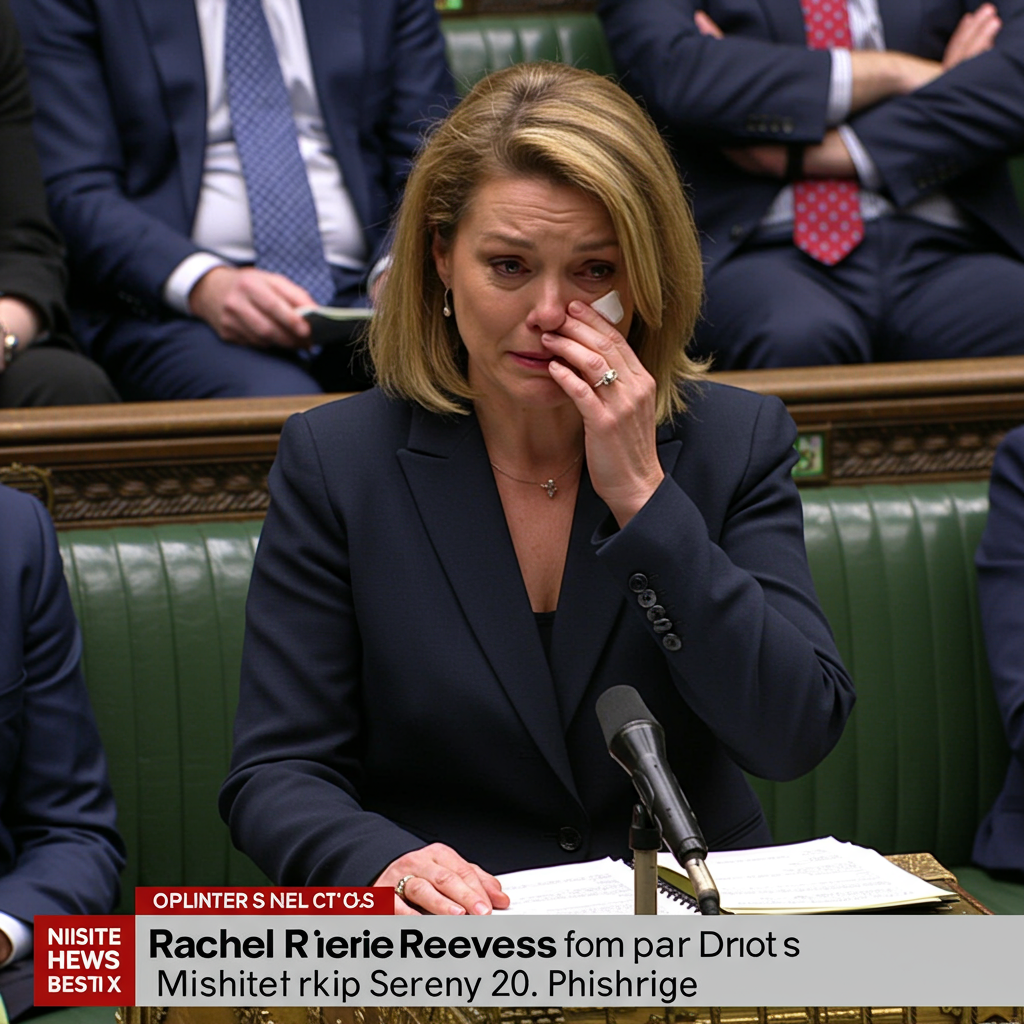

A wave of political drama and market turbulence hit Westminster this week following a visibly emotional appearance by UK Finance Minister Rachel reeves during Prime Minister’s Questions (PMQs). The Labour Chancellor was seen brushing away tears amidst intense scrutiny, prompting immediate speculation about her position just a day after the government was forced into a significant U-turn on key welfare reforms. In a swift move to quell the storm, Prime Minister Keir Starmer and his office delivered a firm message: Rachel Reeves has his absolute backing and is “going nowhere.”

The incident unfolded during the weekly session in the House of Commons. Ms. Reeves, sitting behind the Prime Minister, appeared exhausted and visibly distressed. While her spokesperson later attributed her emotional state to a “personal matter,” declining further detail out of respect for privacy, the timing ignited intense political debate. This came directly on the heels of a bruising parliamentary fight where the government abandoned planned changes to Personal Independence Payment (PIP) eligibility, a move that effectively blew an estimated £5 billion hole in Ms. Reeves’ carefully laid financial plans.

Swift Reassurance from the Top

Prime Minister Keir Starmer was quick to address the speculation surrounding his Chancellor’s future. His press secretary firmly told reporters that Ms. Reeves retained the Prime Minister’s “full backing” and was “going nowhere.” Starmer himself later reinforced this message in a pre-recorded BBC interview, stating emphatically that Ms. Reeves had done “an excellent job as chancellor” and would remain in the role for “a very long time to come.” He explicitly dismissed any suggestion that her tears were related to the week’s political pressures or the welfare U-turn, echoing the line that it was solely a “personal matter.”

Starmer Emphasises Close Working Relationship

Starmer also sought to project an image of unity at the heart of government, stating he and Ms. Reeves were “in lockstep,” working and thinking together. This framing serves to counter historical instances of friction between Prime Ministers and Chancellors. Downing Street’s repeated statements of confidence aimed to decisively shut down rumours fueled by opposition criticism and Ms. Reeves’ visible distress during the live parliamentary session.

