Escalating tensions between Israel and Iran have ignited concerns about the potential for dramatic shifts in the global oil market. While military action between the two regional rivals has intensified, leading to casualties and targeted strikes on various sites, senior officials and energy analysts are now openly discussing a scenario with profound implications: the potential fall of the Iranian regime and its ripple effect on global oil supplies and prices.

Current Conflict Heats Up, Markets Remain Cautious

In recent days, Israeli forces have significantly escalated their military campaign against Iran, a major OPEC crude producer. These actions have included extensive airstrikes on military facilities, leadership targets, and even critical infrastructure. Iran has retaliated with ballistic missile attacks, targeting military and civilian sites in Israel.

Despite eight straight days of intense conflict at the time of initial reporting, the global oil market has shown remarkable restraint. Prices for both U.S. crude oil (WTI) and the international benchmark (Brent) have risen modestly, up around 8-10% since Israel’s offensive began. However, they remain below $80 per barrel. Analysts attribute this cautious reaction partly to global spare capacity, notably from Saudi Arabia, and the fact that Israeli strikes have, so far, largely avoided Iran’s core oil production facilities and major export terminals like Kharg Island. Iran’s current oil export volume is also relatively limited compared to its peak.

Yet, beneath the surface calm, the risk of a major supply disruption – one that could trigger a significant price spike – is growing the longer the conflict persists.

The “Regime Change” Factor and Its Oil Implications

While Israel’s primary stated goal is to degrade Iran’s nuclear program, some Israeli officials and analysts suggest a secondary aim could be to weaken the Iranian security establishment to the point where domestic opposition could potentially challenge the ruling regime. This is described by some as seeking “regime change from within,” distinct from an externally imposed collapse. While Prime Minister Netanyahu has publicly stated regime change is not an official goal, Defense Minister Israel Katz reportedly ordered intensified strikes to “destabilize the regime” by targeting the “foundations of its power.” The U.S. President has also hinted at regime change being an option if Iran doesn’t meet his terms, though U.S. public opinion surveys suggest a strong desire against military involvement in the conflict.

Experts caution there are currently no signs that the Iranian regime is on the verge of collapse. However, analysts like Natasha Kaneva, head of global commodities research at JPMorgan, warn that further political destabilization in Iran “could lead to significantly higher oil prices sustained over extended periods.”

Historical precedent supports this concern. JPMorgan research shows eight cases of regime change in major oil-producing nations since 1979. On average, oil prices spiked by 76% at their peak following these events, eventually stabilizing around 30% higher than pre-crisis levels. The 1979 Iranian revolution, for instance, saw oil prices nearly triple, contributing to a global recession. More recently, the 2011 revolution in Libya caused a significant, albeit less dramatic, price surge. Given Iran’s larger production capacity, a similar event there could have a far greater impact than Libya.

However, experts emphasize that markets would need “strong indicators that the state is coming to a halt, that regime change is starting to look real” before fully pricing in the potential loss of millions of barrels per day from the market.

Beyond Collapse: The Immediate Supply Disruption Threat

Even without outright regime change, the ongoing conflict presents immediate risks to global oil supply, primarily from potential Iranian actions if it feels existentially threatened or seeks leverage.

Targeting Regional Infrastructure: Iran could use its missile capabilities to target energy facilities or oil tankers in neighboring Gulf states.

