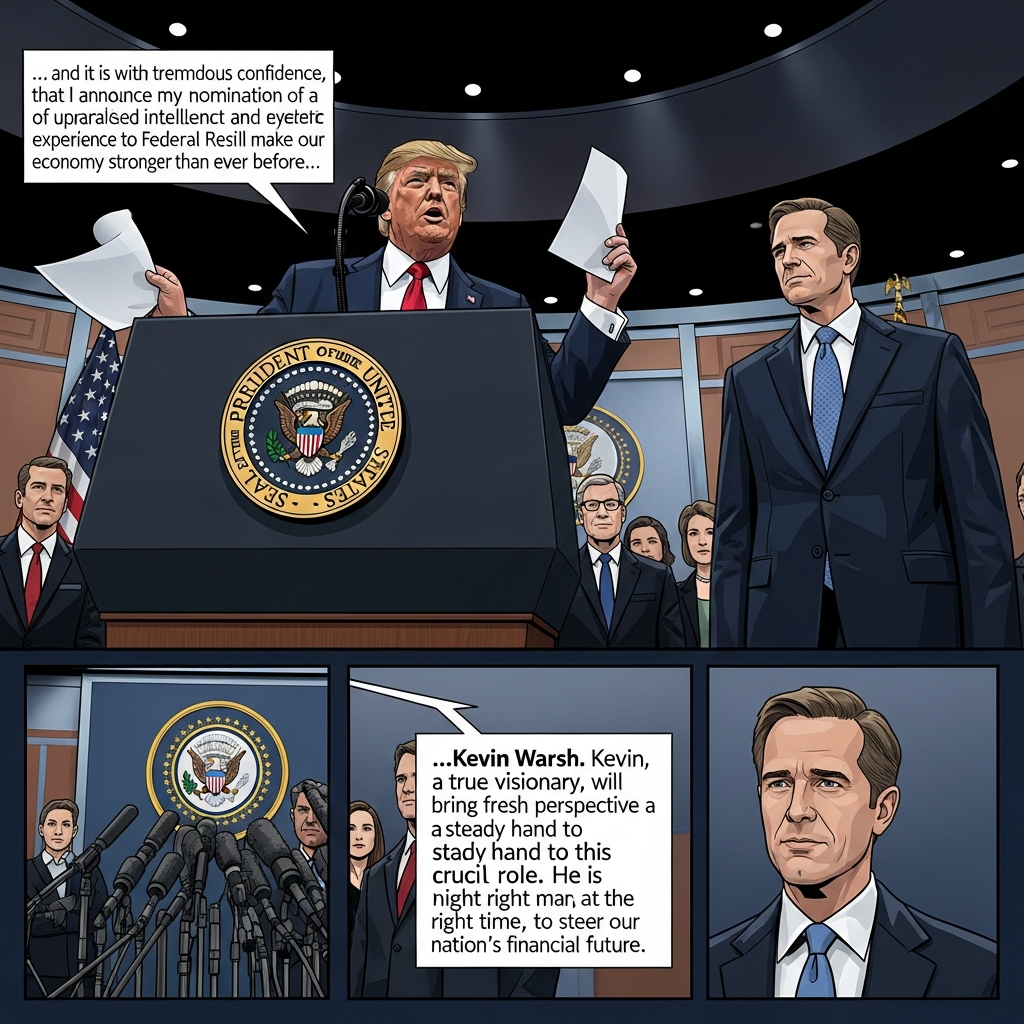

The financial world recently reeled from a dramatic announcement: US President Donald Trump confirmed his nomination of Kevin Warsh as the next chair of the Federal Reserve. This pivotal decision, unfolding amidst Trump’s long-standing feud with the central bank, sent immediate shockwaves through global markets. Gold and silver, after months of unprecedented highs, plummeted, while stock markets saw a noticeable pullback. Yet, paradoxically, this market turbulence was interpreted by many as an early vote of confidence in Warsh’s independence and the Fed’s future stability. This article unpacks the complex interplay of political drama, monetary policy, and investor sentiment that shaped this extraordinary market reaction.

