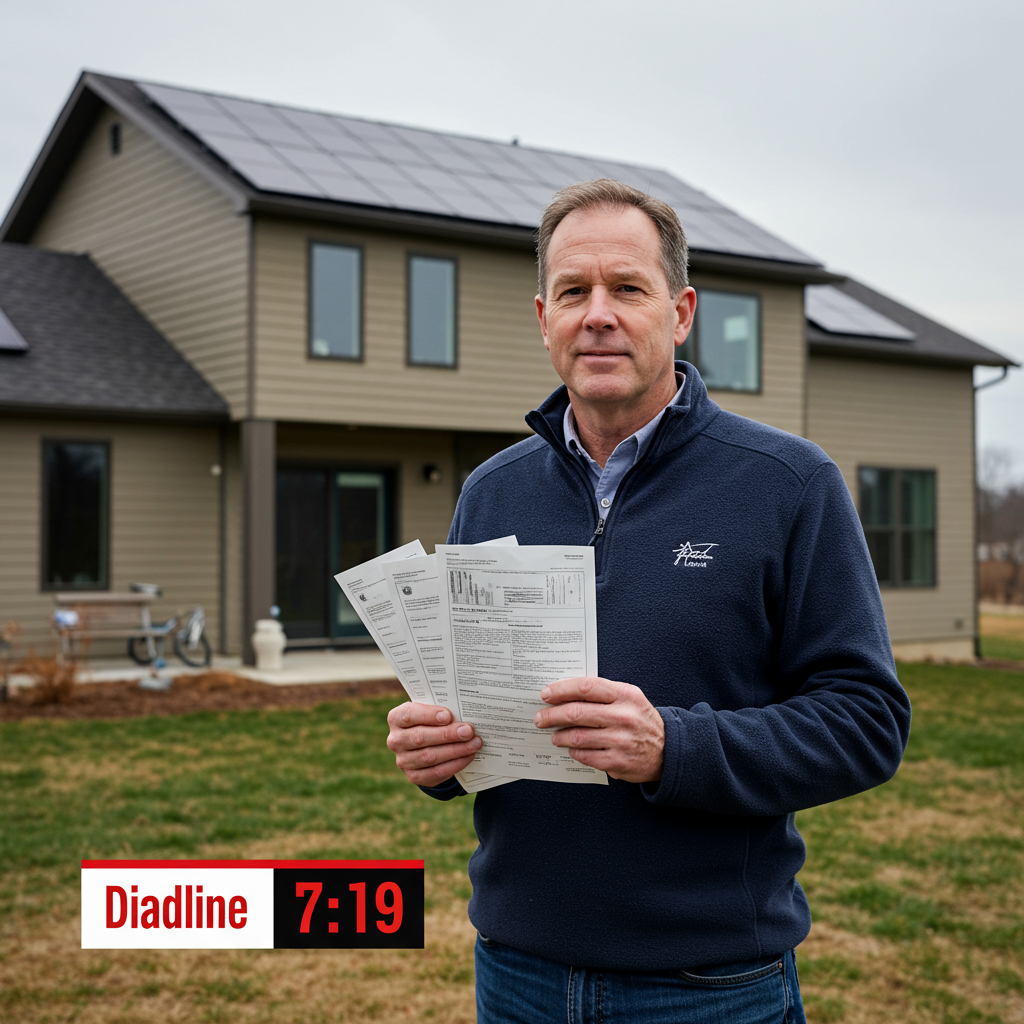

Wisconsin homeowners considering clean energy or energy efficiency upgrades face a looming deadline. Federal tax credits designed to make investments like installing solar panels or updating insulation more affordable are currently under threat of repeal in Congress. The clock is ticking for those hoping to leverage these incentives.

Federal Tax Credits Under Threat

These federal tax credits, expanded under the Inflation Reduction Act (IRA), offer a dollar-for-dollar reduction on your federal tax liability. They are intended to encourage investments that combat climate change and lower energy bills.

According to recent federal data, over 73,000 families in Wisconsin have already benefited from these programs. On average, Wisconsin families claimed over $5,100 for clean energy investments like rooftop solar and an average of $761 for home improvements such as heat pumps, air conditioners, and windows.

However, proposals in Congress aim to phase out or eliminate these incentives. A House budget bill suggests ending the credits as soon as the end of this year, while a Senate version introduced recently would repeal them six months after a bill is passed. Republicans backing the repeal argue it’s necessary to offset other tax cuts and view the credits as unnecessary subsidies.

What Credits Could Disappear?

The federal tax credits currently cover a significant portion of eligible project costs:

Solar Panels, Geothermal Systems, Battery Storage: You can claim 30% of the total cost.

