As a critical July 9th deadline approaches for President Trump’s proposed reciprocal tariffs, U.S. stock markets have paradoxically climbed to unprecedented record highs. This bullish market performance, particularly noticeable in major indices like the S&P 500 and Nasdaq Composite, reflects a complex interplay of economic data, federal Reserve expectations, and evolving trade policy outlooks. Investors are currently navigating potential trade tensions alongside surprising economic strength, leading to a unique moment in the current bull market cycle. Understanding the factors driving this dynamic is essential for grasping the market’s near-term trajectory.

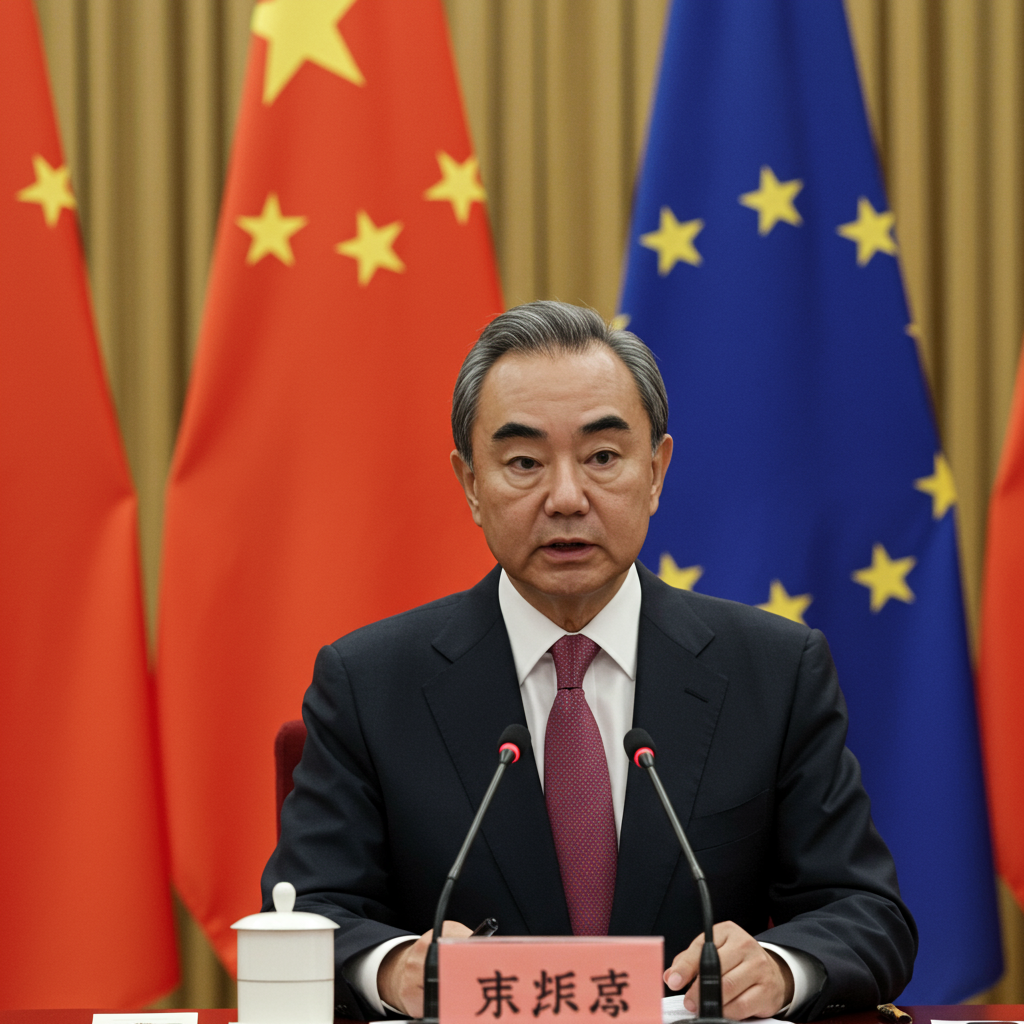

The original deadline for certain tariffs, which were paused on April 2nd, is now just days away. This self-imposed timeframe adds a layer of uncertainty for businesses and markets. The reciprocal tariffs could impact trade relationships with key partners, including the European Union and Canada, although recent focus has also included progress like a newly announced deal with Vietnam. Despite this looming date, Wall Street appears relatively calm. Many analysts suggest that the market has already factored in an outcome where steep, broad tariff increases are avoided, at least for the moment. The prevailing sentiment leans towards the administration extending the pause (“kicking the can”) to prevent the kind of market disruption seen during previous tariff escalations.

Why Stocks Are Reaching New Records

The primary catalyst propelling U.S. stocks to record territory has been a stronger-than-anticipated June jobs report. Released last week, this data significantly eased concerns about a potential slowdown in the American economy. The report revealed that the U.S. economy added a robust 147,000 nonfarm payrolls during June. This figure comfortably surpassed economists’ forecasts, which had centered around 106,000 additions.

Simultaneously, the unemployment rate also showed unexpected improvement. It decreased to 4.1%, defying predictions that it would rise to 4.3%. This combination of strong job creation and falling unemployment paints a picture of a resilient labor market and, by extension, a solid underlying economy. The positive jobs data provided a fresh dose of confidence for investors, overshadowing other potential headwinds like the approaching tariff deadline. The S&P 500 finished the recent holiday-shortened week at a record 6,279.35, up 1.7%. The Nasdaq Composite also hit a new high at 20,601, gaining 1.6%. The Dow Jones Industrial Average added 2.3% and sits just shy of its own record close.

