China’s economy is currently navigating turbulent waters, marked by a significant and concerning trend: deepening deflation. This phenomenon, characterized by falling prices for goods and services, extends from the factory gates to potentially impacting everyday consumer costs. Recent economic data underscores the severity of the situation, presenting a complex challenge for Beijing policymakers striving to maintain stable growth amidst increasing domestic pressures and external headwinds. Understanding the roots and ramifications of this deflationary spiral is essential for grasping the current state of the world’s second-largest economy.

Understanding China’s Deflation Challenge

Deflation occurs when the general price level of goods and services falls over a period of time. In China’s case, this is evident in two key economic indicators: the Producer Price Index (PPI) and the Consumer Price Index (CPI). The PPI measures average price changes received by domestic producers for their output, essentially reflecting prices at the factory level. The CPI, conversely, tracks changes in the prices of a basket of consumer goods and services, indicating inflation or deflation felt by households. Both indexes paint a picture of persistent downward price pressure within the Chinese economy.

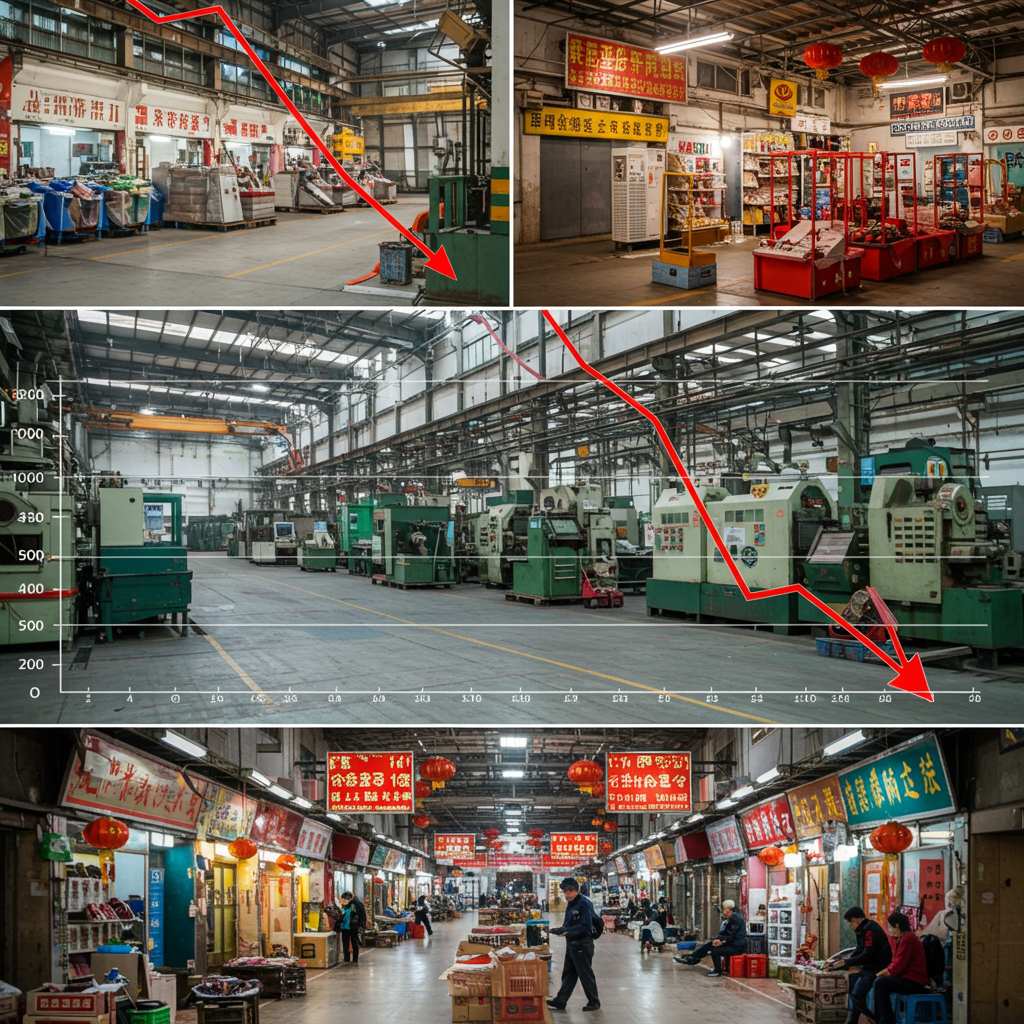

Factory Prices Plummet: The PPI Story

Recent reports highlight a significant decline in China’s factory-gate prices. Data from the National Bureau of Statistics (NBS) shows the Producer Price Index (PPI) has been falling year-on-year for several months. In June, the PPI dropped by a notable 3.6% compared to the previous year. This decline was steeper than the 3.3% fall recorded in May and represents the largest year-on-year decrease since July 2023. Looking back slightly, the PPI fell 3.3% in May, deepening from a 2.7% decline in April. April itself saw a 2.7% year-on-year drop, the sharpest decline in six months at the time. This persistent downward trend in producer prices signals significant challenges for manufacturers, squeezing profit margins and potentially dampening investment incentives across industries.

Weak Consumer Spending: The CPI Signal

While factory prices plummet, consumer prices also indicate underlying economic weakness. The Consumer Price Index (CPI) has shown only marginal growth or even slight declines. In June, the CPI rose by a mere 0.1% year-on-year, reversing a 0.1% decline in May but failing to signal a robust rebound in consumption. May also saw a 0.1% year-on-year dip, while April also saw a 0.1% year-on-year decrease, matching expectations but underscoring the lack of inflationary pressure from demand. On a monthly basis, the CPI fell by 0.1% in June, reflecting ongoing weak overall demand. Although core inflation, which excludes volatile food and fuel prices, saw a comparatively stronger rise of 0.7% year-on-year in June (its highest in 14 months), analysts caution that this alone doesn’t signal a lasting shift towards stronger household spending. The overall picture suggests consumers remain cautious, contributing to the deflationary environment.

Key Drivers Behind the Deflationary Trend

