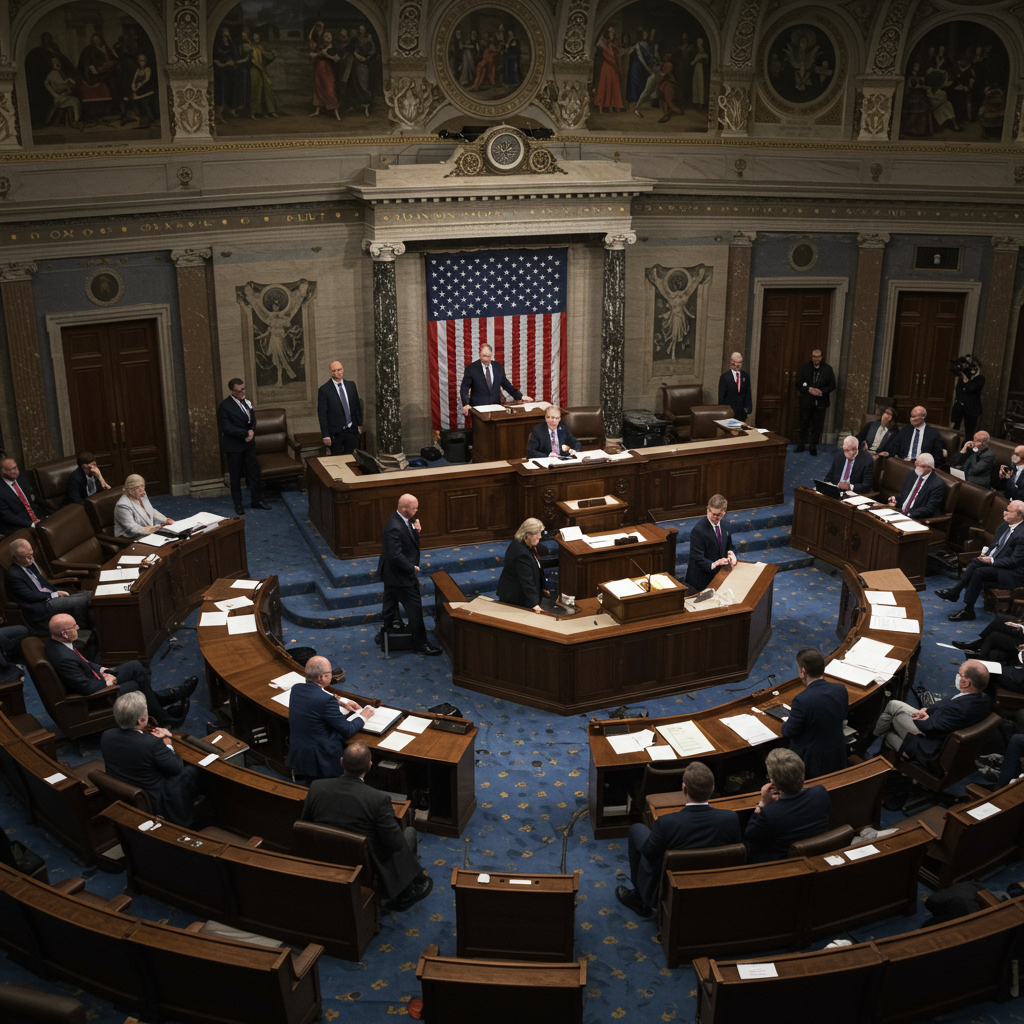

The United States Senate has passed significant legislation aimed at establishing a comprehensive regulatory framework for stablecoins, marking a major milestone for the cryptocurrency industry. The bill, known as the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), received bipartisan support in a 68-30 vote, sending it to the House of Representatives for consideration.

This vote represents the first time the Senate has approved major federal regulation specifically targeting digital assets, offering the crypto sector a long-sought step towards greater credibility and legitimacy in Washington.

What is the GENIUS Act?

At its core, the GENIUS Act focuses on regulating stablecoins – a type of cryptocurrency designed to maintain a stable value, typically by being pegged to existing currencies like the U.S. dollar. Unlike volatile cryptocurrencies such as Bitcoin, stablecoins aim to reduce price fluctuations, making them potentially useful for everyday transactions and bridging traditional and decentralized financial markets.

The bill seeks to bring clarity and federal oversight to the estimated $250 billion stablecoin market, which proponents argue is essential for mainstream adoption and global competitiveness.

