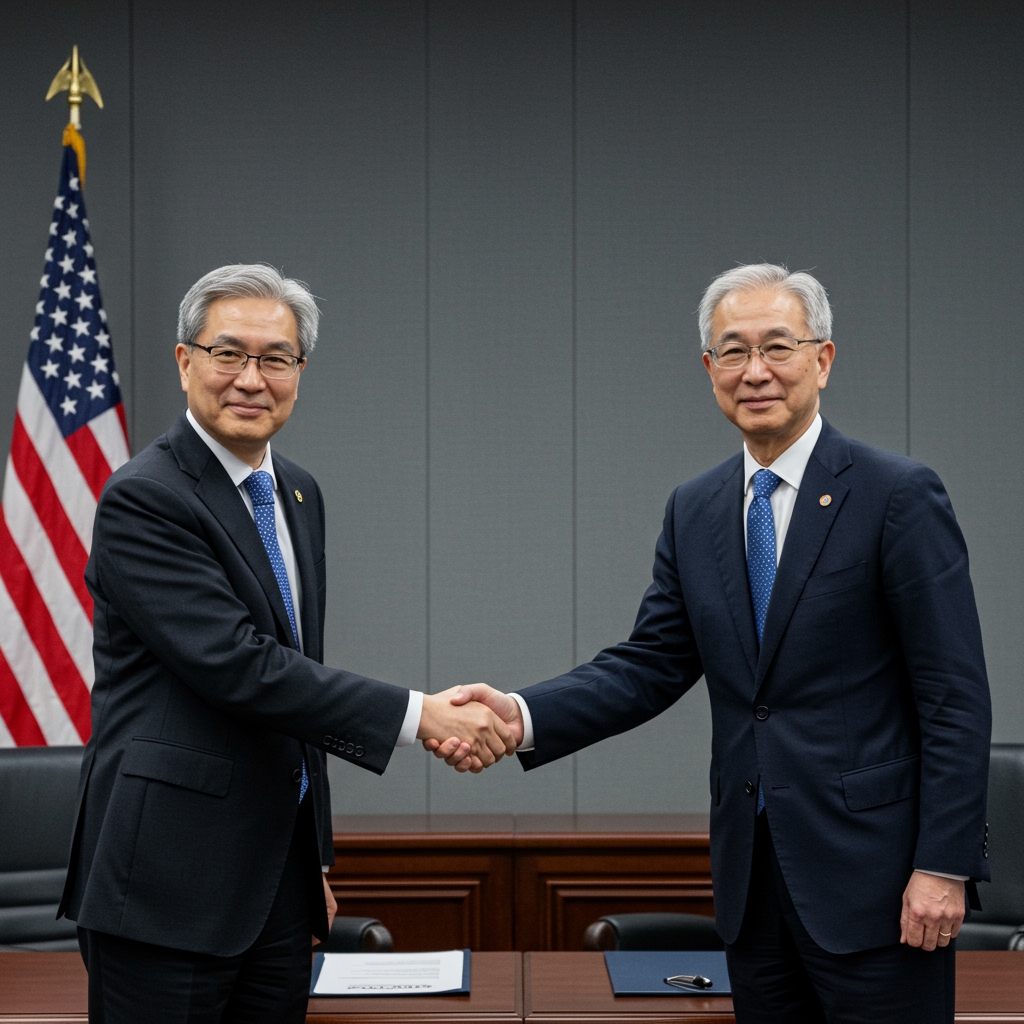

Historic $15 Billion US Steel Sale to Nippon Steel Finalized After National Security Deal

Nippon Steel and U.S. Steel have officially finalized their “historic partnership,” completing the nearly $15 billion acquisition that was first proposed a year and a half ago. The significant transaction, which will combine the Japanese and American steel giants to create the world’s fourth-largest steelmaker, was confirmed Wednesday following the resolution of substantial national security concerns and complex political hurdles.

