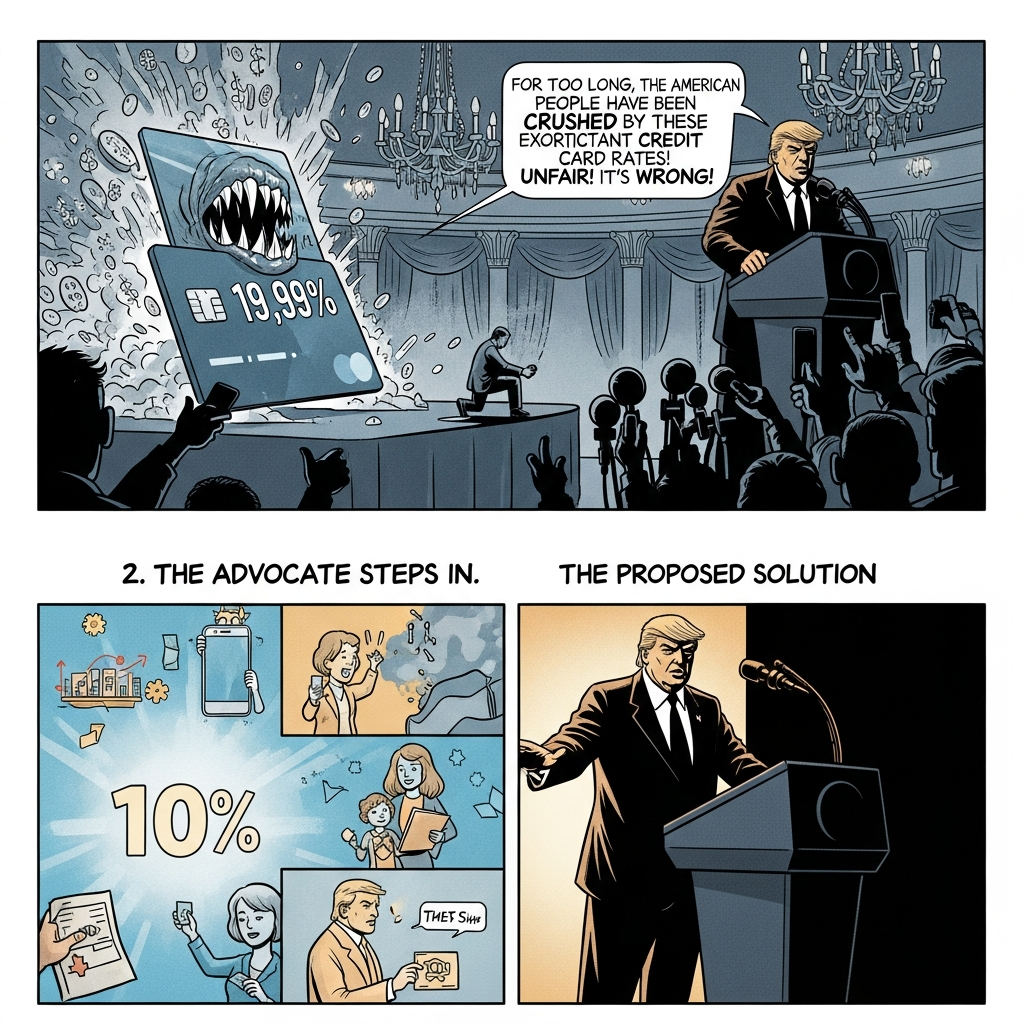

Former President Donald Trump has reignited a critical debate over consumer finance, proposing a one-year, 10% cap on credit card interest rates. This bold declaration, made on his Truth Social platform, aims to tackle what he describes as Americans being “ripped off” by high lending costs. Slated to take effect on January 20, 2026, marking the one-year anniversary of a potential second term, the proposal highlights a significant shift in his approach to financial regulation. It thrusts the complex issue of credit card debt and accessibility into the forefront of political discourse, prompting varied reactions from lawmakers and financial experts alike.

Unpacking Trump’s Proposal: A Closer Look

Donald Trump’s recent call for a 10% limit on credit card interest rates seeks to address surging living costs. He asserts that current rates, often ranging from 20% to 30% or more, are crippling American families. His core argument centers on “AFFORDABILITY!” This focus underscores a broader political strategy targeting the escalating cost-of-living crisis. Trump specifically attributes the high rates and inflationary pressures to the “Sleepy Joe Biden Administration.” However, a critical detail remains unspecified: how would this cap be implemented? It’s unclear if Trump envisions voluntary participation from credit card companies or government enforcement. Legally, such a cap would require congressional action, not just a presidential decree.