The Federal Reserve’s Shift in Focus

The surprisingly strong June jobs report had an immediate and dramatic impact on expectations regarding the Federal Reserve’s monetary policy. Prior to the data release, there was significant speculation that the Fed might move to cut interest rates soon to preemptively support economic growth. However, the robust employment figures fundamentally altered this outlook.

Following the report, bets on a Federal Reserve rate cut at the upcoming July meeting diminished rapidly. According to the CME FedWatch Tool, the probability of a July cut plummeted from 24% just the day before the jobs report to a mere 5% afterward. Expectations for a September cut also decreased significantly, falling from 94% probability to 78%. Economists quickly revised their forecasts, with many, like Joe Brusuelas, chief economist at RSM, stating that a July rate cut is now “completely off the table.” The data, he noted, strongly supports a forecast of a “slowing but solid economy,” suggesting the Fed has less immediate pressure to ease policy. Federal Reserve Chairman Jerome Powell has also reiterated a cautious “wait-and-see” approach, preferring to assess the impact of tariffs and other factors before making rate decisions.

Market Sentiment and Future Outlook

The current record highs in the stock market are largely underpinned by investor confidence in the U.S. economy’s stability. This optimism is coupled with a belief that potential changes in Trump’s tariff strategy, while uncertain, are unlikely to fundamentally derail the positive economic narrative currently driven by the strong labor market. Michael Kantrowitz, chief investment strategist at Piper Sandler, observes that investors are once again pricing macro risks “near zero.”

This indicates a significant “risk-on” rotation in the market, where investors are more willing to take on risk in pursuit of higher returns. This trend could potentially continue, according to analysts. However, it remains vulnerable to the re-emergence of major macro risks. These potential disruptors include unexpected shifts in inflation, sudden changes in interest rate expectations, a weakening of the employment picture, actual significant tariff escalation, or disappointing corporate earnings results.

