Shares of Texas Instruments (TXN) saw a notable boost, rallying amidst broader market gains fueled by easing trade tensions and positive corporate news. While the semiconductor giant’s significant commitment to expanding U.S. manufacturing played a role in investor sentiment, the upward movement was also strongly supported by better-than-expected quarterly financial results around the same timeframe.

A Landmark $60 Billion Investment in U.S. Production

Texas Instruments announced ambitious plans to invest approximately $60 billion in expanding its domestic production capacity. This substantial investment is earmarked for the construction or expansion of up to seven facilities across the United States over an unspecified timeline.

This strategic move aligns with a growing national push for onshoring manufacturing, particularly in critical sectors like semiconductors. Political efforts, including increased tariffs on imports from various countries, have aimed to incentivize companies to bolster production within the U.S. While Texas Instruments already conducts the majority of its manufacturing domestically, its complex supply chain still relies on operations in countries like Taiwan, India, and Singapore. The $60 billion investment signals a significant commitment to deepening its U.S. footprint further.

Strong Earnings and Outlook Add Momentum

Adding fuel to the stock’s rally, Texas Instruments also recently reported first-quarter earnings that surpassed analyst expectations. Coupled with a positive second-quarter outlook, these financial results provided investors with further confidence in the company’s performance and near-term prospects, contributing significantly to the positive stock reaction.

Analyst Views and Market Performance

Market sentiment regarding TXN stock has been mixed overall, yet the recent news prompted positive movement. Wall Street analysts currently hold a consensus “Moderate Buy” rating for Texas Instruments, based on a mix of Buy, Hold, and Sell ratings over the past three months. The average analyst price target stands at around $185.95, suggesting a potential upside from recent trading levels.

However, individual analyst views vary. For instance, one five-star analyst at Wells Fargo reiterated a “Hold” rating on TXN shares, even while increasing their price target. This mixed picture reflects differing perspectives on the company’s valuation and market positioning compared to peers, including international rivals.

Despite some cautious takes, Texas Instruments stock has shown resilience. In the wake of the manufacturing investment announcement and positive earnings, shares saw an intraday rally. Year-to-date, the stock has posted solid gains, though its year-over-year performance has been more modest.

Insights from Market Commentators

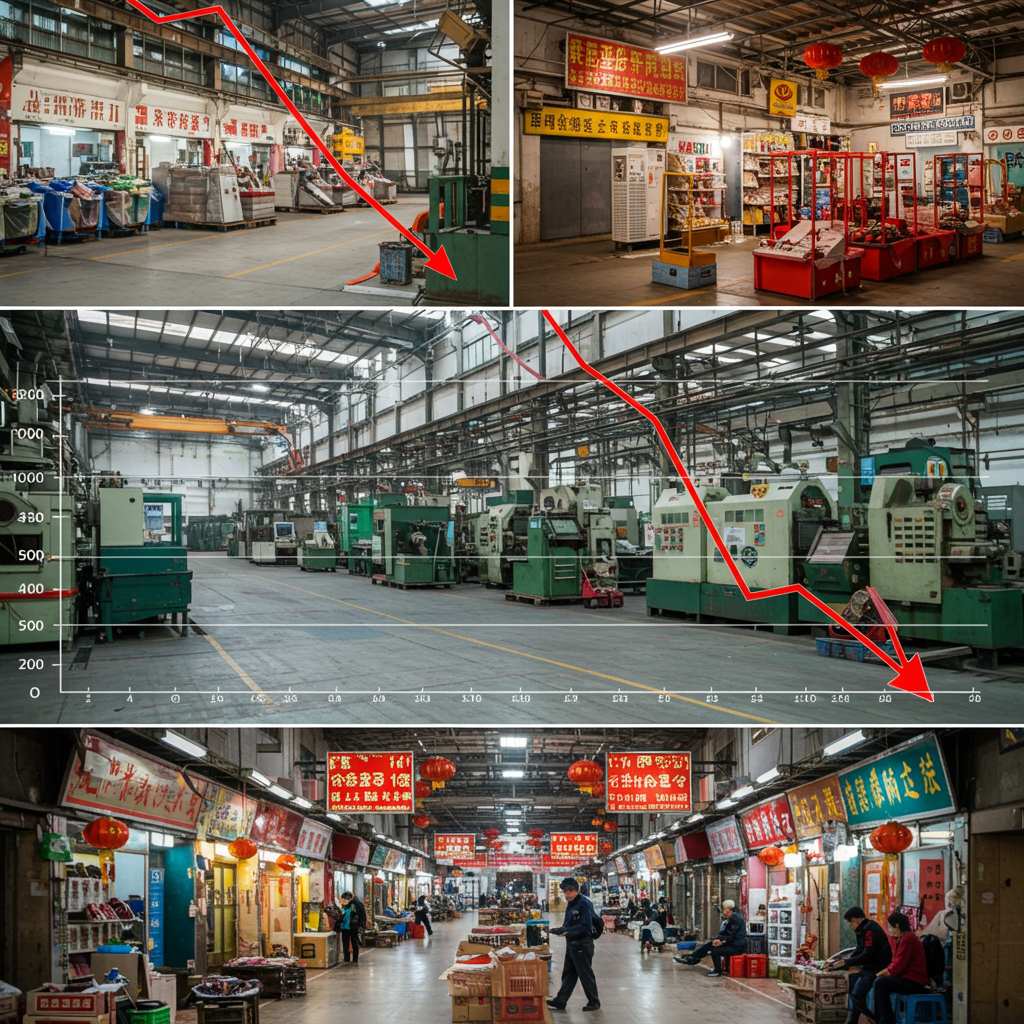

Commentary from market experts sheds further light on TXN’s position. Texas Instruments is widely recognized as the largest producer of legacy semiconductors – older-generation chips critical for various industries, where the U.S. had developed supply chain vulnerabilities. Recent increases in tariffs on such chips (from 25% to 50%) have been seen as a policy directly benefiting domestic legacy chipmakers like TXN.

Some commentators emphasize that TXN is fundamentally an industrial company, distinct from leading-edge chipmakers, and its stock performance often reflects this nature. Management has been praised for being transparent about market conditions, even acknowledging softness in certain areas like the embedded segment.

Texas Instruments designs and produces a wide range of analog and embedded semiconductor chips essential for sectors such as industrial equipment and automotive systems. The combination of a massive domestic investment plan, solid financial results, and a strategic position in key chip markets appears to be underpinning recent investor confidence in TXN stock.