an offer of four years and $220 million, Tucker ultimately chose the Dodgers’ slightly larger four-year, $240 million package. This decision has sent ripples across the league, solidifying the Dodgers’ dynasty while underscoring a challenging offseason for the Mets. Understanding the intricacies of both offers reveals why Tucker opted for the West Coast.

The Mets’ Ambitious Bid: A Deep Dive into Their Offer

The New York Mets made a compelling pitch to secure Kyle Tucker, aiming to anchor their outfield with a perennial All-Star. Their reported final offer was substantial: four years and a hefty $220 million. This proposal from the Mets included several attractive features for Tucker and his representatives.

Specifically, the Mets’ offer reportedly featured a significant $75 million signing bonus. This immediate upfront payment would have provided immense financial security. Furthermore, the contract was structured without any deferred money, ensuring Tucker would receive his full compensation within the four-year term. It was also designed to be slightly frontloaded, with a substantial $120 million to be paid over just the first two seasons. The average annual value (AAV) for the Mets’ offer stood at an impressive $55 million. Crucially, it mirrored the Dodgers’ eventual deal by including opt-out clauses after both the second and third seasons, offering Tucker valuable flexibility to re-enter the market. Despite these favorable terms, the Mets fell short.

Why Tucker Chose L.A.: Money, Opt-Outs, and Championship Dreams

Ultimately, Kyle Tucker and his camp sided with the Los Angeles Dodgers. The Dodgers’ offer, while structurally similar to the Mets’ in terms of duration and opt-out provisions, presented a slightly stronger overall financial package and an immediate path to championship contention. Their winning bid totaled four years and $240 million.

The Dodgers’ deal did include $30 million in deferred money, spread across the final three seasons. However, even with these deferrals, the net present value (NPV) of the contract still calculated to an average annual value north of $57 million, slightly surpassing the Mets’ AAV. When considering the nominal AAV, the Dodgers’ $60 million per year stands as the second-highest in MLB history, trailing only Tucker’s new teammate Shohei Ohtani.

Beyond the raw numbers, Tucker’s decision reflects a clear preference for immediate competitive advantage. He joins a Dodgers team fresh off consecutive championships and poised as heavy favorites for another World Series title in the upcoming 2026 season. The opportunity to play alongside superstars like Ohtani, Mookie Betts, and Freddie Freeman, and to consistently contend for a championship, undoubtedly weighed heavily in his choice. While the Mets possess high-end talent, their recent history, including a second-half collapse and a tumultuous offseason, painted a stark contrast to the Dodgers’ consistent dominance.

Tucker’s Stellar Profile: The Talent the Mets Missed

Kyle Tucker is not just another outfielder; he is a four-time All-Star, a Gold Glove winner, and a consistent offensive force. His impressive career statistics highlight why he was considered the premier free agent available. Now entering his age-29 season, Tucker boasts a career slash line of .273/.358/.507, complemented by 147 home runs and 490 RBIs across 769 games.

Since becoming a full-time player in 2021, Tucker has averaged over 5 Wins Above Replacement (WAR) per season. He has never hit fewer than 22 home runs in a full season, and his OPS+ (On-Base Plus Slugging Plus) has remained exceptionally high, never dropping below 147. His balanced skillset includes powerful hitting, a disciplined plate approach, and strong defensive capabilities, earning him multiple Silver Slugger awards. In his most recent season with the Chicago Cubs, Tucker hit 22 home runs and posted a .266/.377/.464 slash line across 136 games. Despite two stints on the injured list for a calf strain and a hand fracture, he earned an All-Star berth and played through pain during the Cubs’ postseason run. His proven postseason pedigree, consistent production, and star presence made him an ideal target for any contending team.

Mets’ Tumultuous Offseason: A String of Disappointments

For the New York Mets and their loyal fanbase, the Kyle Tucker saga is merely the latest blow in what has been a genuinely brutal offseason. Coming off a disappointing season where a $341 million payroll team collapsed and missed the playoffs, fan frustration is palpable. The team has seen a string of significant departures, with minimal high-impact additions to compensate.

Key departures include franchise cornerstone Brandon Nimmo, who was traded to Texas. Home run leader Pete Alonso signed a five-year, $155 million deal with the Baltimore Orioles. Even closer Edwin Díaz, a fan favorite, opted for a three-year, $69 million deal with the Dodgers, a move that the Mets couldn’t even counter after reportedly offering $66 million. Longest-tenured player Jeff McNeil was also traded to the Athletics. These moves suggest a substantial roster overhaul, not necessarily for the better.

The Mets’ additions have been modest in comparison. They acquired second baseman Marcus Semien in the Nimmo deal and signed former Mariner Jorge Polanco, who has almost no MLB experience at his new projected position of first base. The bullpen, which lost Díaz, Tyler Rogers, and Ryan Helsley, was reinforced with former Yankee relievers Devin Williams and Luke Weaver. Mets owner Steve Cohen’s public anticipation, followed by the actual outcome, only amplified the disappointment. President of baseball operations David Stearns openly acknowledged the fanbase’s frustration, stating his understanding of the sentiment.

