Silicon Valley, long the global epicenter of technological innovation, is undergoing a dramatic transformation. A new era is dawning, characterized by intense competition that is creating unprecedented winners and notable casualties. This isn’t just about market share; it’s about a fundamental reshaping of the industry’s structure, driven primarily by the relentless pursuit of artificial intelligence dominance. Understanding this “winner-take-all” dynamic is crucial for anyone working in, investing in, or simply observing the tech landscape today. The stakes are higher, the rewards are concentrated, and the challenges are significant, impacting everything from workforce compensation to environmental resources.

The Great Tech Divide: AI talent vs. Mass Layoffs

A defining feature of this new era is the stark and growing divide within the tech workforce. While companies are scrambling for specialized expertise, particularly in Artificial Intelligence (AI), this intense demand is simultaneously fueling widespread job insecurity for many others. It’s a landscape where a select few are treated like superstars while thousands face the uncertainty of layoffs.

Top AI researchers are reportedly commanding astronomical compensation packages. We’re hearing figures that could climb into the hundreds of millions of dollars over several years for elite talent. For example, Meta reportedly made substantial offers to researchers from OpenAI, though the specific amounts and structures of these packages have been subject to conflicting claims and disputes regarding their exact size. Similarly, OpenAI’s Sam Altman mentioned competitors offering $100 million signing bonuses to his staff. These sums are described as potentially rivaling or even exceeding CEO pay at some major tech firms and vastly outpacing the salaries of typical tech workers, even those in senior roles. A past analysis noted that a senior software engineer at Meta might earn up to $480,000 in base salary, a figure impressive in absolute terms but dwarfed by these AI talent bids.

This phenomenon stems directly from the overwhelming demand for skilled AI professionals, a demand that far outstrips the current supply. Major players like Meta face immense pressure to secure the necessary expertise to remain competitive in the rapidly accelerating AI race. This requires enormous investment, not only in talent but also in the computing power and infrastructure needed to train and run massive AI models.

Paradoxically, even as companies spend lavishly on AI talent, they are implementing severe cost-cutting measures across other divisions. Mass layoffs have become a frequent headline in the tech industry. Since 2022, over 600,000 tech workers have been laid off, following a period of aggressive hiring. Microsoft alone recently cut thousands of jobs, adding to a total of around 15,000 for the year. This co-occurrence of opulent AI bonuses and widespread job losses is creating considerable resentment and anxiety throughout the tech workforce.

Many rank-and-file employees feel sidelined, perceiving that the industry’s focus has fundamentally shifted. They worry that prioritizing highly compensated, experienced AI hires makes it harder for companies to nurture and develop the next generation of engineering talent from within. Experts and current employees suggest that the immense costs associated with the AI push are likely forcing companies to reduce expenses elsewhere, contributing significantly to layoffs and potentially diverting investment from other innovative projects.

While the most extreme salaries are reserved for elite researchers, demand for AI skills translates to higher compensation across all levels of AI engineering roles compared to their non-AI counterparts. Entry-level AI engineers reportedly earn a noticeable premium, and this gap widens for mid and senior-level positions. The demand for AI skills has grown significantly, showing a strong annual increase since 2019.

Some employees, particularly those embedded within specialized AI teams, view the disproportionately high pay for top talent as a necessary investment. They believe it’s justified for individuals expected to deliver outsized impact that could ultimately benefit the entire company through success and stock value. The current AI talent rush is compared to past tech booms where specialized skills commanded high premiums, but the present situation is marked by a much faster pace and significantly higher stakes, intensifying the effects. However, some observers are skeptical that these “superstar athlete” salaries will become a permanent fixture, anticipating that the market may eventually adjust as more individuals acquire the required AI skills.

Fueling the Race: The Infrastructure Behind AI Dominance

The AI race requires more than just human talent; it demands unprecedented physical infrastructure, particularly in the form of massive data centers. These facilities are the engines powering the AI revolution, and their proliferation across the United States is having significant economic, environmental, and social impacts. This build-out is another critical facet of the winner-take-all dynamic, as companies vie to construct the most extensive computational foundations.

The sheer scale of this expansion is striking. There are currently more than 1,240 data centers either already built or approved for construction across the US. This number represents a staggering fourfold increase compared to just 2010, clearly illustrating the accelerated pace of growth directly tied to the escalating demand for AI computing power.

