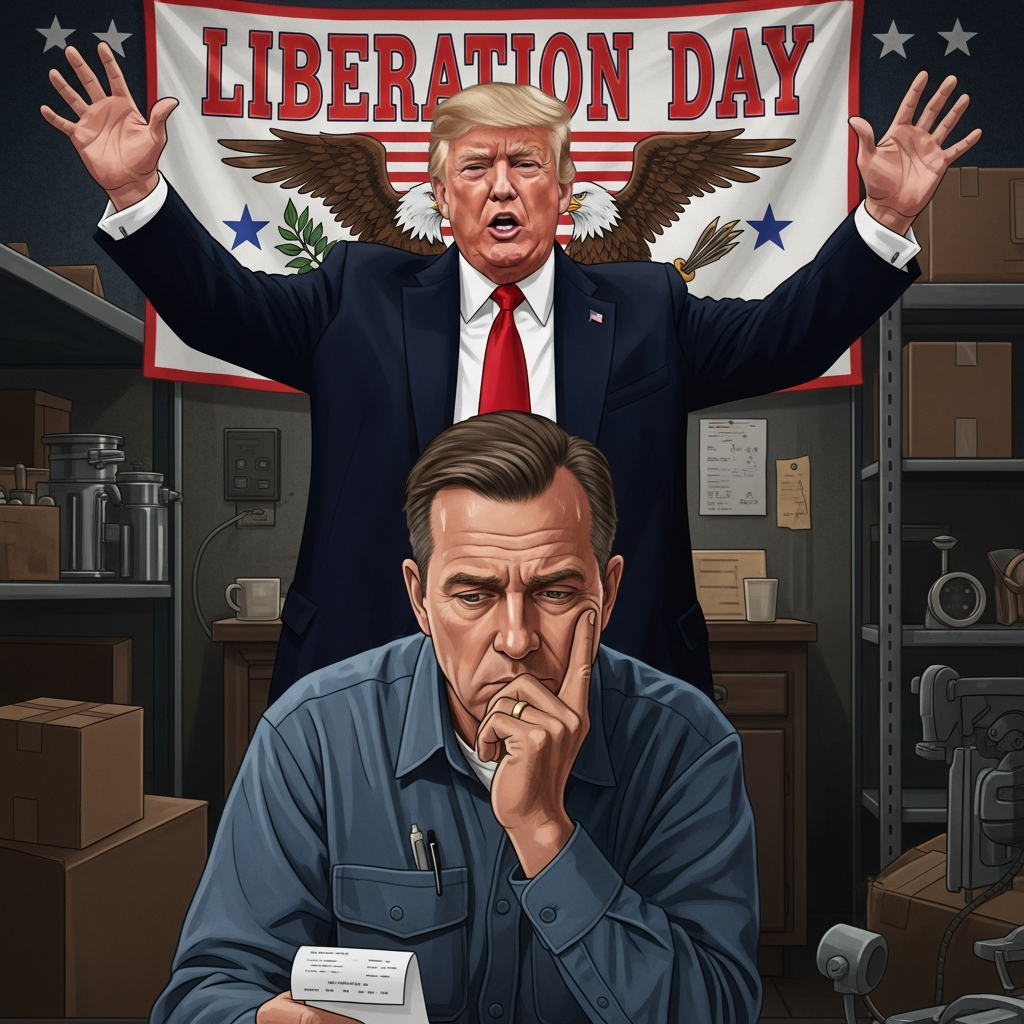

For American small businesses, the path to prosperity is often fraught with challenges, but few are as disruptive as sudden, sweeping trade policy changes. Donald Trump’s “Liberation Day” tariffs, introduced in April 2025, plunged many entrepreneurs into a financial maelstrom, demonstrating a critical lesson: the costs of such policies are overwhelmingly borne by domestic companies and consumers, not foreign exporters. This deep dive uncovers the real economic strain, from depleted business savings to plummeting retail sales, and explores the broader consumer fatigue that has gripped the nation.

The Unseen Toll: American Businesses Absorb Tariff Costs

Contrary to popular political rhetoric, the notion that tariffs primarily hurt foreign nations has been debunked by rigorous economic analysis. A January 2026 study from the Kiel Institute for the World Economy revealed a stark reality: American importers and consumers shoulder a staggering 96 percent of Trump’s tariff costs. Foreign exporters, by contrast, absorb only a mere 4 percent. This critical finding directly contradicts claims of national enrichment through tariffs, highlighting the substantial financial burden placed on the U.S. domestic economy. In 2025 alone, U.S. tariff revenue was approximately $24 billion per month higher than the previous year, a clear indicator of the massive financial transfer from American pockets to government coffers.

