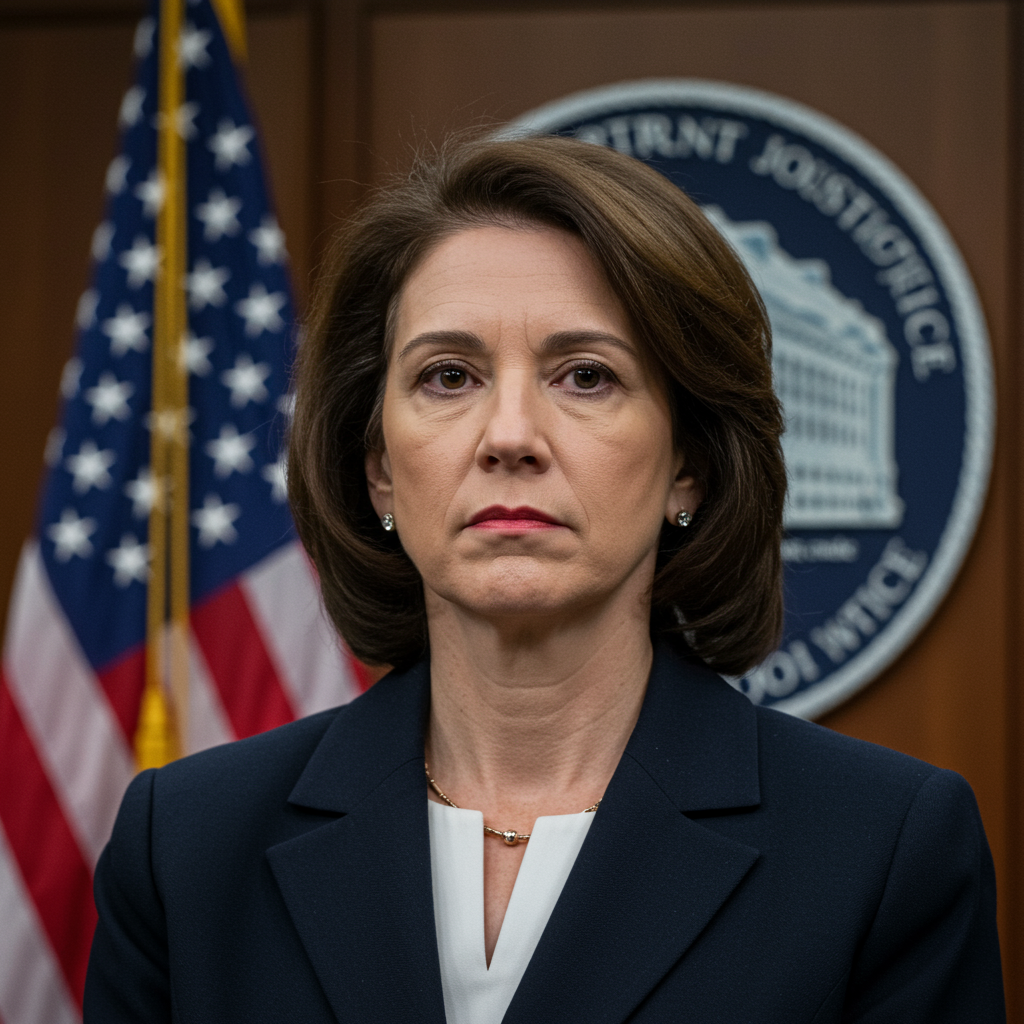

A new political firestorm is brewing around the Federal Reserve, as the Department of Justice is reportedly investigating Federal Reserve Governor Lisa Cook. This scrutiny comes amid an escalating campaign by the Trump administration and its allies to force Cook’s removal. At the heart of the matter are unconfirmed allegations of mortgage fraud, which Governor Cook vehemently denies, stating her unwavering commitment to transparency and remaining in her post. This high-stakes drama not only casts a shadow over a prominent economic figure but also reignites concerns about the independence of the nation’s central bank and the potential weaponization of federal agencies for political ends.

The Mounting Pressure on Governor Lisa Cook

The push for Governor Lisa Cook’s removal has intensified dramatically. Appointed to the Federal Reserve Board by President Joe Biden in 2022, Cook has become a focal point for critics aligned with former President Donald Trump. Despite the increasing pressure, Governor Cook has made her position clear: she has “no intention of being bullied” into stepping down. She emphasizes her commitment to addressing any questions regarding her financial history and is actively gathering accurate information to provide a factual account.

Decoding the Mortgage Fraud Allegations

The core accusations against Governor Cook revolve around alleged mortgage fraud, specifically dual primary residence declarations. These claims were publicly amplified by Bill Pulte, the head of the US Federal Housing Finance Agency (FHFA) and a vocal critic of the Federal Reserve. Pulte submitted a criminal referral to the Department of Justice, detailing his allegations.

According to Pulte’s referral, Cook reportedly secured two separate mortgage agreements within a month in 2021, each for a property she declared as her principal residence:

Ann Arbor, Michigan (June 2021): A 15-year mortgage for a property, declaring it as her primary residence.