While land use is a consideration, the most significant concerns surrounding this rapid development are the immense demands these data centers place on electricity grids and water supplies. Training and running large AI models is vastly more computationally intensive than traditional online activities like searching or sending email, potentially requiring 100 to 1,000 times more computation. This dramatic increase translates directly to higher energy consumption. Major tech companies building these facilities have seen their energy needs soar. Google, for instance, doubled its total energy consumption between 2019 and 2023. The company has acknowledged challenges in its sustainability goals, partly due to emissions from suppliers manufacturing the energy-intensive components needed for data centers.

AI data centers are also substantial consumers of water, utilizing millions of gallons primarily for cooling purposes. This water use is often “consumptive,” meaning the water evaporates into the atmosphere rather than returning immediately to the local water system like typical residential use. This can impact local water resources. While companies may engage in water replenishment efforts, experts argue these are often insufficient and call for greater attention to the water footprint throughout the entire supply chain.

Despite these environmental and resource pressures, towns and public officials often face a complex situation. Many local municipalities openly welcome the data center industry. A primary driver for this welcoming stance is the significant tax revenue that data centers can generate, providing crucial funding for essential public services like schools and infrastructure. Public officials must balance the benefits of this tax income against the growing strain on local resources. Some towns even actively compete for data center projects by offering attractive tax breaks.

Beyond local tax benefits and short-term construction jobs, the growth of AI infrastructure is argued to yield broader advantages. A strong domestic AI industry is often seen as enhancing national security. Companies are reportedly aware of the public scrutiny regarding their resource consumption and are beginning to implement strategies aimed at improving efficiency and transitioning towards greater reliance on renewable energy sources. The critical question remains whether these efforts will be sufficient to significantly reduce their environmental footprint as the demand for AI continues to grow.

