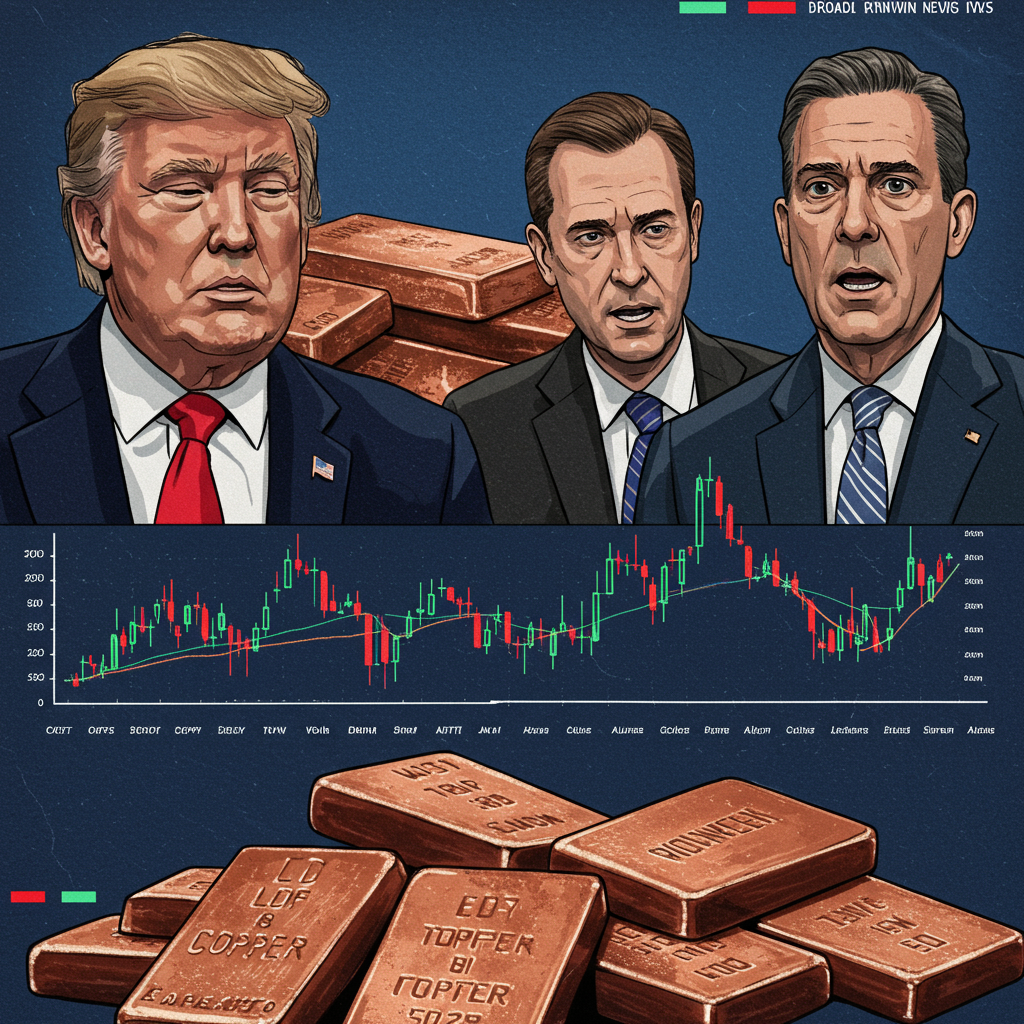

President Donald Trump’s latest move to escalate trade tensions is sending shockwaves through global commodity markets, particularly impacting copper. This critical industrial metal, vital for everything from home wiring to advanced tech, is seeing unprecedented price volatility. Businesses relying on copper are facing mounting costs and significant uncertainty as the administration signals a tough stance on trade. This disruption is part of a broader pattern of market instability tied to recent tariff threats, affecting investors and industries worldwide. The potential for a steep 50 percent tariff on copper imports announced by the president is driving much of this concern.

Copper prices Climb Amid Tariff Fears

The immediate market reaction to President Trump’s tariff threats has been dramatic. Futures contracts for copper in New York surged, hitting a record price level on Tuesday. This spike occurred as traders anticipated higher costs and potential supply disruptions stemming from the proposed tariffs.

However, the picture is slightly different in other markets. While New York prices rose, copper prices on the London Metal Exchange (LME) saw declines. This divergence highlights how specific tariff threats can create localized market distortions, driving up prices in the targeted region (the US) while potentially dampening global demand sentiment elsewhere. Analysts suggest this price gap between the Comex in New York and the LME could persist in the short term, vulnerable to further shifts based on trade policy developments.