Atlanta, Georgia (July 2021): Just weeks later, she allegedly purchased another property, securing a 30-year mortgage and committing to use that property as her primary residence.

Pulte further supported his claims by sharing images on social media platform X, purporting to show Cook’s signatures on documents for both mortgages. However, the images themselves did not explicitly confirm the primary residence claims directly from the documents. Governor Cook has noted that the alleged mortgage application in question dates back four years, preceding her 2022 appointment to the Federal Reserve.

Trump’s Broader Campaign Against the Federal Reserve

The targeting of Lisa Cook is not an isolated incident but rather fits within a larger, ongoing narrative of former President Trump’s “extraordinary war on the Fed’s independence.” Trump has a well-documented history of challenging the central bank, frequently breaking with established precedent to publicly demand interest rate cuts and call for the resignation of Fed Chair Jerome Powell.

This aggressive approach underscores a consistent theme of the Trump administration: seeking to exert political influence over institutions traditionally designed to operate independently. While Trump reportedly faced legal complexities in attempts to fire Powell without cause before his term ends in May 2026, allies like Pulte have pointed to the Federal Reserve’s costly Washington D.C. headquarters renovation as potential “cause” for Powell’s removal. Pulte had even previously suggested Powell’s resignation would be “the right decision for America.”

Political Motivations and the Weaponization of Justice

The campaign against Governor Cook is viewed by some as an extension of this broader strategy, with critics like California Senator Adam Schiff accusing the Trump administration of “weaponizing the US justice system” for political attacks. It’s noteworthy that Bill Pulte has leveled similar mortgage fraud claims against other prominent Democratic figures, including New York Attorney General Letitia James and Senator Adam Schiff himself. Both James and Schiff have vehemently denied these allegations, dismissing them as “baseless.”

This pattern suggests a coordinated effort to discredit and pressure political opponents and independent institutions through legal and public accusations. The Department of Justice, while reportedly investigating Cook, has declined to comment on the ongoing situation, as has the Federal Reserve.

The Federal Reserve’s Structure and Limits of Authority

A critical legal point in this evolving saga is the authority – or lack thereof – of the Federal Reserve Chair. Under the Federal Reserve Act, Fed Chair Jerome Powell does not possess the unilateral power to remove another member of the board of governors. Governors serve fixed terms and can only be removed “for cause” by the President, typically a high legal bar that requires demonstrating gross misconduct. This legal framework is designed to insulate the central bank from political whims and ensure its independence in setting monetary policy.

The timing of this criminal referral against Cook also coincides with a significant period for the Federal Reserve. It was announced just as the central bank kicked off its annual monetary policy conference in Jackson Hole, Wyoming. Fed Chair Powell was scheduled to deliver a highly anticipated speech at this conference, expected to offer crucial insights into the central bank’s assessment of current economic data and its potential future path for interest rate adjustments. The controversy surrounding Cook, therefore, threatened to overshadow these critical economic discussions.

Understanding the Stakes for Fed Independence

The ongoing pressure on Governor Lisa Cook highlights the delicate balance of power between the executive branch and independent government bodies like the Federal Reserve. The Fed’s independence is considered paramount for its ability to make sound monetary policy decisions, free from short-term political considerations. When allegations, especially unconfirmed ones, are publicly amplified and potentially tied to the Department of Justice, it can create a chilling effect and undermine public trust in the integrity of these institutions. This situation serves as a stark reminder of the continuous challenges faced by institutions striving to maintain their autonomy in a highly polarized political landscape. The outcome of the reported DOJ investigation and the continued political pressure on Governor Cook will undoubtedly have lasting implications for the Federal Reserve’s perceived independence and its crucial role in the nation’s economy.

Frequently Asked Questions

What are the specific allegations leveled against Federal Reserve Governor Lisa Cook?

Federal Reserve Governor Lisa Cook is facing unconfirmed allegations of mortgage fraud. These claims, primarily brought forward by Bill Pulte of the FHFA, center on her allegedly declaring two different properties as her primary residence when obtaining mortgages for them just weeks apart in 2021. One property is in Ann Arbor, Michigan, and the other in Atlanta, Georgia. Cook denies these claims and is gathering facts to address them.

Who is Bill Pulte and what is his role in the pressure campaign against Lisa Cook?

Bill Pulte is the head of the US Federal Housing Finance Agency (FHFA) and a vocal ally of former President Donald Trump. He has played a central role in the campaign against Governor Cook by submitting a criminal referral to the Department of Justice regarding the mortgage fraud allegations. Pulte has also used social media to publicize his claims and has targeted other prominent Democratic figures with similar accusations.

Can Federal Reserve Chair Jerome Powell remove Governor Lisa Cook from her position?

No, Federal Reserve Chair Jerome Powell does not have the authority to remove Governor Lisa Cook or any other member of the Board of Governors. Under the Federal Reserve Act, governors serve fixed terms and can only be removed “for cause” by the President. This legal provision is designed to ensure the central bank’s independence from political influence, allowing it to make monetary policy decisions based on economic data rather than political pressure.