The Aftermath: Mets’ Urgent Search for Outfield & Pitching Help

With Kyle Tucker off the board, the New York Mets face an urgent need to pivot, particularly in left field where the Nimmo trade created a void. The team now looks to other top free-agent outfielders, with Cody Bellinger emerging as a primary target. Bellinger, who spent last season with the Yankees, is reportedly drawing interest from his former team with a five-year offer in the $155-160 million range. However, his agent, Scott Boras, is reportedly pushing for a seven-year commitment. Pursuing Bellinger would require the Mets to reverse their recent aversion to long-term contracts.

Beyond Bellinger, everyday outfield options in free agency are scarce. Harrison Bader, a glove-first center fielder who had a middling season with the Mets just two years prior, is one of the few remaining. However, the Mets may not view him as a significant upgrade over Tyrone Taylor, nor does he offer the middle-of-the-order bat they sought in Tucker. The club could also explore aggressive trade scenarios for players like Jarren Duran or Lars Nootbaar. Acquiring Duran from the Red Sox, for instance, would likely involve parting with one of the Mets’ talented young starting pitchers alongside immediate infield help like Brett Baty or Mark Vientos. Additionally, with “unused Tucker money,” the Mets could shift focus to bolster their pitching rotation, with former Astros ace Framber Valdez reportedly still available on the market.

Dodgers’ Unstoppable Ascent: A Dynasty Strengthened

The acquisition of Kyle Tucker further cements the Los Angeles Dodgers’ status as the most dominant force in Major League Baseball. This move is more than just an offseason victory; it’s a strategic declaration. With Tucker, the Dodgers now project to have seven of the majors’ 29 biggest contracts by AAV in 2026, showcasing their unparalleled willingness to invest at the highest financial echelons.

Tucker is expected to slot into right field, a position where Michael Conforto struggled last season. This shift will allow Teoscar Hernandez to move to left field, where he played predominantly during the 2024 World Series season. Tucker’s exceptional bat, Gold Glove-caliber defense, and postseason experience provide an immediate upgrade and a middle-of-the-order force for an already formidable lineup. The Dodgers’ consistent ability to attract and sign top-tier talent, including Edwin Díaz earlier this offseason, highlights their “bet on now” philosophy. This signing reshapes the balance of power and extends their championship window, setting a new benchmark for success in modern baseball.

Looking Ahead: What This Means for MLB’s Balance of Power

The Kyle Tucker signing is a pivotal moment that will influence the trajectory of MLB, particularly in the National League. For the Dodgers, it reinforces their dynasty, solidifying their position as perennial contenders. For the Mets, it intensifies scrutiny on their front office and ownership as they navigate a challenging offseason. The market’s pivot towards shorter, high-AAV deals also signifies a new era in free agency, where players like Tucker “bet on themselves” to re-enter the market in their prime. This trend could also accelerate discussions surrounding a potential lockout after the 2027 season, as player valuations continue to skyrocket. Ultimately, Tucker’s decision highlights the complex interplay of financial offers, competitive aspirations, and team dynamics that define modern professional baseball.

Frequently Asked Questions

What were the key differences between the Mets’ and Dodgers’ offers to Kyle Tucker?

The Mets reportedly offered Kyle Tucker four years, $220 million, with a substantial $75 million signing bonus, no deferred money, and opt-outs after the second and third seasons. The Dodgers’ winning bid was four years, $240 million, also with opt-outs after the second and third seasons, but included $30 million in deferred money. While the Mets’ AAV was $55 million, the Dodgers’ adjusted AAV was slightly higher, exceeding $57 million, and their nominal AAV of $60 million was the second-highest in MLB.

How does Kyle Tucker’s move to the Dodgers impact the MLB championship landscape?

Kyle Tucker joining the Los Angeles Dodgers significantly strengthens their position as a dominant force in MLB, particularly in the National League. His addition bolsters an already star-studded lineup with a consistent offensive threat and Gold Glove defense, making the Dodgers even stronger contenders for future World Series titles. For the New York Mets, missing out on Tucker exacerbates a challenging offseason, highlighting their struggles to attract top talent and potentially altering the competitive balance by further solidifying their rival’s power.

What are the Mets’ next steps for their outfield after missing out on Tucker?

After failing to sign Kyle Tucker, the New York Mets are now prioritizing other options to fill their outfield void, especially in left field. Their primary target is likely Cody Bellinger, though the Yankees are also reportedly in contention, and Bellinger’s agent is seeking a long-term deal. The Mets might also explore trade opportunities for players like Jarren Duran or Lars Nootbaar, potentially offering talented prospects or immediate infield help. Additionally, with the financial flexibility from missing Tucker, they could pivot to signing a top-tier starting pitcher like Framber Valdez.

The Kyle Tucker free agency saga underscores the fierce competition for elite talent in Major League Baseball. While the Mets presented a compelling offer, the Dodgers’ blend of financial might and championship pedigree proved irresistible. This move has profound implications for both franchises, setting the stage for an intriguing season as the Dodgers aim to extend their dynasty and the Mets strive to redefine their path forward.