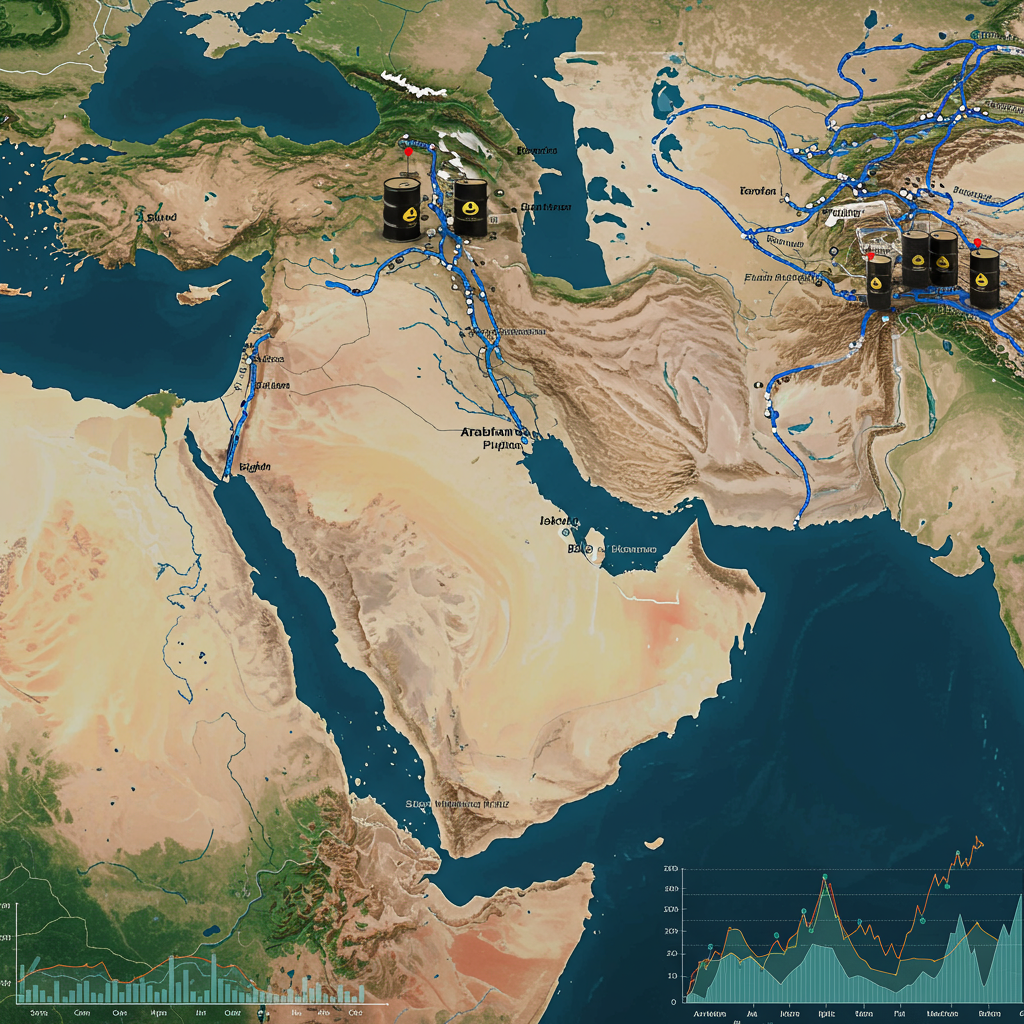

Strait of Hormuz Blockade: Perhaps the most significant threat involves the Strait of Hormuz. This narrow waterway, situated between Iran and Oman, is a crucial chokepoint through which approximately one-fifth to one-third of the world’s total seaborne oil trade passes daily (around 20 million barrels). Iran has previously threatened to disrupt shipping here. Reports have emerged of Iran aggressively jamming ship transponders in the strait, prompting warnings to vessels to avoid the area.

While closing the strait would severely damage Iran’s own oil export-dependent economy, some analysts believe Tehran might consider this action if it feels it has nothing left to lose. Experts debate the likelihood and duration of a potential blockage. While some believe U.S. naval presence could resolve a disruption quickly, others like Bob McNally, a former U.S. energy advisor, argue Iran could interrupt shipping for weeks or months, a far longer period than the market currently anticipates.

A full mobilization by Iran to disrupt shipping in the Strait of Hormuz could send oil prices surging significantly, potentially exceeding $100 per barrel, impacting global markets despite assessments that the direct impact on U.S. gasoline prices might be limited.

The Geopolitical Chessboard

The conflict is unfolding within a complex geopolitical landscape. Israel’s focus on the nuclear program remains paramount, driven by intelligence suggesting Iran is close to military enrichment capacity. Iran views its nuclear program as vital leverage but fears retaliation for its strikes traps it in an escalating cycle. Its regional proxies, while targeted and weakened by Israel, could still be used to pressure the U.S., potentially targeting bases or personnel, though Iran is reportedly wary of giving the U.S. a direct pretext to fully enter the war.

Russia, a partner of Iran, initially saw potential benefits like higher oil prices and attention shifting from Ukraine, but now faces the risk of losing a key ally if the Iranian regime collapses and appears unable to offer meaningful military assistance to Tehran. China, reliant on the region for energy, has called for de-escalation.

Ultimately, while Iranian regime change remains a speculative outcome tied to the conflict’s progression, the more immediate and significant risk to global oil prices stems from potential supply disruptions, particularly any prolonged interference with traffic through the vital Strait of Hormuz. The interplay of military actions, political objectives, and the high stakes for oil flows will continue to keep markets on edge.