Real Stories: Entrepreneurs Caught in the Crossfire

The abstract numbers translate into profound hardship for individual businesses. Beth Benike, a mother and entrepreneur from Oronoco, Minnesota, exemplifies this struggle. After years of service in the U.S. Army, Benike developed the “Busy Baby Mat,” an innovative solution for parents. Her business, launched in 2017, gained significant traction after a 2021 appearance on Shark Tank and secured deals with Target and Walmart.

However, the abrupt announcement of Trump’s tariffs in April 2025 brought her booming business to a screeching halt. Benike was faced with an additional $230,000 tariff on a $160,000 product shipment already en route from China. With only 30 to 45 days to secure these unexpected funds, she simply couldn’t comply. Her products were out of stock for two months, leading to an estimated half a million dollars in lost revenue. To survive, Benike had to lay off two of her five employees, cash in her retirement savings, tap into family savings, and forgo her own salary. While a potential Supreme Court ruling on Trump’s use of the International Emergency Economic Powers Act (IEEPA) could offer some relief by refunding the $50,000 in tariffs she did manage to pay, the looming threat of reinstatement under other legal pretexts continues to breed profound uncertainty.

Chaos is Expensive: More Businesses Feel the Pinch

Benike’s story is not an isolated incident. Across the country, other businesses faced similar predicaments, underscoring the “chaos is expensive” principle that defines an unpredictable trade environment.

Dan Turner, who runs Turner Hydraulics, experienced a parallel crisis. He ordered a custom item from China, expecting a 25 percent tariff. However, the “Liberation Day” tariffs threatened an $84,000 tariff on a $49,000 item already in transit. Even after the rate was eventually lowered to 55 percent, his company incurred a significant loss. This volatility forced Turner to seek alternative foreign suppliers. Yet, even these efforts were hampered by broader political issues, leading to constant unpredictability. In 2025, Turner Hydraulics saw a revenue decrease of over 10 percent. Now, Turner must provide open-ended price quotes to customers, resulting in lost orders from those unwilling to accept fluctuating costs.

Hanna Scholz, owner of Bike Friday, a custom bicycle manufacturer in Oregon, described being “hit hard and in many different ways.” Despite manufacturing her bikes in the U.S., her reliance on overseas components led to a 17 percent drop in U.S. sales in 2025. Scholz emphasized that chaos impacts not just direct pricing but also timing, vendor availability, and shipping delays. Consequently, she couldn’t offer pay raises, reduced hours for some staff, and didn’t replace two retired employees. For Scholz, a Supreme Court ruling against emergency tariffs could help “calm the anxiety” and rebuild confidence in institutional stability.

A Broader Economic Slowdown: The Consumer’s Plight

While tariffs directly impact businesses, their effects ripple through the economy, exacerbating a broader consumer slowdown already underway. Americans are grappling with depleted savings and plummeting sales, signaling a fundamental shift in spending behavior.

The Vanishing Cushion of Savings

The post-pandemic era saw many households build up financial buffers thanks to government aid and reduced spending. However, this cushion has largely evaporated. Personal savings rates are at their lowest in years. Families are increasingly dipping into remaining savings or relying on credit cards to cover essentials like rent, food, utilities, and healthcare, as persistent high prices erode disposable income. Lower- and middle-income households face immense pressure, with rising credit card balances and missed payments becoming more common. This isn’t just a statistic; it reflects a psychological shift, where financial insecurity leads to widespread reduced spending, impacting the entire economy.

Retail Sales Plummet as Fatigue Sets In

As household savings dwindle, retail sales have taken a hit. Retailers report slower foot traffic and weaker revenues, particularly in non-essential categories such as clothing, electronics, and home goods. Major chains are responding by cutting prices and reducing inventory. Small businesses, with tighter margins and limited credit access, face even greater challenges. Dining out has become a luxury for many, impacting restaurants and their staff. This consumer spending pullback is particularly dangerous because consumption drives nearly two-thirds of U.S. economic activity, creating rapid ripple effects from factories to employment.

Inflation’s Lingering Shadow and Elevated Interest Rates

Even though inflation has somewhat cooled, prices for essentials like food, housing, and insurance remain significantly higher than pre-peak levels, consuming larger portions of household budgets. Simultaneously, the Federal Reserve’s elevated interest rates, a tool to combat inflation, have made borrowing substantially more expensive for mortgages, car loans, and credit cards. This makes debt servicing a major burden for many families. The uneasy balance is clear: inflation is lower, but consumer confidence has not fully returned, as the Fed’s strategy simultaneously slows economic growth.

