A major legislative showdown is brewing in Washington, D.C. house Speaker Mike Johnson has voiced significant displeasure with the comprehensive spending and tax package recently approved by the Senate, setting the stage for a contentious debate and potential battle within the House Republican conference as a critical deadline approaches. This “megabill,” central to President Donald Trump’s agenda, returns to the House substantially altered from its original form, triggering sharp criticism and highlighting deep divisions within the GOP.

The Return of the Megabill: Johnson’s Initial Reaction

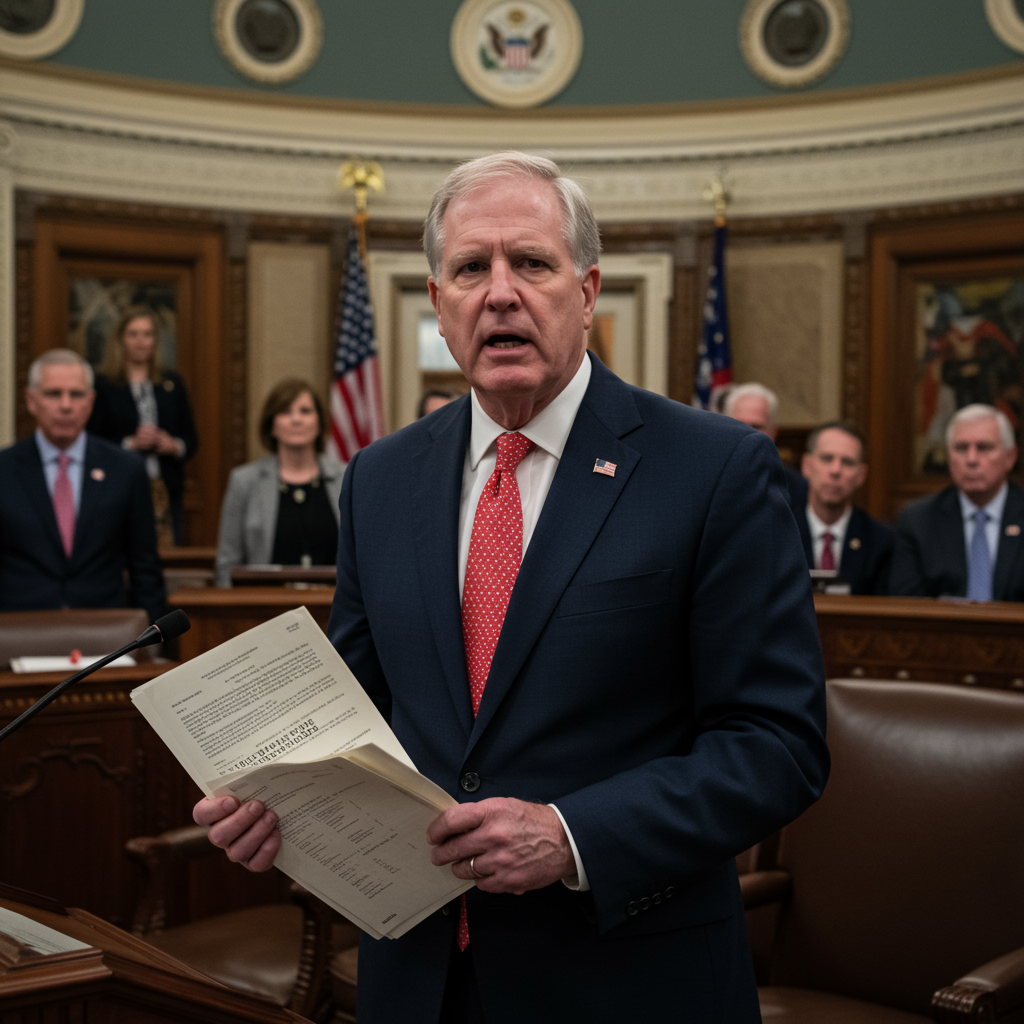

Speaking outside the House Rules Committee, which was meeting to discuss the massive legislation, Speaker Johnson did not mince words regarding the changes made by the Senate. “I’m not happy with what the Senate did to our product,” Johnson stated plainly. He acknowledged the back-and-forth nature of the legislative process but emphasized the challenges ahead. Getting his members on board with the revised bill will require considerable effort. “So high stakes, aggressive schedule, and we knew we would come to this moment,” he added, underscoring the intense pressure surrounding the bill’s passage.