Market sentiment indicators reflect this elevated optimism. Citi’s Levkovich Index, a gauge incorporating factors like short positions and leverage, recently hit 0.39. This level sits slightly above the 0.38 threshold typically seen as signaling “euphoria” or an overstretched market position. While markets can sometimes sustain such enthusiastic levels, this heightened sentiment places additional pressure on the upcoming second-quarter earnings season. Scott Chronert, Citi US equity strategist, suggests that anything less than strong earnings beats combined with positive forward guidance (“beats-and-raises”) could prompt traders to take profits, especially since the Fed is perceived to be holding rates steady for the time being.

What to Watch This Week

Looking ahead, the economic data calendar for the upcoming week is relatively quiet compared to the impact of the recent jobs report. Investors will still monitor several key releases for further insights into the economy’s health. These include the NFIB small business optimism index, providing a pulse on sentiment among small businesses. The New York Fed’s 1-year inflation expectations survey will offer clues on consumer price outlooks. MBA Mortgage Applications data will indicate activity in the housing market.

Crucially, the minutes from the Federal Reserve’s most recent FOMC meeting are scheduled for release. These minutes will provide deeper insight into the committee members’ discussions and rationales leading up to their decision, potentially clarifying their views on the economic outlook, inflation, and future policy direction before the impact of the latest jobs data was fully absorbed. Corporate earnings reports are limited, with Delta (DAL) scheduled to report during the week, leading a relatively light earnings calendar.

Other data points to consider include the revised first-quarter GDP figures, which showed a 0.5% decline. Economists largely attribute this dip to a surge in imports, potentially linked to companies attempting to pre-empt future tariffs, and anticipate a rebound in the second quarter. Despite this, the economy is still seen as “slowing, but remaining resilient.” In contrast to the strong US market performance, some Asian equity markets experienced declines, reacting with apprehension to the approaching US tariff deadline, highlighting the global impact of trade policy uncertainty.

Frequently Asked Questions

What is the upcoming Trump tariff deadline and its potential impact?

President Trump has set a self-imposed deadline of July 9th for implementing reciprocal tariffs that were previously paused on April 2nd. This deadline creates uncertainty for trade relationships, particularly with the EU and Canada. While a specific outcome is unclear and an extension is widely expected by analysts, failure to reach agreements or extend the pause could lead to increased tariffs, potentially disrupting global trade and causing market volatility, similar to reactions seen in Asian markets recently.

Why did stocks reach record highs despite tariff uncertainty?

U.S. stocks climbed to record highs primarily due to a stronger-than-expected June jobs report. The report showed robust job creation (147,000 nonfarm payrolls) and a lower unemployment rate (4.1%), easing fears of an economic slowdown. This positive economic data boosted investor confidence and shifted expectations away from imminent Federal Reserve interest rate cuts, leading market participants to focus on the economy’s strength rather than the potential tariff risks, which many believe will be deferred.

How is the strong jobs report influencing Federal Reserve rate cut forecasts?

The strong June jobs report significantly reduced the likelihood of near-term interest rate cuts by the Federal Reserve. Following the data release, the probability of a July rate cut, as tracked by the CME FedWatch Tool, plummeted from 24% to just 5%. Expectations for a September cut also fell. The data suggests the U.S. economy is solid, removing pressure on the Fed to cut rates to stimulate growth. This shift means the Fed is now widely expected to keep rates steady for the immediate future, impacting borrowing costs and market expectations.

Conclusion

The U.S. stock market’s ascent to record highs amid the approaching Trump tariff deadline reflects a market balancing economic strength against potential policy risks. The powerful June jobs report has been a key driver, alleviating slowdown fears and firmly placing the Federal Reserve on hold regarding interest rate cuts. This positive economic backdrop and the expectation among many analysts that the tariff deadline will be extended have allowed investors to largely shrug off the trade uncertainty for now. However, market sentiment indicators point to high levels of optimism, potentially leaving the market vulnerable if major macro risks—be it actual tariff escalation, disappointing corporate earnings, or unexpected inflation—re-emerge. The upcoming week’s quiet data calendar puts further focus on any trade developments and the details revealed in the FOMC minutes.