A Striking Shift in Financial Stance

This latest proposal marks a notable departure from Trump’s previous actions regarding financial regulation. During his prior administration, significant changes were made to consumer protections. For instance, his administration dismantled an $8 credit card late fee limit. This limit, initially imposed by the Biden administration, was projected by the Consumer Financial Protection Bureau (CFPB) to save families over $10 billion annually. Furthermore, when a federal judge blocked Biden’s effort in 2024, the Trump administration notably sided with the banks challenging the rule. Critics also point out that his administration historically sought to curb the powers of the CFPB, a key financial watchdog agency. This agency is responsible for protecting consumers and ensuring fair financial markets.

The Consumer’s Burden: Why a Cap Appeals

The idea of capping credit card interest rates resonates with millions of Americans facing substantial debt. Federal Reserve statistics show that average credit card interest rates currently exceed 20%. The problem is significant. Americans collectively owed a record $1.23 trillion in credit card balances last year, according to the Federal Reserve Bank of New York. A 2024 NerdWallet study revealed the average U.S. household with credit card debt carried a balance of $10,563. These figures highlight a widespread financial strain.

Supporters argue that a cap would offer much-needed relief to these households. They believe credit card issuers can absorb the reduction without severe consequences. Both Senator Bernie Sanders (I-Vt.) and Representative Anna Paulina Luna (R-Fla.) have voiced concerns. They accuse “big banks” of making “huge profits” by “ripping off” working-class Americans and trapping them in debt. A 2023 CFPB report also noted that credit card rates have “soared far above the cost of offering credit.” The bipartisan appeal of such a measure is evident, with previous legislative efforts for a 10% cap co-sponsored by Senator Josh Hawley (R-Mo.) and Senator Bernie Sanders.

The Other Side of the Coin: Potential Economic Risks

While the concept of a credit card interest rate cap has widespread appeal, it faces strong opposition from the financial industry and some economists. Opponents warn of potentially detrimental effects that could outweigh the benefits.

Key concerns include:

Restricted Credit Access: Banks, which heavily rely on credit card interest for revenue, might significantly tighten lending standards. This could lead to a reduction or elimination of credit card access for “riskier” borrowers. Lower-income individuals or those with lower credit scores could find it harder to obtain credit.

“Loan Shark” Risk: Billionaire hedge fund manager Bill Ackman called the proposal a “mistake.” He argued that if lenders cannot charge rates sufficient to cover losses and earn a reasonable return, they would cancel cards. This could force millions to turn to unregulated, high-cost alternatives like payday lenders or pawn shops. These options often carry even higher rates and worse terms.

Devastating Impact for Millions: A coalition of major banking groups, including the American Bankers Association, warned of a “devastating” outcome. They claim a 10% cap would “reduce credit availability” for millions of American families and small business owners. The Bank Policy Institute estimated over 14 million households could lose access.

Worsening the “K-shaped Economy”: Some experts suggest that reduced credit availability for less affluent individuals could exacerbate the “K-shaped economy.” This term describes a widening wealth gap where wealthier individuals thrive, while others struggle with higher prices and increased debt.

Scott Simpson, CEO of America’s Credit Unions, echoed these sentiments. He stated that a 10% cap would not make credit more affordable but “unattainable for millions.”

Political Reactions and Bipartisan Divides

Trump’s proposal has ignited a flurry of reactions across the political spectrum. Senator Josh Hawley (R-Mo.) quickly expressed support, stating he “can’t wait to vote for this.” However, other prominent figures have been more critical. Senator Elizabeth Warren (D-Mass.), a leading voice on financial regulation, dismissed the idea as a “joke.” She accused Trump of not genuinely caring about affordability and of previously trying to “shut down the CFPB.”

Senator Bernie Sanders, despite his own similar proposals for interest rate caps, also criticized Trump. Sanders pointed out that Trump failed to act on campaign promises to cap rates during his previous presidency. Instead, Sanders argued, Trump “deregulated big banks” which continued charging high interest. This highlights the complex political dynamics surrounding financial reform, where agreement on the problem doesn’t always translate into agreement on solutions or sincerity of purpose.

