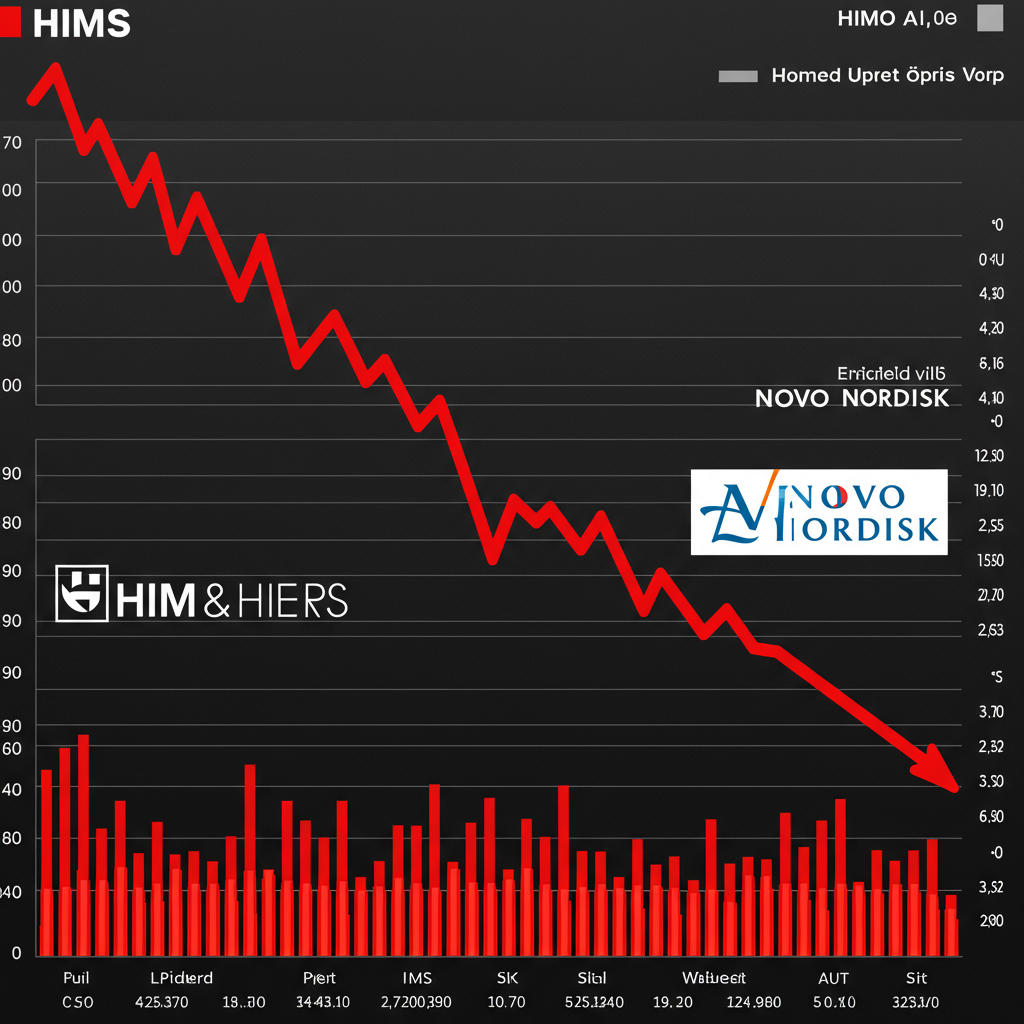

Hims & Hers (HIMS) stock experienced a dramatic sell-off on Monday, plunging around 30-35% in its steepest one-day decline ever. The catalyst for the sharp drop was Danish pharmaceutical giant Novo Nordisk (NVO) abruptly ending its partnership with the telehealth company. Novo Nordisk accused Hims & Hers of “deceptive promotion and selling of illegitimate, knockoff versions” of its popular weight-loss drug, Wegovy (semaglutide), and failing to comply with laws designed to protect patient safety.