What Sparked the Speaker’s Ire? Unpacking the Senate’s Version

The Senate’s modifications to the House-passed bill are extensive and highly controversial. Passed following a grueling 26-hour session and a razor-thin 50-50 tie vote broken by Vice President JD Vance, the Senate package includes permanent extensions of the 2017 tax cuts, new tax breaks campaigned on by President Trump (like those for tip income and overtime), and a significant increase to the state and local tax (SALT) deduction cap, raising it from $10,000 to $40,000 until 2030.

However, these tax cuts are coupled with sharp spending reductions, primarily targeting Medicaid. The Senate version cuts over $1 trillion, largely from this healthcare program for low-income Americans, and phases out Democratic-backed clean energy tax credits. It also implements new work requirements for Medicaid and SNAP (food stamps) recipients. Despite some initial proposed Medicaid cuts being blocked by the Parliamentarian, key controversial elements, including a cut to the provider tax, remain, albeit with implementation delays. The bill also includes significant spending increases, boosting funding for the Pentagon by approximately $157 billion and immigration enforcement by $175 billion.

This blend of tax cuts and spending reductions creates a significant fiscal imbalance. According to a Congressional Budget Office (CBO) analysis, the Senate plan includes roughly $4.5 trillion in net tax cuts but only $1.2 trillion in net spending cuts over a decade.

Conservative Revolt: House Republicans Draw a Line

The Senate’s changes, particularly the substantial increase in the bill’s projected impact on the national debt, have ignited fierce opposition among House conservatives. Leading the charge is Rep. Ralph norman (R-S.C.), who declared his unwillingness to support the domestic policy legislation. Norman criticized the Senate version for adding hundreds of billions more to the deficit than the House plan. “That math doesn’t work out. They’ve added $670 something billion dollars,” Norman told reporters.

Norman advocated for a hardline stance: the House should reject the Senate’s version outright. He suggested sending the original House bill back to the Senate and leaving town, signaling a refusal to even consider the Senate’s proposal. “My advice is to send the House bill back, pack our bags and go home and tell them to get serious,” Norman stated, directing his message at Senate Republicans. Speaker Johnson was later seen huddling with Norman and Rep. Chip Roy (R-Texas), a fellow member of both the Rules Committee and the conservative House Freedom Caucus, highlighting the internal pressure Johnson faces from his right flank. This conservative opposition is critical, as House Republicans hold a narrow majority and can only afford a few defections to pass legislation.

A Grueling Senate Process: Narrow Passage and Political Fallout

The Senate’s path to passing the bill was arduous and politically charged. The 50-50 vote, broken by Vice President Vance, underscored the deep partisan divide and even cracks within the Republican conference, with three Republican senators (Collins, Paul, Tillis) voting against the measure. The 26-hour “vote-a-rama” saw numerous amendments debated and rejected, though some key changes were made, including the removal of a controversial excise tax on wind and solar projects (while still phasing out clean energy credits) and the addition of a $50 billion stabilization fund for rural hospitals.

Senate Minority Leader Chuck Schumer (D-N.Y.) lambasted the bill and the process. He called the vote a “betrayal” and accused Republicans of using accounting tricks (like a “current policy baseline”) to mask the bill’s true cost. Schumer characterized the legislation as delivering “the biggest tax breaks for billionaires ever seen,” paid for by cuts to healthcare and food aid. He predicted the vote would politically harm Republicans for years due to the bill’s projected unpopularity. Even Republican Sen. Lisa Murkowski (R-Alaska), who ultimately supported the bill after securing concessions for her state (like a potential waiver from SNAP cost-sharing), described the process as “awful” and “frantic,” noting the bill “needed more work.”

The Fiscal Fallout: Trillions Added to the Debt

One of the most significant criticisms of the Senate version centers on its impact on the national debt. While proponents argue the tax cuts and certain spending increases will stimulate the economy, fiscal watchdogs paint a grim picture. As noted in the CBO analysis, the bill adds roughly $3.3 trillion to the deficit over the next decade, potentially increasing closer to $4 trillion with added interest costs.