Broader Economic Agenda: Beyond Credit Cards

The credit card interest rate cap is not an isolated proposal. It forms part of a broader series of populist economic pronouncements from Donald Trump. These pronouncements aim to position him as a champion for the everyday American. Earlier in the same week, he suggested directing “representatives” to buy $200 million in mortgage bonds. The goal was to lower home costs and monthly payments. He also proposed banning institutional investors from purchasing single-family homes. Additionally, he mentioned signing an executive order to limit defense contractors’ corporate spending.

These actions collectively signal a strategy targeting large corporations and financial institutions. They aim to address “affordability concerns” and reduce borrowing costs across various sectors. Trump has also urged the Federal Reserve to aggressively cut its benchmark interest rate. Such cuts would influence a wide range of borrowing costs, though they could risk exacerbating inflation. He also anticipates nominating a new Federal Reserve chair soon, stating his preference for someone “honest with interest rates.”

The Legislative Reality: Congressional Hurdles

Despite the high-profile nature of Trump’s proposal, its path to becoming law faces significant hurdles. A crucial point often overlooked is that the President of the United States cannot unilaterally impose a credit card interest rate cap. Such a fundamental change to the financial system requires an act of Congress. Historically, similar legislative efforts have struggled to gain traction and pass into law.

The debate over the 10% cap underscores a fundamental tension in economic policy. On one side are advocates for consumer protection and debt relief. On the other are concerns about market functioning, credit availability, and the potential for unintended negative consequences. The political will and legislative coordination required to enact such a far-reaching measure would be substantial. Public opinion, while generally favorable to reducing interest rates, also reflects skepticism about Trump’s overall economic impact. A recent CNN poll indicated 61% of Americans believe his policies have “worsened economic conditions.”

Frequently Asked Questions

What is the primary argument for capping credit card interest rates?

The main argument for capping credit card interest rates, particularly at 10% as proposed by Donald Trump, is “AFFORDABILITY!” Proponents emphasize providing relief to American consumers burdened by high interest payments, often exceeding 20-30%. With Americans owing a record $1.23 trillion in credit card debt and the average household owing over $10,000, a cap is seen as a direct way to reduce financial strain. Supporters, including some bipartisan lawmakers, believe it would prevent credit card companies from “ripping off” working-class Americans and ensure fairer lending practices.

What are the potential negative consequences if a 10% credit card interest rate cap were implemented?

Implementing a 10% credit card interest rate cap could lead to several negative consequences. Financial institutions, heavily reliant on interest income, might tighten lending standards dramatically. This would likely reduce credit availability for millions, especially lower-income individuals or those with lower credit scores deemed “riskier” borrowers. Experts warn this could force consumers towards less regulated, more costly alternatives like payday lenders or pawn shops, effectively creating a “loan shark” problem. Additionally, banking groups argue such a cap could be “devastating” for small businesses and households that depend on credit cards, potentially exacerbating economic inequalities.

How realistic is Trump’s proposal for a 10% credit card interest rate cap to become law?

The realism of Trump’s 10% credit card interest rate cap proposal becoming law is complex. While the idea enjoys some bipartisan support in principle, the President cannot unilaterally impose such a cap; it requires an act of Congress. Passing comprehensive financial regulation through Congress is historically challenging, and similar past legislative efforts have not succeeded. Furthermore, the powerful banking industry strongly opposes the measure, citing severe economic consequences. Despite the populist appeal, the substantial legislative hurdles, combined with divided political opinions and potential economic backlash, make the immediate enactment of such a cap highly uncertain.

Conclusion: A High-Stakes Financial Debate

Donald Trump’s proposal for a 10% credit card interest rate cap represents a significant intervention into the American financial landscape. Framed as a crucial step towards “AFFORDABILITY!” and a response to what he terms a “ripped off” public, it aims to alleviate the mounting burden of consumer debt. While the concept garners support from those eager for debt relief, it faces staunch opposition from the banking industry and some economists who warn of severe unintended consequences, particularly reduced credit access for vulnerable populations. The proposal also highlights a complex political dynamic, with both bipartisan support for the idea of rate caps and strong partisan disagreements over how to achieve them and Trump’s sincerity. Ultimately, whether this ambitious proposal gains traction will depend on navigating significant legislative hurdles and balancing competing interests within a deeply divided political and economic environment.