In immediate response to the fallout, Needham analyst Ryan MacDonald downgraded Hims & Hers stock from Buy to Hold. The firm also removed its prior $65 price target and took HIMS off its Conviction List. The downgrade reflects concerns over the termination of this key collaboration and the significant potential for legal and regulatory challenges ahead.

Why Needham and Others See Legal Risks

Needham’s downgrade stems from the belief that Hims & Hers will likely continue offering personalized GLP-1 medications (used for weight loss and diabetes) based on its interpretation of Section 503A of the Food, Drug, and Cosmetic Act, which governs compounded drugs. MacDonald views this approach, especially after Novo Nordisk’s pointed accusations, as bringing back the risk of litigation or regulatory action from bodies like the FDA.

Adding to the challenge, Needham notes that Hims & Hers now faces a competitive disadvantage. Major GLP-1 manufacturers like Eli Lilly (LLY) and Novo Nordisk maintain partnerships with HIMS’s rivals in the telehealth space. MacDonald suggests that HIMS stock could remain range-bound for the foreseeable future until the legality of its specific compounding and personalization practices is definitively determined.

Other Wall Street analysts echoed the concerns about increased legal exposure. Morgan Stanley analyst Craig Hettenbach, who maintains a Hold rating with a $40 price target, estimates that personalized compounded semaglutide doses make up a substantial portion – over 50% – of Hims & Hers’ target weight loss revenue of $725 million for 2025. He believes the abrupt termination intensifies litigation worries.

Truist Securities analyst Jailendra Singh, also rating the stock Hold with a $45 price target, explicitly stated that with the partnership termination, litigation risk is “back on the table.” Singh warned that a potential lawsuit could be a prolonged process, possibly dragging on for 18-24 months and acting as a persistent overhang on HIMS stock. While Singh speculated branded Wegovy might not have been a huge direct revenue driver for HIMS, its listing likely provided “credibility” and drove consumer traffic, which could now decline, potentially impacting the core compounding business.

Bank of America analyst Allen Lutz, holding a more bearish Sell rating with a $28 price target, called the deal’s end a “clear negative” and sees a high likelihood of Novo Nordisk pursuing litigation. Lutz noted that while branded Wegovy represented only a small percentage (~2%) of HIMS’s Q2 GLP-1 orders, minimizing direct revenue loss from the partnership itself, a significant risk looms from a slowdown in HIMS’s core business, which could jeopardize revenue estimates for late 2025 and 2026.

Companies Clash Over Split

The split has quickly devolved into a public dispute between the two companies.

Novo Nordisk’s accusation centers on alleged deceptive promotion and selling of “illegitimate, knockoff versions” of Wegovy, claiming it puts patient safety at risk. Dave Moore, Executive Vice-President of Novo Nordisk’s US operations, emphasized the company’s commitment to patient safety and stated they would take action against those engaging in “illegal sham compounding” that jeopardizes public health. Reports suggest Novo Nordisk’s specific concern included allegations that Hims & Hers used illicit semaglutide potentially sourced from unregulated Chinese manufacturers.

Hims & Hers CEO Andrew Dudum swiftly countered Novo Nordisk’s claims, expressing disappointment and accusing Novo Nordisk management of “misleading the public.” Dudum alleged that Novo Nordisk’s commercial team pressured Hims & Hers to dictate clinical standards and steer patients towards branded Wegovy, even if not clinically appropriate. He stated that Hims & Hers refuses to be “strong-armed” by “anticompetitive demand” from any pharmaceutical company that undermines provider independence and limits patient choice.

What’s Next for HIMS Stock?

Following the dramatic price drop, Wall Street analysts currently hold a “sidelined” view on HIMS stock. The consensus rating stands at Hold, based on one Buy, eight Holds, and two Sell recommendations. The average analyst price target is $39.80, suggesting a modest 5.2% potential upside from recent levels.

The outlook for Hims & Hers will largely depend on its ability to navigate the legal and regulatory landscape surrounding its compounding practices and rebuild trust in the wake of Novo Nordisk’s serious allegations. The future trajectory of the stock appears uncertain until the clarity on these key issues emerges.