Wall Street Rallies as Geopolitical Jitters Subside, S&P 500 Closes Near All-Time Peak

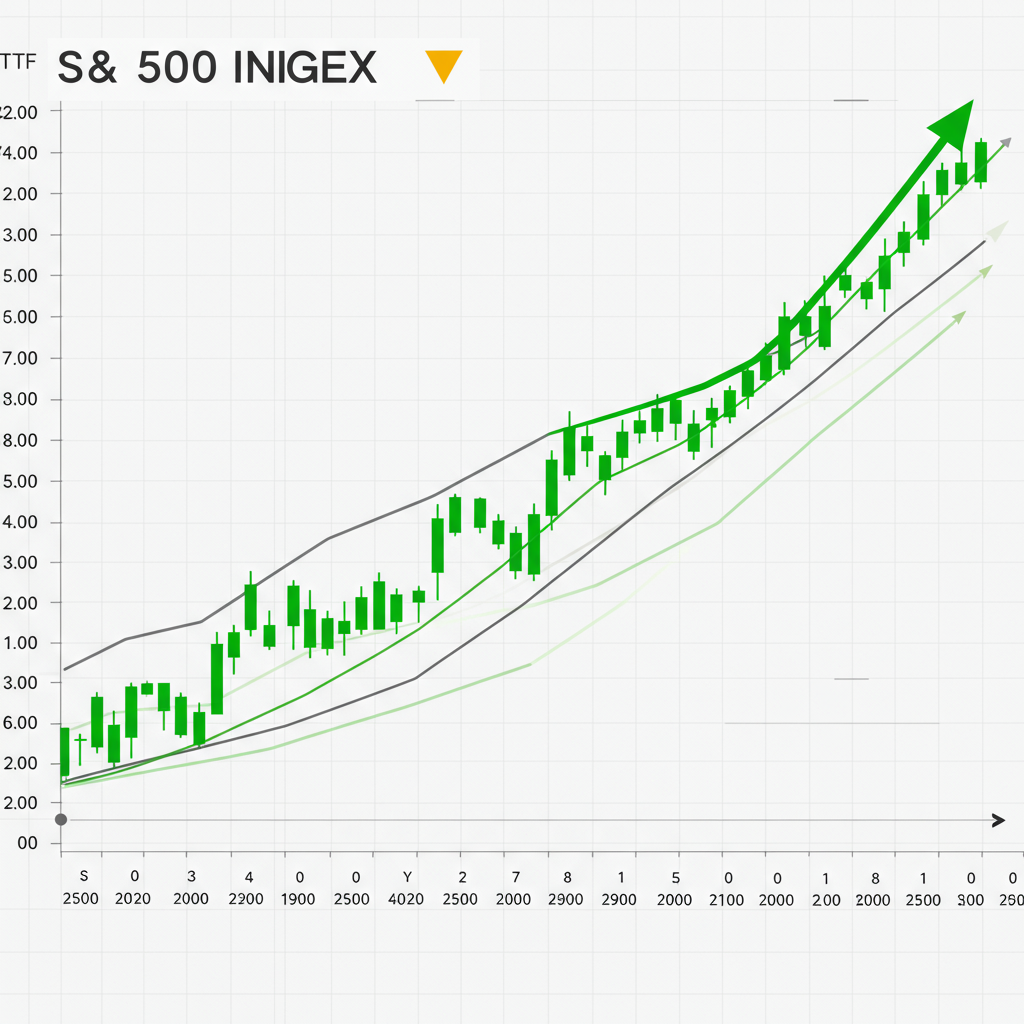

U.S. stock markets surged on Tuesday, posting their second consecutive day of strong gains. Major indices climbed by more than 1%, propelled by investor optimism surrounding a perceived cooling of tensions in the Middle East. The benchmark S&P 500 closed just shy of its all-time high, while the Nasdaq 100 notched a new record closing high.

The broad market advance, characterized by some analysts as a “relief rally,” saw investors welcome news of a fragile ceasefire between Israel and Iran. This de-escalation was a primary driver, overshadowing other factors including cautious commentary from the Federal Reserve and weaker domestic economic data. According to Rob Haworth, senior investment strategy director at U.S. Bank Asset Management Group, the market’s reaction was a direct response to the perceived calm, stating that “Stocks today are really relieved that there is a ceasefire.”

Key Index Performance:

Dow Jones Industrial Average (.DJI): Rose 1.19%

S&P 500 (.SPX): Gained 1.11%, closing within striking distance of its February 19th record.

Nasdaq Composite (.IXIC): Advanced 1.43%

Nasdaq 100 (.NDX): Achieved an all-time closing high.

The positive sentiment wasn’t confined to the U.S., with foreign stock markets also reportedly experiencing a strong day, indicating a broader global reaction to the easing geopolitical risk.

Impact on Sectors and Stocks

The cooling tensions had a direct impact on certain sectors. Airline stocks gained altitude, with the S&P 1500 Airlines index advancing 2.4%. Conversely, defense stocks lost ground, with Lockheed Martin and RTX Corp seeing declines.

Lower crude oil prices, stemming from reduced supply concerns related to the conflict, dragged energy shares lower, making them the worst-performing sector within the S&P 500, dropping 1.5%. Technology shares led the gainers.

Among individual companies:

Broadcom (AVGO): Shares hit a record peak, climbing nearly 4% after HSBC upgraded the semiconductor manufacturer’s rating from “hold” to “buy.”

Coinbase Global (COIN): Rose over 12% as Bitcoin hit a one-week high, boosting crypto-related stocks.

FedEx (FDX): Dropped more than 4% in extended trading following the release of quarterly results that included a disappointing current-quarter forecast.

Tesla (TSLA): Underperformed the “magnificent 7” group, dropping 2.4%.

Economic Landscape and Fed Watch

Investors also processed insights from Federal Reserve Chair Jerome Powell’s congressional testimony. Powell reiterated the central bank’s “wait and see” approach regarding interest rate cuts, stating that decisions would hinge on a clearer understanding of the economic effects, particularly those stemming from tariffs. He noted the Fed is “well positioned to wait to learn more” before adjusting policy.

Financial markets are currently pricing in a greater than 20% chance of a Fed rate cut in July and a nearly 70% probability of the first cut occurring in September.

Adding to the economic picture, consumer confidence deteriorated this month. The data revealed increasing pessimism toward the jobs market, falling to its lowest level in over four years. However, according to market strategists, the significant relief rally driven by geopolitical factors managed to overshadow the negative pressure from the softer consumer sentiment data.

Looking ahead, markets await further economic data this week, including the Commerce Department’s final reading on first-quarter GDP on Thursday and the closely watched Personal Consumption Expenditures (PCE) report on Friday, which will provide insights into inflation and consumer activity.

Market breadth was positive, with advancing issues significantly outnumbering decliners on both the NYSE and Nasdaq, reflecting the broad nature of the rally.