The Cost of the Welfare U-Turn

Central to the week’s turmoil was the government’s decision to scale back proposed welfare reforms. Plans to restrict eligibility for Personal Independence Payment (PIP) were abandoned just 90 minutes before MPs were scheduled to vote. This, along with dropping plans to end the Universal Credit health element, followed intense pressure and the threat of a Labour backbench rebellion. While allowing the broader welfare bill to pass, the concessions nullified the projected £5 billion annual savings by 2030 that Ms. Reeves had factored into her fiscal strategy.

A Challenge to Fiscal Rules

This abandoned saving creates a significant challenge for the Finance Minister. Ms. Reeves has repeatedly stressed her commitment to self-imposed fiscal rules, notably the ambition to fund day-to-day government spending from tax receipts rather than increasing borrowing. The £5 billion gap makes adhering strictly to this rule considerably more difficult without finding equivalent savings elsewhere or, potentially, increasing taxes.

Market Reaction Reflects Uncertainty

The scenes in parliament and the subsequent political fallout sent ripples through financial markets. British government bonds saw their effective borrowing costs rise, and the pound fell notably against the dollar during and immediately after PMQs. Market analysts pointed to speculation about Ms. Reeves’ job security as a factor, given the perceived link between her emotional state and the political pressure. However, the reaction also reflected broader concerns about the government’s ability to manage its finances and how the £5 billion gap would ultimately be funded, drawing parallels for some with market instability seen after previous, less fiscally disciplined announcements.

Speculation on Underlying Factors

Beyond the official “personal matter” explanation, reports from Westminster suggested that a contributing factor to Ms. Reeves’ distress might have been an earlier heated exchange with Commons Speaker Sir Lindsay Hoyle. It was reported Hoyle had been abrupt with her, possibly related to comments he made about her requiring shorter answers during Treasury Questions the previous day. While a spokesperson for the Speaker declined to comment, allies of Ms. Reeves reportedly cited this as a potential cause, with one report quoting the Chancellor as saying she was “under so much pressure.” Ms. Reeves was later seen leaving the Commons holding hands with her sister, Labour MP Ellie Reeves, in a gesture of solidarity.

Political Barbs and the Path Ahead

Opposition politicians seized on the situation. Conservative leader Kemi Badenoch singled out Ms. Reeves during PMQs, commenting that she looked “absolutely miserable” and challenging the Prime Minister on whether she would remain Chancellor until the next election. Badenoch characterised Ms. Reeves as a “human shield” for Mr. Starmer’s policy reversals. Starmer countered by questioning Badenoch’s own job security but initially avoided an explicit commitment to Reeves’ tenure stretching to the next election, although his press secretary later clarified his position forcefully.

The Specter of Tax Rises

The £5 billion gap created by the welfare U-turn, combined with Labour’s commitments not to raise income tax, employee national insurance, or VAT, has intensified focus on other potential revenue-raising measures. Experts from the Institute for Fiscal Studies (IFS), including incoming director Helen Miller, have suggested that with departmental spending plans largely fixed and planned benefit cuts abandoned, other tax rises are looking “increasingly likely” to meet fiscal targets. This analysis suggests the summer months will see heightened speculation about which taxes might be targeted. While Starmer declined to rule out all future tax rises when questioned, maintaining the standard position that budgets are not written live at the despatch box, the fiscal challenge remains.

For Rachel Reeves, the week highlighted the immense pressure of the Chancellor role, blending personal challenges with high-stakes political and economic decisions. Despite the emotional moment and the political fallout from the welfare policy reversal, she retains the strong public backing of the Prime Minister as she navigates the difficult task of balancing the nation’s books while adhering to fiscal rules and pre-election tax pledges. The question of how the £5 billion gap will ultimately be closed remains a critical challenge looming over future budget plans.

Frequently Asked Questions

Why was UK Finance Minister Rachel Reeves reportedly emotional in Parliament?

While her spokesperson stated it was due to a “personal matter,” Ms. Reeves’ emotional appearance during Prime Minister’s Questions (PMQs) occurred amidst intense political pressure. It followed a controversial government U-turn on welfare reforms that created a significant financial gap. Reports also suggested a contributing factor might have been a difficult exchange with Commons Speaker Sir Lindsay Hoyle shortly before the session, where Ms. Reeves reportedly mentioned feeling “under so much pressure.”

How did the welfare reform U-turn impact the government’s finances?

The decision to abandon planned restrictions on Personal Independence Payment (PIP) eligibility, reportedly due to pressure from Labour MPs, eliminated approximately £5 billion in projected annual savings by 2030. This created a substantial shortfall in the government’s financial plans, directly impacting Chancellor Rachel Reeves’ ambition to fund day-to-day spending solely from tax revenues rather than increasing borrowing, a key fiscal rule she has emphasised.

What does the fiscal gap mean for potential tax increases in the UK?

The £5 billion gap created by the welfare U-turn, combined with Labour’s pledges not to increase income tax, employee national insurance, or VAT, has led experts to suggest other tax rises are increasingly likely. The Institute for Fiscal Studies (IFS) has highlighted that with spending plans and other benefit commitments relatively fixed, filling this funding gap may necessitate looking at other areas for increased revenue, intensifying speculation about potential tax policy changes.