The Trump-Fed Tangle: A Battle for Control

For over a year, President Trump has engaged in an open and often vitriolic conflict with the Federal Reserve and its current chairman, Jerome Powell. Despite Trump appointing Powell in 2017, their relationship quickly soured. The core disagreement centered on interest rates, with Trump repeatedly demanding faster and deeper cuts to bolster economic growth, a stance Powell resisted. Public attacks followed, with Trump labeling Powell a “clown” and openly threatening his dismissal.

Escalating Tensions and Threats to Independence

The dispute escalated beyond harsh words. Trump’s Justice Department launched investigations into Federal Reserve Governor Lisa Cook for alleged historical mortgage fraud and, more alarmingly, initiated a criminal probe into Chairman Powell himself concerning purported overspending on Fed office renovations. These allegations were largely dismissed by experts as baseless attempts to exert political pressure. Powell staunchly defended the Fed’s autonomy, asserting that interest rates are set for the public good, not presidential preference. His stance garnered significant international backing, with 14 central bank chiefs globally affirming that central bank independence is fundamental to price, financial, and economic stability. Historical parallels highlight the dangers: presidential interference with the Fed contributed to the stagflation crisis of the 1970s, and more recent interventions in Argentina and Turkey triggered severe financial downturns.

Enter Kevin Warsh: A Hawkish Perspective

Against this backdrop of conflict, Kevin Warsh emerged as Trump’s surprising pick. A former banker and Federal Reserve governor, Warsh also served as an economic advisor to both President George W. Bush and, initially, to Trump. Earlier speculation had pointed to Kevin Hassett, but concerns mounted that Hassett was too closely aligned with Trump, fueling fears about the Fed’s independence. Warsh, however, arrived with a strong reputation for independence and, critically, as an “inflation hawk.”

Understanding “Hawks” and “Doves” in Monetary Policy

The Federal Reserve’s primary responsibility is to manage US interest rates, balancing economic growth and employment against the imperative of controlling inflation. Lower interest rates can stimulate the economy but risk inflation, while higher rates can curb inflation but potentially slow growth and increase unemployment. Central bank independence ensures these delicate decisions are guided by evidence and long-term economic needs, free from short-term political pressures. An “inflation hawk” prioritizes combating inflation, often favoring higher interest rates, whereas a “dove” emphasizes economic growth and job creation, leaning towards lower rates. Warsh, during his previous tenure at the Fed, consistently displayed hawkish tendencies, even expressing greater concern about inflation than job recovery after the 2008 global financial crisis. This made him a curious choice, given Trump’s consistent calls for lower rates. While Warsh has recently voiced some criticisms echoing Trump’s views, the question remains whether his inherent hawkishness will reassert itself.

The Market’s Swift Reversal: Gold, Silver, and the “Debasement Trade”

The announcement of Warsh’s nomination triggered an immediate and dramatic market shift. Spot prices for gold plummeted 12% to approximately $4,786 an ounce, marking its steepest single-day loss in over a decade. Silver experienced an even more precipitous decline, plunging as much as 32% to around $80 an ounce, its sharpest fall since 1980. This significant correction followed months of record highs for both precious metals, driven by global instability, concerns over Fed independence, and a speculative bubble.

Unwinding the “Debasement Trade”

For months, markets had anticipated a Fed chair inclined to aggressively cut interest rates to support an “affordability push.” This expectation had weakened the US dollar by 11% over the past year, making hard assets like gold and silver more attractive. This phenomenon was dubbed the “debasement trade,” where investors flocked to precious metals fearing the dollar’s vulnerability to inflation, chaotic trade policies, and a politicized central bank. Warsh’s nomination, however, signaled a potential shift. His perceived hawkishness and commitment to Fed independence immediately boosted the US Dollar Index by nearly 1%. Market strategists quickly weighed in: Art Hogan of B. Riley Wealth Management attributed the sell-off to the dollar’s surge and investors’ desire to lock in profits after the “parabolic move” in metals. José Torres of Interactive Brokers described it as a “knee-jerk reaction” to hype and speculation. David Rosenberg noted that Warsh’s nomination prompted an “unwinding” of the debasement trade, indicating “less dovish” and more “orthodox expectations” for Fed policy.