The Committee for a Responsible Federal Budget (CRFB) was particularly critical, arguing the Senate failed to meet the House’s stated goal of offsetting tax cuts with commensurate spending cuts. They contend the Senate fell short by $600 billion or more on the spending side compared to what was needed to balance the proposed $4.5 trillion in tax cuts. CRFB President Maya MacGuineas called the process a “failure of responsible governing,” emphasizing that the bill’s cost, if made permanent, would exceed the combined cost of several major recent spending bills, including the CARES Act and the Bipartisan Infrastructure Law.

Impact on Americans: Healthcare, Safety Nets, and More

Beyond the fiscal implications, the Senate-passed bill is projected to have direct impacts on millions of Americans, particularly regarding healthcare and social safety nets. Critics estimate that the legislation could cause at least 17 million Americans to lose health coverage by 2034. This projected loss stems from the deep cuts to Medicaid and the expiration of enhanced Affordable Care Act (ACA) subsidies, which would likely increase costs for those relying on marketplace coverage.

The bill’s implementation of new work requirements for Medicaid and SNAP, along with requiring some states to share costs for food aid, are also points of contention. Opponents argue these measures will harm vulnerable populations and contradict President Trump’s earlier assurances that his plan would only target waste and fraud in Medicaid, not negatively affect beneficiaries.

The Clock is Ticking: July 4th Deadline Looms

With the bill now back in the House, the pressure is on to reconcile the differences with the Senate version and potentially send a final package to the President’s desk. There was an initial target to get the bill signed by July 4th. Asked about this deadline, Speaker Johnson remained non-committal. “We’ll see what happens in the next 24 hours,” he said, reflecting the uncertainty and intense negotiations underway. Meeting this aggressive timeline will require navigating the internal GOP divisions highlighted by conservatives like Ralph Norman.

What Happens Next? The House Faces Tough Choices

The return of the megabill to the House precipitates a critical decision point. House Republicans must now decide how to proceed. Their options include accepting the Senate’s version despite their dissatisfaction, attempting to amend the bill further and send it back to the Senate for another round of votes (which could be complex and time-consuming), or potentially rejecting the Senate changes, which could kill the legislation altogether. Given the narrow House majority, the vocal opposition from conservatives who threaten to vote against even the procedural rule to bring the bill up for debate poses a significant hurdle. The coming days will reveal whether Speaker Johnson can unify his conference or if the disagreements will derail this signature piece of President Trump’s legislative agenda.

Frequently Asked Questions

What are the main differences between the House and Senate versions of the “megabill”?

The Senate version, passed in early July 2025, includes permanent extensions of tax cuts and adds significantly more to the national debt than the version originally passed by the House. While both included spending cuts, the Senate’s failed to match the scale of its tax cuts, adding roughly $670 billion more in deficit spending compared to the House plan, according to critics. The Senate also added or removed specific provisions, such as increasing the SALT deduction cap, removing a wind/solar excise tax, and adding a rural hospital fund.

How would the Senate-passed “megabill” impact the national debt and federal spending?

According to a CBO analysis, the Senate’s version is projected to add about $3.3 trillion to the national debt over the next decade, potentially reaching $4 trillion with interest costs. This is primarily because the roughly $4.5 trillion in tax cuts significantly outweighs the approximately $1.2 trillion in net spending cuts included in the bill. Fiscal watchdogs like the Committee for a Responsible Federal Budget criticized this imbalance as failing to meet responsible budget standards.

Why are some House conservatives opposing the Senate’s “megabill”?

House conservatives, including Rep. Ralph Norman, are opposing the Senate’s changes primarily because they significantly increase the projected national debt compared to the House’s original bill. They argue the Senate failed to make sufficient spending cuts to offset the tax cuts. Some conservatives feel the House should reject the Senate’s version and insist on their original proposal, believing the Senate’s bill is fiscally irresponsible and falls short of the conservative goal of matching tax reductions with spending reductions.

Conclusion

The Senate’s passage of its revised megabill has landed squarely back in the lap of the House, creating a major political challenge for Speaker Mike Johnson. His public dissatisfaction, coupled with outspoken opposition from within his own party’s conservative wing, signals a rocky path forward. With the clock ticking towards a potential July 4th deadline and the stakes involving key elements of President Trump’s agenda, the coming days in the House are set to be filled with intense negotiations and the potential for significant legislative drama as leaders attempt to bridge the divide and determine the fate of this controversial package.