The Federal Reserve has opted to keep interest rates steady, marking a period of cautious observation as policymakers weigh the potential economic impact of President Donald Trump’s evolving trade policies and escalating tensions in the Middle East.

The central bank maintained its benchmark lending rate within the range of 4.25% to 4.5%, where it has remained since January. This decision comes as economists anticipate that the unpredictability of Trump’s trade disputes could ultimately lead to higher prices and a rise in unemployment within the U.S. economy.

Watching the Global Impact of Tariffs

While Trump’s tariffs have initially led to increased imports into the U.S., dampening economic growth in certain sectors, inflation has remained relatively subdued, and the labor market has shown resilience. However, Fed officials are signaling a shift in their outlook. Updated economic projections now forecast a potentially larger increase in unemployment this year than previously estimated in March, alongside an expectation for prices to rise more than initially thought.

Fed Chair Jerome Powell highlighted the expectation that tariffs will eventually contribute to higher inflation, although the precise extent remains uncertain. He indicated that this impact needs to become clearer before the Fed would consider lowering borrowing costs. “We have to learn more about tariffs,” Powell stated, emphasizing the difficulty in confidently predicting the appropriate policy response until the size of the effects is apparent.

Adding to the Fed’s caution are tangible signs of economic strain internationally, linked explicitly to tariff concerns. Recent Purchasing Managers’ Index (PMI) surveys from Europe illustrate this. In Germany, the Eurozone’s largest economy, the PMI dropped below 50 in April, signaling contraction, with survey publishers citing “Tariff concerns and uncertainty weighed on business confidence and demand.” Similarly, the UK saw its lowest PMI reading since late 2022, with businesses widely commenting on the negative impact of U.S. tariffs and a subsequent slump in client confidence. Early data from key global trade indicators, like a reported decline in South Korea’s exports, further underscores a potential broader slowdown. Major international bodies, including the International Monetary Fund (IMF), have also downgraded global growth forecasts, explicitly warning that Trump’s unpredictable tariff policy and retaliatory measures from trading partners are expected to significantly impact economies worldwide. This global economic damage adds another layer of complexity for the Fed as it assesses the full consequences of trade friction.

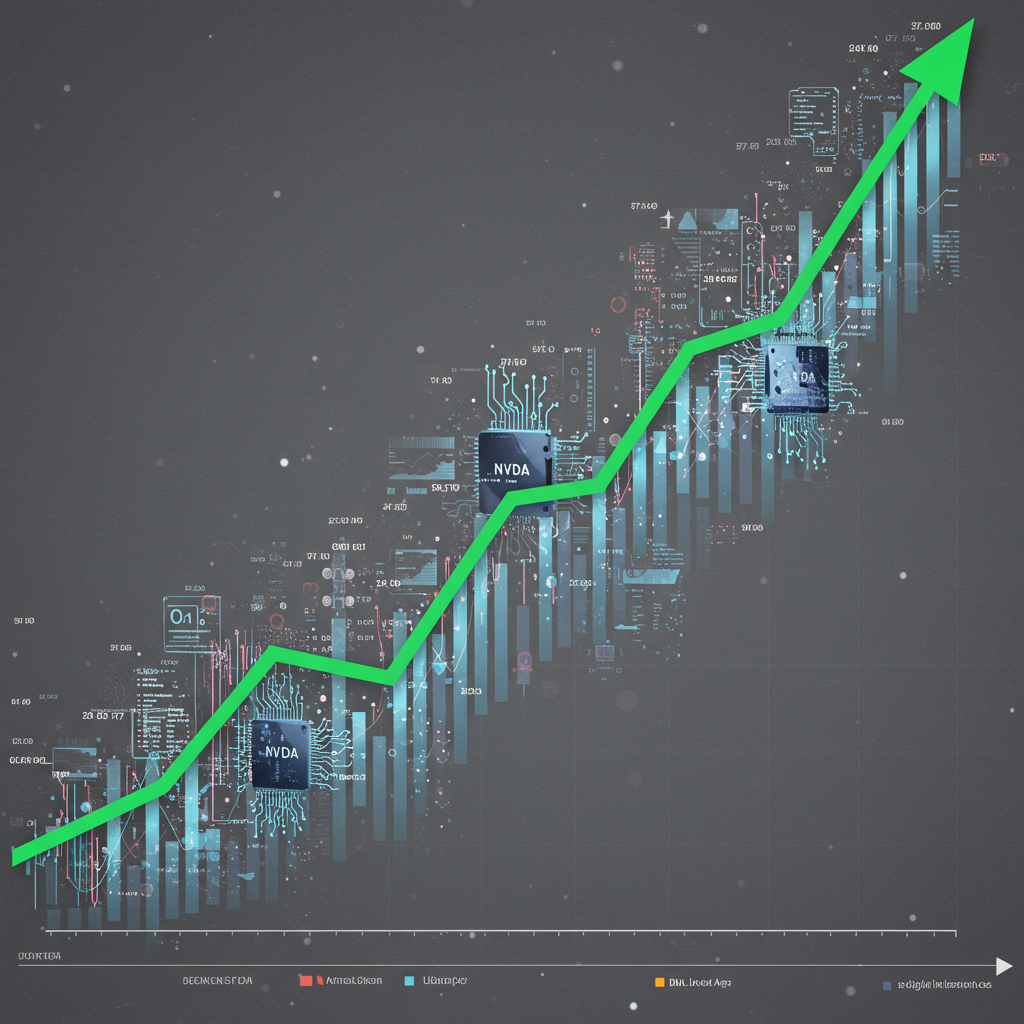

The uncertainty surrounding the tariffs’ ultimate effect on prices also appeared to contribute to a dip in U.S. stock markets following Powell’s remarks.

Looking ahead, Fed policymakers continue to project two potential rate cuts this year based on the median forecast, though a growing number of officials (seven compared to four in March) foresee no cuts at all. Should a rate cut occur, it’s increasingly viewed by investors as a potential “bad news rate cut” – one likely prompted by rising unemployment as consumers and businesses feel the pinch of tariff-related costs and uncertainty. Recent data, such as a sharp drop in retail sales influenced by declining car purchases, suggests consumers may already be exhibiting caution, which is significant given that consumer spending drives roughly two-thirds of the U.S. economy.

Monitoring Middle East Tensions

Beyond trade, the Fed is also closely monitoring the escalating conflict between Israel and Iran. Recent developments have heightened concerns, including the possibility of U.S. military involvement. This conflict has already impacted global oil prices, which could potentially translate to higher energy costs in the U.S.

While acknowledging the potential for higher energy prices due to the conflict, Powell suggested such effects are unlikely to have a lasting impact on overall inflation, unlike the sustained shocks seen in the 1970s. He noted that the U.S. economy is now “far less dependent on foreign oil” than it was decades ago. Even if energy prices climb, it would represent a significant hurdle for the Fed to consider raising interest rates again.

In addition to global uncertainties, the Fed is also keeping tabs on domestic policy, including a pending tax and spending bill in the Senate, though its projected economic boost is estimated to be more modest than the 2017 tax cuts.

For now, the Fed’s stance reflects a preference to wait and assess how these complex global and domestic factors, particularly the impacts of trade policy and Middle East tensions, unfold and translate into concrete economic data before making any changes to interest rates.