Broader Market Responses and Global Ripples

The impact of Warsh’s nomination wasn’t confined to precious metals. US stock markets also saw declines, with the tech-heavy Nasdaq Composite dropping over 1%, the S&P 500 falling 0.43%, and the Dow Jones Industrial Average dipping 0.36%. This pullback on Wall Street was partly influenced by renewed concerns over extensive investments in artificial intelligence (AI), with some analysts fearing that company valuations were becoming “a little too stretched” after years of tech-fueled rallies.

A Mixed Global Picture

Globally, the reaction was more nuanced. While Asian markets generally closed with losses, following the US tech retreat, European stock markets registered gains. The US dollar, strengthening significantly against other major currencies, indicated investor confidence in a potentially more stable and independent Fed. Fawad Razaqzada of Forex.com suggested that Warsh’s appointment could be “good news for the dollar,” mitigating risks associated with a more dovish Fed. Even highly speculative assets like Bitcoin, which had seen a two-month low, faced ongoing volatility, as elevated inflation metrics challenged the “liquidity narrative” that often props up such assets with expectations of easier monetary policy. This underscores a divergence between theoretical expectations of rate cuts and real-world economic data. Amidst this broader market flux, individual companies like Verizon bucked the trend, surging nearly 12% on strong quarterly reports.

The Enduring Credibility of the Fed

The dramatic market reaction to Trump’s Fed chair pick ultimately underscores the profound importance of the Federal Reserve’s credibility, both domestically and internationally. The global dominance of the US dollar is a cornerstone of American economic hegemony. While Trump has often expressed skepticism about central bank independence, his nomination of Warsh suggests a recognition of the critical need to maintain the integrity of the US currency and the Federal Reserve as an institution.

The market’s interpretation of Warsh’s appointment as a step towards greater financial stability and potentially less inflationary pressure, despite his recent rhetorical alignment with Trump, speaks volumes. It indicates that investors prioritize a Fed that is perceived as independent and committed to its core mandate of price stability.

Frequently Asked Questions

Why did gold and silver prices crash after Kevin Warsh’s nomination?

Gold and silver prices crashed significantly because investors re-evaluated their expectations for future interest rate policy and economic stability. For months, prices of these precious metals had been driven up by the “debasement trade,” where investors bought hard assets fearing that a politicized Fed under Trump would aggressively cut rates, weaken the US dollar, and fuel inflation. Warsh, known as an inflation “hawk” committed to Fed independence, signaled a less dovish monetary policy. This perception unwound the debasement trade, boosted the US dollar, and led investors to sell off gold and silver, expecting lower inflation and greater financial stability.

What is the significance of “central bank independence” in this scenario?

Central bank independence is crucial because it ensures that monetary policy decisions, such as setting interest rates, are made based on economic data and long-term stability rather than short-term political goals. In this scenario, President Trump’s repeated public attacks and legal threats against current Fed Chair Jerome Powell raised serious concerns about the Fed’s autonomy. Warsh’s nomination, despite his past advisory role to Trump, was largely interpreted by markets as a move towards preserving this independence, which is seen as vital for maintaining the credibility of the US dollar and preventing economic crises like the 1970s stagflation or recent events in Argentina and Turkey.

How might Kevin Warsh’s appointment impact future interest rates and the US dollar?

Kevin Warsh’s appointment could lead to expectations of a more cautious approach to interest rate cuts. Historically, Warsh is an “inflation hawk,” meaning he prioritizes fighting inflation, which typically involves higher interest rates. While he has recently expressed views critical of the Fed, aligning with Trump’s desire for lower rates, his core reputation suggests he might resist aggressive easing. If his hawkish tendencies prevail, this could mean fewer and slower rate cuts than anticipated under a different candidate. This perception would likely continue to support a stronger US dollar, as a tighter monetary policy generally makes a currency more attractive to international investors.

The Road Ahead: Navigating Uncertainty

The appointment of Kevin Warsh as Federal Reserve chair is more than a change in leadership; it’s a statement about the direction of US monetary policy and the integrity of its institutions. While the initial market reaction suggests confidence in a more stable and independent Fed, the lingering question remains: Can Trump’s recognition of the Fed’s credibility consistently temper his instinct to interfere with interest rate settings? The path ahead for the US economy, its markets, and the global financial system will hinge on this delicate balance.