Geopolitical tensions are surging in the Middle East following recent U.S. strikes on Iranian nuclear sites. In a significant escalation, Iran’s parliament has reportedly backed a move to block the vital Strait of Hormuz. While this potential closure raises alarms globally, experts warn that such a drastic step could ultimately harm Iran more than its adversaries.

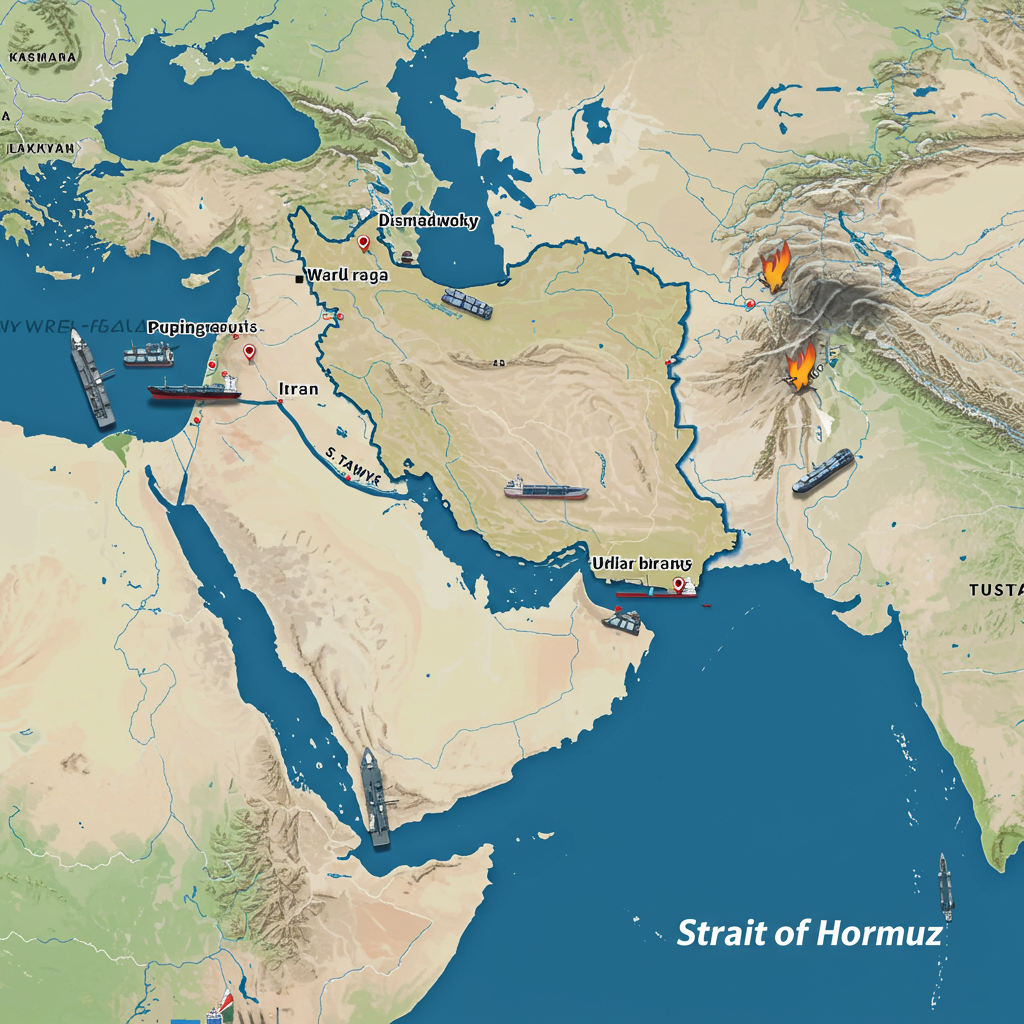

The Strait of Hormuz, connecting the Persian Gulf to the open ocean, is not just a waterway – it’s the world’s most critical oil transit chokepoint. Data reveals approximately 20% of global oil and petroleum product consumption, alongside about 20% of the world’s liquefied natural gas (LNG), transits this narrow passage daily. The prospect of its closure immediately raises the specter of aggravated geopolitical tensions and soaring energy prices worldwide.

