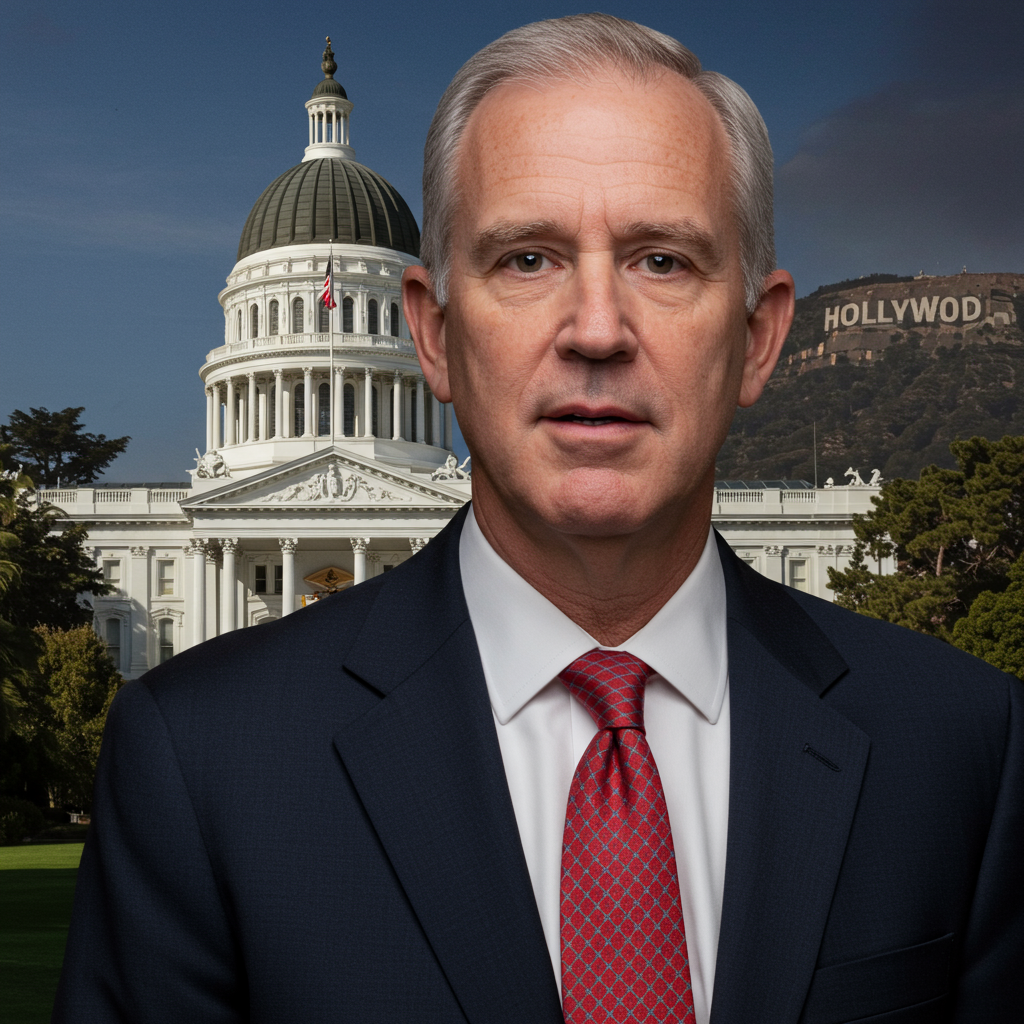

California’s glittering film industry, from iconic landmarks to star-studded premieres, is undeniably woven into the state‘s identity. Many state leaders naturally want to keep this industry thriving here. However, one California State senator, Roger Niello, took a different path. He voted against a major expansion of the state’s film and television tax credit program. His decision wasn’t just about the hundreds of millions of dollars involved; it highlighted fundamental questions about California’s approach to economic development and statewide priorities. This perspective offers a critical look at how the state invests taxpayer money amidst significant financial challenges.