Multiple factors are converging to create this challenging economic backdrop in China. While external trade dynamics play a significant role, deep-seated domestic issues also contribute substantially to the persistent deflationary pressures. Understanding the interplay of these forces is crucial for analyzing the current economic climate.

The US-China Trade War Impact

The ongoing trade dispute with the United States under President Donald Trump is clearly impacting China’s economy, notably contributing to the deflationary trend. Increased US tariffs have dampened demand for Chinese exports, adding to the downward pressure on prices. Data from May specifically showed a sharp slowdown in export growth overall (4.8% year-on-year, down from 8.1% in April) and a particularly stark decline in exports to the United States, which plunged by 34.5% year-on-year in value terms. This represents the sharpest drop since February 2020. NBS statistician Dong Lijuan directly linked the weaker demand for exports to the “uncertainty in the global trade environment” and the chilling effect of tariff threats on business confidence and export expectations. The trade war forces manufacturers to compete fiercely on price, both domestically and internationally.

Persistent Weak Domestic Demand

Beyond external trade frictions, persistent weakness in China’s domestic demand is a major contributor to deflation. Several factors constrain household spending and business investment. A prolonged downturn in the housing market has eroded wealth and confidence. High levels of household debt limit discretionary spending. Job insecurity, even if perceived, encourages saving rather than spending. These structural issues have constrained consumer spending and investment. The lack of robust domestic demand fuels aggressive price wars across various sectors, from automakers offering significant discounts to e-commerce giants subsidizing services, indicating that even dominant consumer tech companies feel the pressure of cautious household spending. This internal fragility compounds the economic headwinds faced by the country.

Consequences for China’s Economy

The deepening deflationary trend has significant implications for China’s economic health and stability. It affects businesses, influences policy decisions, and impacts the overall growth trajectory. The consequences ripple through various layers of the economy, demanding careful management from Beijing.

Pressure on Companies and Investment

Industrial deflation, as seen in the falling PPI, puts immense pressure on corporate profits. When the prices companies receive for their goods decline, while input costs may not fall at the same pace, profit margins get squeezed. This can reduce companies’ ability to invest in new equipment, research and development, or expansion, potentially hindering long-term productivity growth. The strain on the manufacturing sector is evident, with factory activity showing contraction for a third consecutive month in June, even as the pace of decline slowed slightly. Weak employment and new export orders highlight the ongoing difficulties faced by manufacturers already contending with intense global competition and rising input costs. This economic environment can dampen overall investment sentiment.