Heat Pumps: You can claim 30% of the cost, up to a $2,000 annual limit.

Insulation, Air Sealing, Ventilation: You can claim 30% of the cost, up to a $1,200 annual limit.

Importantly, these tax credits for owned solar systems (purchased with cash or a loan) are currently set at 30% through 2032 under the IRA. If your tax liability in the year of installation is less than the credit amount, you can carry forward the unused portion to future tax years.

Why the Push to Act Now?

The potential elimination of these credits could significantly impact the affordability of clean energy and efficiency upgrades, particularly for middle- and low-income families. Kevin Kane, chief economist with Green Homeowners United, notes that repealing the credits will make these projects more difficult to undertake.

Industry professionals anticipate a potential “mad dash” by homeowners trying to claim the credits before they expire, according to Kane. This rush could strain installation capacity. Angie Kochanski, director of business development at Arch Solar, highlights that contractors typically need six to ten weeks just to obtain permits and utility approvals.

Beyond individual homeowners, the clean energy industry in Wisconsin is concerned. Solar companies, already facing challenges from higher interest rates, anticipate a dramatic shrinking of the market if the credits disappear. Experts estimate residential solar installations could fall by half next year, jeopardizing thousands of jobs. Cory Neeley of SolarShare Wisconsin Cooperative called the potential repeal a “huge slap in the face” for businesses that have invested in scaling up.

Broader Energy Goals at Risk

Ending these incentives is also seen as detrimental to broader energy goals. Kathy Kuntz, director of the Dane County Office of Energy and Climate Change, emphasizes that now is not the time to slow down investment in clean energy, especially as the nation’s grid faces increased demand, partly from power-hungry data centers. Upgrades help homeowners save money and reduce strain on the grid. Local governments, like the city of Green Bay, have passed resolutions supporting the retention of clean energy funding, citing its importance for meeting carbon neutrality goals.

Wisconsin’s Home Energy Rebates: A Separate Opportunity

While federal tax credits face uncertainty, Wisconsin residents have another avenue for saving on energy upgrades: federally funded Home Energy Rebates administered by the state through the Focus on Energy program. These rebates, established by the IRA and totaling $149 million for Wisconsin, are not currently under threat of repeal and are expected to be available for the next two to three years.

These rebates are distinct from tax credits and offer different benefits:

Home Efficiency Rebates (HOMES Program): Wisconsin was one of the first states to launch this program. It offers rebates for comprehensive projects that significantly improve a home’s overall energy efficiency (measured or modeled savings). Eligibility is open to all income levels, though lower-income households (under 80% area median income) can receive higher rebates, potentially covering up to 100% of costs (capped at $10,000). Rebates for other income levels are capped at 50% of costs. These rebates are often applied as an upfront deduction on contractor bills and require a home energy audit.

- Home Electrification and Appliance Rebates (HEAR Program): Wisconsin’s HEAR program is approved and expected to launch later. This program targets low- and moderate-income households (up to 150% area median income) and provides point-of-sale discounts on specific Energy Star certified electric appliances like heat pumps (for heating/cooling), heat pump water heaters, induction stoves, and heat pump dryers, as well as related electrical upgrades. There are caps per appliance and an overall household cap ($14,000).

- Assess the Urgency: If utilizing the federal tax credits is crucial for your project’s affordability, understand that the window to complete the work and claim the credit before potential repeal is closing rapidly. Factor in potential delays from permitting and installation timelines.

- Explore Wisconsin Rebates: Regardless of the tax credit situation, investigate the available HOMES rebates (and soon HEAR rebates) through Wisconsin’s Focus on Energy program. These funds are available now and can significantly lower upfront costs, especially for income-qualified households.

- Get Quotes: Contact qualified local contractors specializing in solar, HVAC (for heat pumps), or insulation. Get detailed quotes that outline eligible costs for both tax credits and potential rebates.

- Consult a Tax Professional: Understand how the federal tax credit applies to your specific tax situation and whether the carry-forward provision would benefit you.

- Stay Informed: Keep an eye on legislative developments regarding the federal tax credits.

- www.wpr.org

- www.nytimes.com

- www.marketwatch.com

- www.nerdwallet.com

- www.canarymedia.com

These state-administered federal rebates can often be combined with federal tax credits (if available when you complete the project) and other local or utility incentives, maximizing your overall savings.

What Wisconsin Homeowners Should Do Now

If you’ve been considering home energy efficiency upgrades or installing rooftop solar, now is the time to explore your options:

Don’t sit on the fence if upgrading your home’s energy performance is a goal. Leverage the incentives available through Wisconsin’s rebate programs, and act swiftly if you hope to take advantage of the federal tax credits before they potentially disappear.