The pursuit of the iconic Pittsburgh-based steelmaker by Nippon Steel proved to be a protracted process. Even after U.S. Steel shareholders approved the transaction over a year ago, the deal faced significant delays, largely due to national security reviews and entanglement in U.S. presidential politics, particularly in the key battleground state of Pennsylvania.

Both President Joe Biden and former President Donald Trump had initially voiced opposition to the acquisition while on the campaign trail. At one point, President Biden had used the authority of the Committee on Foreign Investment in the United States (CFIUS) to signal intent to block the deal before leaving office. However, following his election, Trump reportedly shifted his stance, becoming open to finding a workable arrangement and ordering a new CFIUS review, ultimately paving the way for negotiations under his administration.

Addressing National Security Concerns: The ‘Golden Share’ Agreement

The key to finalizing the acquisition hinged on addressing the national security worries surrounding foreign ownership of a critical American industry asset. This was achieved through a national security agreement negotiated under the Trump administration, which introduced an unprecedented element: a “golden share” provision.

This unique clause grants the U.S. federal government specific, potent rights and significant influence over the combined entity’s future operations, particularly those impacting domestic steel production and U.S. interests.

While the full text of the agreement has not been made public, key aspects of the government’s oversight rights have been revealed. The U.S. government gains the right to appoint an independent director to the combined company’s board. More crucially, it holds “consent rights” over several vital matters affecting U.S. Steel’s operations within the United States. These include:

Any proposed reductions in Nippon Steel’s committed capital investments as outlined in the agreement.

Changes to U.S. Steel’s corporate name and headquarters location.

The closing or idling of U.S. Steel plants in the United States.

Transferring production or jobs outside of the U.S.

Acquiring competing businesses within the U.S.

Certain decisions related to trade, labor, and sourcing outside the United States.

Nippon Steel’s Commitments and Strategic Vision

Beyond the governmental oversight framework, Nippon Steel made several significant commitments to secure the deal and address concerns from stakeholders, including labor unions and policymakers. These include pledges to ensure the U.S. Steel board has a majority of American citizens and that the management team is also primarily composed of American citizens.

Nippon Steel also committed not to conduct layoffs or plant closings as a direct result of the acquisition. Furthermore, they pledged to protect U.S. Steel’s interests in trade matters, avoid importing steel slabs that would directly compete with U.S. Steel’s key blast furnaces (such as those in Braddock, Pennsylvania, and Gary, Indiana), prioritize sourcing from U.S. domestic locations where possible (like Minnesota mining operations), and allow U.S. Steel to pursue trade actions under U.S. law.

A cornerstone of the finalized deal is Nippon Steel’s substantial financial pledge: $11 billion committed for upgrades to U.S. Steel facilities through 2028. This investment aims to integrate Nippon Steel’s “top-notch technology” with U.S. Steel’s existing infrastructure, which analysts and company officials have noted could benefit from modernization.

For Nippon Steel, the acquisition provides strategic access to the robust U.S. steel market, a sector that has been strengthened by tariffs implemented under both the Trump and Biden administrations. The merger is expected to significantly increase Nippon Steel’s annual crude steel production capacity to around 86 million tons, bringing it closer to its global target of 100 million tons.

Union Opposition and Future Outlook

Despite the finalized agreement and the commitments made, the United Steelworkers union (USW), which represents some U.S. Steel employees, has maintained its opposition to the acquisition. The USW’s international president noted that the union’s current labor agreement with U.S. Steel expires in 2026 and stated that the union is ready to respond with “full strength and solidarity” if the job security, pensions, retiree health care, or other benefits of their members are threatened.

Mergermarket analyst Reuben Miller commented that while the approval under the Trump administration was appropriate, the “golden share” arrangement could potentially have long-term implications for inbound investment into the U.S. by introducing the risk of government involvement in private enterprise.

In conclusion, the complex $15 billion acquisition of U.S. Steel by Nippon Steel has been finalized after successfully navigating significant political and national security challenges. The agreement rests on a unique national security pact that grants the U.S. government substantial oversight and consent rights, alongside significant financial and operational commitments aimed at safeguarding American jobs, production capacity, and strategic interests within the vital domestic steel sector.