Policy Dilemma for Beijing

The confluence of deepening producer deflation, weak consumer price growth, external trade pressures, and domestic structural issues creates a complex balancing act for Chinese policymakers. They face pressure to implement stimulus measures to boost demand and prevent further economic slowdown. However, they must weigh this against concerns about potentially increasing debt risks, particularly at the local government level, or inadvertently fueling asset bubbles, such as in the property market, which they are currently trying to stabilize. Finding the right mix of monetary and fiscal policies to stimulate targeted areas without creating new instabilities is a significant challenge.

Policy Responses and Future Outlook

In response to the mounting economic pressures, Beijing has initiated various measures aimed at stabilizing growth and countering deflationary forces. However, the effectiveness and scale of these actions remain key questions as the economy navigates this difficult period. Both monetary and fiscal tools are being considered and deployed.

Monetary Stimulus Measures

The persistently soft inflation figures provide the People’s Bank of China (PBOC) with room to potentially ease monetary policy further. Lowering interest rates makes borrowing cheaper, theoretically encouraging businesses to invest and consumers to spend. Beijing has already rolled out several monetary stimulus measures, including cuts to benchmark lending rates and providing liquidity injections into the financial system. For instance, a significant package of stimulus measures announced around the time of the April data release included interest rate cuts and a substantial injection of liquidity. Some economists suggest that further rate cuts might be necessary, possibly in the fourth quarter, to adequately support economic activity.

Fiscal Policy Needs

Beyond monetary policy, there is a strong consensus among economists that more proactive fiscal policy is essential to boost domestic demand directly. This could involve increased government spending on infrastructure, social welfare programs, or direct support to consumers to encourage spending. Beijing is reportedly pursuing a variety of measures aimed at stimulating consumption across different economic sectors. A low-cost loan program worth 500 billion yuan was announced in May, specifically targeting support for elderly care and services consumption. Such targeted fiscal interventions are seen as crucial for addressing the underlying demand weakness.

Navigating the Path Forward

China’s economic path forward appears challenging, influenced by ongoing trade tensions and the need to rebalance the economy towards domestic consumption. While trade negotiations between China and the US continue, hopes for a significant de-escalation or a return to pre-tariff trade levels are tempered. The impact of the trade war is also prompting efforts to redirect export-oriented businesses towards the vast domestic market. Major retailers are reportedly taking steps to help exporters pivot focus. However, this shift could potentially depress domestic prices further if overall demand doesn’t strengthen considerably. Global investment banks have reacted by lowering their GDP growth forecasts for China, with some estimates now falling below the official target of around 5%, partly attributing this to the damaging effects of the trade conflict. The world’s second-largest economy faces a difficult balancing act to maintain growth amidst increasing volatility.

Frequently Asked Questions

What are the latest figures showing deepening deflation in China?

Recent data from China’s National Bureau of Statistics confirms deepening deflation. In June, the Producer Price Index (PPI), measuring factory-gate prices, fell 3.6% year-on-year, a sharper drop than in preceding months and the largest decline since July 2023. The Consumer Price Index (CPI), a gauge of household inflation, rose by a mere 0.1% in June, just recovering from a slight decline in May but indicating weak consumer demand. These figures highlight persistent downward pressure on prices across the economy.

How does the US trade war contribute to China’s deflation?

The trade war with the US contributes significantly by reducing demand for Chinese exports through tariffs and increased uncertainty. This forces Chinese manufacturers to potentially lower prices to remain competitive globally or pivot unsold goods to the domestic market, increasing supply there and driving down prices. For instance, exports to the US plunged by 34.5% year-on-year in May, reflecting the direct impact of tariffs and a chilling effect on business confidence regarding overseas trade.

What risks and policy responses are associated with China’s deflation?

Deepening deflation poses risks like squeezed corporate profits, dampened investment, and potential job losses if companies cut costs. It puts pressure on Beijing to act. Policymakers are responding with monetary stimulus, including interest rate cuts and liquidity injections, providing the PBOC room to ease further. Fiscal policy is also crucial, with calls for more government spending and measures like targeted loan programs (e.g., for services consumption) to directly boost weak domestic demand and counter the deflationary trend.

China’s battle against deflation is multi-faceted, rooted in both global trade dynamics exacerbated by the US trade war and persistent structural issues within its domestic economy. The data on falling factory and weak consumer prices paints a clear picture of the challenge. Policymakers face a delicate balancing act, needing to stimulate growth without creating new risks. The path ahead requires careful navigation, focusing on bolstering domestic demand and adapting to a less certain global trade environment, as the world watches how the economic giants manage these significant headwinds.