Expert Outlook: Structural Shifts and “America Alone”

JPMorgan CEO Jamie Dimon warns that this economic shift, marked by expected rising inflation and declining employment, presents a significant challenge. He argues that the extraordinary economic stimulus from the pandemic has finally run its course. While robust consumer health initially surprised Wall Street, preventing a hard landing, Dimon indicates that the economy hasn’t escaped entirely unscathed. He observes that the “extra money from COVID is kinda gone,” leading lower-income individuals to “normalize” their spending. In contrast, higher-income consumers continue to spend, buoyed by strong asset values.

Dimon emphasizes focusing on “real numbers” rather than misleading sentiment indicators, as he anticipates these numbers will deteriorate. He attributes past economic strength to massive government spending and quantitative easing, asserting that the “real reversal” of these extraordinary measures is just beginning. Beyond immediate cycles, Dimon highlights “complex, moving tectonic plates” of structural shifts, including changes in trade, economics, geopolitics, and ongoing fiscal deficits, all of which he considers inherently inflationary. He stresses the critical importance of keeping international alliances strong, cautioning that “America First is fine, as long as it doesn’t end up being America alone.” This sentiment resonates strongly with the unpredictable nature of tariff policies and their potential to isolate U.S. businesses in a global market.

Navigating a Chaotic Future: Resilience Amid Uncertainty

The current economic landscape is defined by volatility and uncertainty, largely fueled by unpredictable trade policies. The Supreme Court ruling on Trump’s emergency tariff powers might offer a temporary reprieve, but the administration’s stated intent to reinstate tariffs under other legal provisions means the underlying challenge persists. This unpredictability hinders businesses’ ability to plan for capital expenses, manage supply chains, and maintain stable operations.

For businesses, flexibility and adaptation are paramount. This involves exploring diversified supply chains, enhancing e-commerce efficiency, and potentially expanding budget-friendly product lines to cater to a cautious consumer base. Households, on their part, are increasingly focusing on meticulous expense tracking, prioritizing emergency savings, and avoiding high-interest debt. The U.S. economy, therefore, finds itself at a crossroads. Its future hinges on whether wage growth can restore consumer confidence, if inflation can ease without triggering a full-blown downturn, and how effectively policymakers can provide a stable, predictable environment.

Frequently Asked Questions

Who truly bears the cost of Trump’s tariffs, according to economic studies?

Economic studies, such as one from the Kiel Institute for the World Economy in January 2026, indicate that American importers and consumers bear the overwhelming majority of tariff costs. This research found that 96 percent of Trump’s tariff costs were absorbed domestically, with foreign exporters accounting for just 4 percent. This directly contradicts the idea that tariffs primarily benefit the U.S. or that foreign entities pay the bulk of the expense.

How might a Supreme Court ruling on emergency tariff powers impact affected businesses?

A Supreme Court ruling challenging the use of the International Emergency Economic Powers Act (IEEPA) for tariffs could offer some relief to affected businesses. For instance, Beth Benike, whose company faced severe financial distress due to tariffs, might receive a refund for the $50,000 in duties she paid. However, the potential impact is limited because the administration could reinstate tariffs under different legal provisions, leading to ongoing uncertainty and preventing businesses from making long-term strategic decisions.

What are the broader economic implications for American consumers and businesses amid trade policy shifts?

The broader economic implications include a significant consumer slowdown, marked by depleted household savings and plummeting retail sales. Tariffs contribute to higher prices for goods, which, combined with inflation and elevated interest rates, reduce consumers’ disposable income. This leads to reduced spending on non-essentials, impacting businesses’ revenues, leading to potential layoffs, reduced expansion, and a generally cautious economic outlook. The instability makes it difficult for both businesses to plan and for consumers to feel financially secure.

Conclusion: A Call for Stability

The narratives of American small businesses like Busy Baby Mat, Turner Hydraulics, and Bike Friday paint a vivid picture of the profound and often devastating impact of unpredictable trade policies. While the initial intent of tariffs may be to protect domestic industries, the evidence clearly shows that the financial burden falls disproportionately on American companies and consumers, exacerbating a broader economic slowdown. From vanishing household savings to widespread consumer fatigue, the ripple effects are undeniable. As experts like Jamie Dimon warn of structural economic shifts and the dangers of isolationist policies, the call for greater stability and foresight in trade policy becomes increasingly urgent. For the health of both businesses and households, a predictable and supportive economic environment is paramount.