Iran’s Risky Gamble: Alienating Neighbors and Partners

Despite the parliamentary approval, the final decision on closing the strait rests with Iran’s national security council. Energy intelligence experts view the possibility of a full closure as “absolutely minimalistic,” citing the immense self-inflicted damage Iran would incur.

Blocking the strait risks turning neighboring oil-producing countries, many of whom rely heavily on this route for their exports, into outright adversaries. This could easily escalate into hostilities. Furthermore, a closure would severely impact Iran’s own crucial oil export markets, particularly in Asia, where the majority of its crude is sold. Antagonizing major buyers like China, which also depends heavily on Gulf oil flows, is a significant risk Tehran is unlikely to take lightly.

As one expert noted, there is “very, very little to be achieved, and a lot of self-inflicted harm that Iran could do.” Disrupting supplies could also “put a target” on Iran’s own energy infrastructure and the ruling regime, especially at a time of heightened military readiness from the U.S. and Israel.

Global Energy Markets on Edge

The mere threat of disruption is enough to send ripples through global energy markets. While US-associated vessels have reportedly continued transiting the strait without interruption so far, indicating no immediate threat to commercial shipping, the shipping industry is already reacting.

Avoidance and Delays: Some shipping groups have begun avoiding the Strait of Hormuz or putting vessels on “standby,” delaying entry into the Gulf amidst deepening fears of conflict. Tanker entry rates have slowed, with vessels waiting for opportune moments to transit.

Higher Costs: Insurance costs for shipping in the region have likely been hiked again following the reported parliamentary approval.

- Price Volatility: Oil prices have shown volatility following the U.S. strikes and Iran’s response. Amidst rising tensions, U.S. leaders have publicly pressed for keeping oil prices low, urging domestic producers to increase output to counter potential supply disruptions. While oil prices initially dipped after these calls, they later extended gains, with Brent futures briefly jumping significantly before easing, highlighting market sensitivity to the geopolitical risk.

- www.nbcsandiego.com

- www.nbcchicago.com

- www.nbclosangeles.com

Should Iran proceed with a closure, the impact would be far-reaching. Not only would Iran’s exports be affected, but also those of major Gulf nations like Saudi Arabia, the UAE, Kuwait, and Qatar. This could potentially remove billions of barrels of oil from global markets and cause feedstock shortages for regional refineries, impacting supply to Asia, Europe, and North America.

Natural gas flows would also be severely hit, with Qatar’s substantial LNG exports (roughly 20% of global supply) struggling to reach key markets.

Limited Alternatives and Price Impact

Alternative supply routes for Middle Eastern oil and gas are extremely limited. Existing pipeline capacity in countries like Saudi Arabia and the UAE is insufficient to offset potential maritime disruptions through the Persian Gulf and Red Sea. Experts estimate spare pipeline capacity is only a fraction of the oil volume normally transiting the strait daily.

Analysts project that a significant disruption could push oil prices substantially higher. One forecast suggests Brent crude could briefly spike to around $110 per barrel if flows through the strait were to drop by 50% for a month and remain reduced thereafter. This underscores the market’s current pricing-in of a geopolitical risk premium.

A Spectrum of Disruption

Rather than an “all or nothing” approach, experts suggest Iran’s actions in and around the strait are more likely to operate on a sliding scale of disruption. A potential strategy could involve “rattling” oil flows just enough to cause moderate price increases, potentially harming the U.S. economically, but stopping short of a full blockade that would provoke a major military response targeting Iran’s core energy infrastructure. Potential methods for disruption could include using small boats for a partial blockade or, in a more extreme scenario, mining the waterway.

Ultimately, while Iran’s parliamentary move signals intent and heightens global anxiety, the economic and geopolitical costs of fully blocking the Strait of Hormuz mean it remains a threat with severe potential consequences, primarily for Iran itself. The situation continues to be closely monitored by global markets and governments alike.