Why Tariffs Jolt the Copper Market

Copper is more than just a metal; it’s a fundamental component in countless industries. It’s essential for residential and commercial construction, used extensively in plumbing and electrical wiring. The automotive sector relies heavily on copper, particularly with the growing demand for electric vehicles. High-tech devices, the power grid infrastructure, and critical data centers all require substantial amounts of copper.

For American businesses across these sectors, a 50 percent tariff translates directly into significantly higher raw material costs. These costs can be difficult to absorb, potentially leading to increased prices for consumers, reduced profitability, or even delayed projects and slowed expansion. Economists have noted that US consumers and businesses typically bear a substantial portion of tariff costs, estimated at around 40 percent in many cases, a figure that could rise over time depending on market adjustments.

Broader Economic & Geopolitical Fallout

The proposed copper tariff isn’t happening in a vacuum; it’s part of a wider push by the Trump administration involving potential levies on various imports, including pharmaceuticals. This aggressive stance has contributed to significant volatility across financial markets. Stock indices like the S&P 500 and Dow Jones Industrial Average have experienced sharp swings, reflecting deep investor uncertainty about the economic future.

The escalating trade war threatens to slow global economic growth. Experts like Jamie Dimon, CEO of JPMorgan Chase, have warned that tariffs will likely lead to higher prices and weigh on an already challenged US economy grappling with sticky inflation and geopolitical tensions. Some analyses suggest these actions could cause “irreversible damage” and increase the likelihood of a recession.

Global Supply Chains and Legal Challenges

The geopolitics of copper supply are also complex. Copper-rich regions, particularly in Africa, have become strategic focal points. Both the Biden administration and the European Union have invested heavily in infrastructure projects there, aiming to secure supply amidst a significant presence from China. Tariffs add another layer of complexity to these already competitive supply dynamics. Canada, for instance, is a major supplier of copper (and other metals) to the US, making it particularly vulnerable to potential tariffs.

Adding to the uncertainty, the legality of President Trump’s broad global tariffs, often justified under the International Emergency Economic Powers Act (IEEPA), is currently being challenged in federal court. A lower court initially ruled these tariffs exceeded the president’s authority, granting tariff-setting power primarily to Congress. While this ruling is temporarily stayed, an appeals court is set to hear arguments soon. Businesses challenging the tariffs argue that the IEEPA is being misused as a “blank check” for the president to unilaterally impose taxes, a power they contend rests solely with the legislative branch. This legal battle injects a significant element of doubt into the long-term permanence of the tariff regime.

Impacts Beyond Industry

The economic pressures from rising copper prices can have unexpected social consequences. Spikes in the value of scrap metal often correlate with increased crime, as thieves target streetlights, train yards, and even residential plumbing lines to capitalize on the demand for copper.

Market reactions to the trade tensions are not uniform. While some investors in the stock market seem to hope for a swift resolution or a change in stance, others, particularly in commodity and bond markets, appear less optimistic. Yields on the 10-year Treasury note, which influence lending rates for businesses and homeowners, have been rising, reflecting underlying concerns about inflation and economic stability. The administration has set an August 1 deadline for trade talks, with the president stating there will be “no extensions,” emphasizing his commitment to a hard-line approach despite market volatility and economic warnings.

Frequently Asked Questions

What is the proposed copper tariff rate and why is it happening?

President Trump has announced plans for a steep 50 percent tariff on copper imports. This action is part of a broader strategy to use tariffs as leverage in trade talks and to encourage domestic production and reduce reliance on foreign supply chains. The administration views persistent trade deficits as a national emergency justifying these measures under laws like the International Emergency Economic Powers Act (IEEPA).

Where are copper prices being impacted differently by the tariffs?

The tariff threat has caused copper prices to react differently in key markets. Futures contracts for copper in New York (Comex) surged to record highs, reflecting anticipated higher costs for US buyers. In contrast, prices on the London Metal Exchange (LME), a global benchmark, have seen declines. This creates a notable price gap between the US and international markets due to the localized impact of the proposed import tariffs.

How might Trump’s copper tariffs affect US businesses and consumers?

US businesses that use copper extensively in manufacturing for homes, cars, technology, and infrastructure will face significantly higher material costs if the tariffs are implemented. These increased costs could be passed on to consumers through higher prices for goods and services. Economists estimate that businesses and consumers in the US often bear around 40 percent of the cost of tariffs, potentially rising over time, which can slow economic activity and contribute to inflation.

Rising tensions around President Trump’s trade policies, including the specific threat of a 50 percent tariff on copper, continue to create significant uncertainty for global markets and businesses. The situation is compounded by ongoing legal challenges to the administration’s tariff authority and differing reactions from commodity traders and equity investors. The economic consequences, ranging from increased costs for businesses to broader concerns about inflation and growth, remain a key focus as the August 1 trade talk deadline approaches.