Key Provisions of the Proposed Regulation

If enacted into law, the GENIUS Act would introduce several key requirements for companies issuing stablecoins:

Asset Backing: Issuers would be mandated to back their stablecoins with safe, highly liquid assets equal to the value of the coins issued. This includes holding actual U.S. dollars or short-term U.S. Treasury securities. This is a critical safeguard designed to prevent collapses similar to the 2022 failure of the Terra-Luna stablecoin system.

Transparency and Oversight: The bill requires issuers to publicly disclose the composition of their reserves on a monthly basis, promoting transparency.

Segregated Reserves & Capital: Rules would be established for segregating reserves and maintaining minimum liquid capital requirements for issuers.

AML/Anti-Terrorism Measures: The legislation mandates the implementation of robust anti-money laundering (AML) and anti-terrorism processes.

Regulatory Authority: It expands regulatory authority over stablecoins for key financial bodies including the Department of Treasury, the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the FDIC.

Bankruptcy Priority: Stablecoin owners would be prioritized in cases where a custodian or issuer faces bankruptcy.

The goal of these provisions is to enhance the reliability and trustworthiness of stablecoins, aiming to restore confidence in a market recently impacted by instability.

Supporters Hail Milestone

Proponents argue the GENIUS Act will usher in a “new era of payments,” enabling faster and cheaper transactions and modernizing the U.S. financial system. Senator Bill Hagerty (R-Tenn.), the bill’s lead sponsor, stated the legislation would boost demand for U.S. Treasury securities and help maintain the dollar’s global dominance. He believes it’s a significant step toward breaking down barriers between traditional and decentralized finance.

Supporters, including Senator Kirsten Gillibrand (D-N.Y.), emphasize that congressional inaction has left the digital asset space as a “wild West,” exposing consumers to risks and hindering businesses. They argue federal regulation is necessary to provide the clarity for the U.S. to lead in this evolving market. Treasury Secretary Scott Bessent reportedly suggested the U.S. dollar stablecoin market could expand significantly, potentially reaching $2 trillion over the next decade if the bill becomes law. Leaders from major crypto companies also praised the bill as a bold step forward.

Challenges, Criticisms, and Conflicts

Despite achieving bipartisan support, the GENIUS Act faced significant hurdles and ongoing criticism. An earlier version of the bill was blocked in the Senate over concerns about national security and insufficient anti-money laundering protections, requiring weeks of intense negotiation to add amendments.

These negotiated changes included:

A requirement for members of Congress and Executive Branch officials to disclose stablecoin holdings exceeding $5,000.

Stronger bankruptcy protections for bank depositors.

- A directive for the Treasury Department to issue rules for monitoring suspicious transactions within the stablecoin ecosystem.

- www.investopedia.com

- www.aljazeera.com

- builtin.com

- www.cbsnews.com

- www.nbcnews.com

However, strong opposition remained, particularly from some Democrats, who argued the amended bill still lacks sufficient safeguards and oversight. A major point of contention centers on concerns about potential corruption risks related to President Donald Trump and his family’s significant investments and income from cryptocurrency ventures, including World Liberty Financial and its USD1 stablecoin. Financial disclosures reportedly show Trump earning substantial income from this firm.

Critics like Senator Elizabeth Warren (D-Mass.) argued the bill does not go far enough to prevent officials from profiting from crypto ventures and could potentially facilitate corruption or undermine national security by making stablecoins a vehicle for illicit finance. She and others pointed to the bill’s explicit exclusion of the President and Vice President from restrictions on executive branch officials issuing stablecoins as a specific concern regarding conflicts of interest. Warren described the bill as “weak” and potentially written to benefit industry insiders and Trump’s financial interests.

Other criticisms raised include the lack of clear prohibitions preventing large technology companies from issuing private stablecoins and concerns from state regulators about the bill potentially granting “unsupported expansion” of authority to uninsured banks. Two Republican senators also voted against the bill, citing opposition to federal regulation or fears it cedes too much power to large tech firms.

What Lies Ahead?

With Senate passage secured, the GENIUS Act now moves to the House of Representatives. The Republican-controlled House has also been developing its own version of bipartisan digital asset legislation. The bill may face further modifications and negotiations as the two chambers work towards reconciling their versions before a final bill could potentially be sent to the President for signature.

The path forward highlights the ongoing debate in Washington over finding the right balance between fostering innovation in the rapidly expanding crypto market and implementing robust regulations to ensure financial stability, consumer protection, and national security.