A Lone Voice Against the Tide

Supporting the film tax credit is highly popular within the California Legislature. With 120 lawmakers, Senator Niello stood as one of only two legislators to vote “No” on the latest proposals to dramatically increase the credit. This near-unanimity speaks volumes about the industry’s influence and the political landscape surrounding it. Questioning initiatives tied to the bright lights and cameras of Hollywood carries political risk. Yet, Senator Niello argued that while the film industry is part of California’s story, the chosen method of support—large, targeted tax credits—is not the kind of economic policy that genuinely benefits the entire state.

Doubling Down Amidst Deficit

The recent budget discussions saw a significant push to more than double the state’s film and television tax credit. The annual allocation jumped from $330 million to a staggering $750 million. This substantial increase comes at a time when California faces a projected $12 billion budget deficit. Approving such a massive expenditure under these circumstances raises legitimate questions about the state’s economic priorities. California’s budget resources are not limitless. Senator Niello emphasized that a truly effective program should not be measured simply by how quickly its funding is spent, but by its actual, verifiable impact. The increased incentives are approved through 2035, potentially channeling $1.5 billion over the next decade.

Producer Scott Budnick was quoted in a Politico article regarding the proposed $750 million expansion. He reportedly said, “My hope is we blow through this money, and we’re gonna have to go back to the governor for even more next year.” While perhaps a lighthearted comment, Senator Niello felt it underscored a potentially problematic expectation: that this large sum might be quickly depleted, signaling a need for even greater future investment, regardless of the state’s financial health.

Lack of Evidence for Statewide Economic Impact

A core part of Senator Niello’s argument rests on independent analysis. Earlier this year, the nonpartisan Legislative Analyst’s Office (LAO) released a report evaluating the effectiveness of the film tax credit. The LAO’s conclusion was stark: “there is currently no compelling evidence to suggest that film tax credits have a positive effect on the size of the state’s economy overall.”

Senator Niello believes this finding alone should prompt a serious re-evaluation of the policy. Spending hundreds of millions of taxpayer dollars on an initiative that a nonpartisan state office says shows “no compelling evidence” of boosting the overall economy is a critical point of contention. It suggests that the significant investment might not be achieving its stated goal of broad economic uplift for California.

Benefits Concentrated in One Region?

Economic development policy, in Senator Niello’s view, should aim to lift up all parts of California. It shouldn’t solely reinforce the advantages of one specific region. The film industry is heavily concentrated in the greater Los Angeles area, already one of the state’s most economically dominant regions. The tax credit, by primarily supporting this industry, effectively sends massive checks to bolster an area that is already thriving relative to many others in the state.

Furthermore, the nature of film and television productions is often temporary. Projects wrap, sets are dismantled, and crews move on. This can result in transient economic activity rather than durable, long-term growth in specific communities.

Comparing this to sectors like manufacturing infrastructure provides a contrast. Supporting manufacturing can often lead to sustained job creation and economic stability in communities across the state that need jobs the most. When public funds support these sectors, the result can be more balanced growth and more lasting benefits statewide.

The Opportunity Cost: What Else Could $750 Million Do?

Every dollar allocated to the film tax credit is a dollar that cannot be used for other essential services or priorities across California. This is known as opportunity cost. Given the state’s multibillion-dollar deficit and increasing pressure on core public services like education, healthcare, and infrastructure, hard questions about fiscal priorities become crucial.

A CalMatters column by Dan Walters highlighted the sentiment felt in other vital, yet often overlooked, California industries. Agriculture, for instance, generates roughly $60 billion annually, approximately twice the estimated economic footprint of the film industry. Despite facing rising labor costs and environmental regulations, farmers have received little targeted relief. Yet, the political spotlight, and significant state funding, has focused intensely on Hollywood. Governor Newsom reportedly made the $750 million film tax credit expansion a top budget priority, even amidst the $12 billion deficit. This stark contrast illustrates the difficult choices facing policymakers and the perceived favoritism towards the film industry.

A Patch, Not a Solution, for Business Costs

California is widely recognized as a challenging place to do business. Recent rankings, like CNBC’s 2024 report, placed California 45th in cost of doing business and dead last (50th) in cost of living. These rankings, Senator Niello argues, are not coincidental. They are the predictable outcome of decades of policies that have layered regulation upon regulation and tax upon tax. This environment leads many employers to choose to grow their businesses elsewhere.

Industry-specific tax credits, including the film tax credit, are seen by critics as an attempt to merely “patch over” these deeper structural problems. The approach feels like saying, “We know it’s expensive to operate here because of our policies, so here’s a tax break to help you offset those self-inflicted costs.” Senator Niello views this as a form of damage control rather than genuine economic reform.

Seeking a Broader, More Equitable Vision

The significant increase in the film tax credit might temporarily boost production in Los Angeles for a few more months. However, Senator Niello contends it will not fix the underlying economic challenges facing communities like Fresno, Redding, Eureka, or Sacramento. It will not lower housing costs for Californians statewide. It won’t inherently make it easier for businesses in any sector to build facilities, hire workers, or expand operations across the state. It certainly won’t single-handedly push California back into the top 10 states for business climate or lift it from the bottom regarding affordability.

Senator Niello expressed pride in California being home to incredibly creative professionals. However, he suggested that if lawmakers truly want to support the industry, the conversation needs to shift. Instead of targeted subsidies, the focus should be on addressing the high cost of living and doing business for everyone. The goal should be to make California a place where individuals and businesses want to stay and flourish without needing continuous, costly subsidies.

He argued that respecting Hollywood, and indeed all of California’s industries and residents, means being honest about what truly helps its workers and the state as a whole. Sometimes, doing what is right for the majority requires stepping away from politically popular measures and choosing “The Road Not Taken,” a path focused on broader, more sustainable economic reform rather than narrow, targeted aid.

Frequently Asked Questions

Why did Senator Niello vote against the $750M film tax credit expansion?

Senator Roger Niello voted against the expansion primarily because he believes the large, targeted tax credit is a shortsighted approach to economic development. He argues it disproportionately benefits one region (Los Angeles), shows no compelling evidence of positive impact on the overall state economy according to the LAO, and represents a significant opportunity cost amidst a state budget deficit. He feels it doesn’t address the deeper issues making California expensive for all businesses and residents.

What did the nonpartisan LAO report say about the film tax credit’s economic impact?

The nonpartisan Legislative Analyst’s Office (LAO) conducted a report evaluating the state’s film tax credit program. Their key finding was that “there is currently no compelling evidence to suggest that film tax credits have a positive effect on the size of the state’s economy overall.” This independent assessment was a major factor cited by Senator Niello in his decision to oppose the program’s expansion.

Does the film tax credit benefit California’s economy statewide, according to critics?

Critics, including Senator Niello and findings from the LAO report, argue that the film tax credit’s benefits are primarily concentrated in the heavily industrialized greater Los Angeles area. They contend that while it may help production there, it does little to stimulate economic growth or create durable jobs in other parts of the state. They suggest the money could be better used to address statewide issues that impact all industries, such as the high cost of living and doing business, fostering more balanced and widespread economic benefits.

A Different Path Forward for California

Senator Roger Niello’s vote against the $750 million film tax credit expansion highlights a debate about California’s economic future. His position challenges the prevailing political will, arguing that while supporting a key industry like film is important, the method matters. Relying on costly, targeted subsidies, especially when state finances are strained and independent analysis questions the broader economic impact, may not be the most effective path. Instead, his perspective advocates for addressing the fundamental costs that make California a challenging place for all businesses and residents. This approach, while less politically popular, seeks to create a more sustainable and equitable economic climate across the entire state.

References

- www.hollywoodreporter.com

- <a href="https://www.imdb.com/news/ni65354757/?ref=nwcart_perm”>www.imdb.com

- www.hollywoodreporter.com

- deadline.com

- deadline.com