Market Dynamics & the Pursuit of Dominance

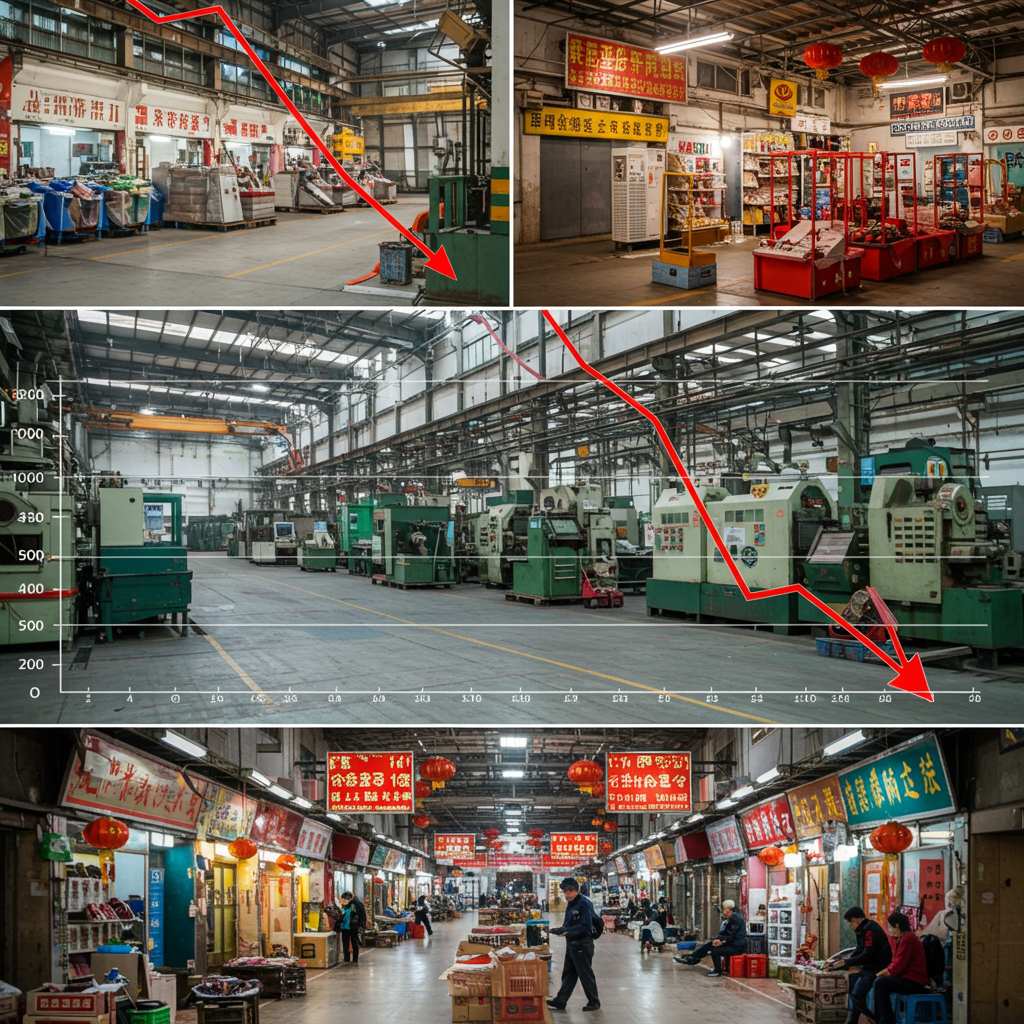

The intensified competition fueled by AI is fundamentally altering market dynamics in Silicon Valley, amplifying the “winner-take-all” tendencies seen in past tech cycles. This era sees companies pouring unprecedented resources into AI, believing that leadership in this field will translate into overall market dominance. This echoes previous periods of rapid growth and valuation inflation, but on a potentially grander scale.

Historical context from analyses like the 2015 “Unicorn Club” report shows that the pursuit of dominance and high valuations is not new. Factors like compelling products enabling easier global adoption (smartphones, social networks) previously created a perception of winner-take-all markets, driving investor FOMO (Fear Of Missing Out) and competitive capital environments. The rise of “paper unicorns”—privately held companies with billion-dollar-plus valuations—became significant, fueled by optimistic private markets that allowed for valuation inflation compared to publicly traded companies. Building a unicorn was difficult then, and achieving dominance in AI now requires exponentially more capital and talent.

Today, the AI race exacerbates these tendencies. The belief is that whoever achieves significant breakthroughs or holds a lead in foundational AI models could gain an insurmountable advantage, capturing a disproportionate share of future markets. This fuels aggressive spending on talent and infrastructure, driving valuations for AI-focused companies or divisions sky-high, even while other parts of the business may be shedding staff.

However, this aggressive pursuit of dominance through inflated private valuations carries risks, as highlighted in historical analyses. The “Unicorn Club” report noted concerns about capital efficiency, particularly for private companies where valuations might be less tied to immediate profitability or sustainable metrics. This created a potential gap between private valuations and potential exit values (via IPO or acquisition), raising the possibility of “Unicorpses” (failed unicorns) or IPOs that effectively function as “down rounds” for investors and employees whose options might be underwater based on peak private valuations.

In the current AI-driven environment, these risks could be amplified. The immense capital requirements for AI development and infrastructure might lead to even greater pressure on companies to achieve high valuations, potentially outstripping sustainable business fundamentals in other areas. The concentration of resources on AI could also divert attention and investment from other areas of innovation, potentially limiting overall industry growth diversity in the long term.

Fragmentation as a Counterpoint? The Shifting Social Media Landscape

While the AI sector appears to be consolidating power and driving a winner-take-all dynamic for talent and infrastructure, other parts of the tech landscape might be experiencing the opposite: fragmentation. The social media world, which previously saw a few giants dominate, is showing signs of splintering, offering a nuanced counterpoint to the idea of a monolithic winner-take-all era across all of Silicon Valley.

Elon Musk’s platform X (formerly Twitter) is a prime example. Following controversial changes under Musk’s ownership, including reduced content moderation, the reinstatement of controversial accounts, and algorithmic shifts, the platform has seen a significant exodus of users. Many users cite the increasingly toxic atmosphere and Musk’s personal actions as reasons for leaving. Data indicates a consistent decline in X’s daily active users since 2022, with notable dips occurring after specific events, like the US election.

This departure from a formerly dominant platform coincides with the rise and growth of alternative services. Platforms like Threads (Meta) and Bluesky are attracting users seeking different online spaces. These newer platforms are seeing significant user growth, competing for top spots in app download charts, while X’s ranking has fallen. This migration is supported by data showing deactivated X accounts, increased searches for “Delete X,” and major organizations abandoning their official accounts.

This trend suggests a move away from the idea of a single “public square” online. Experts argue that this fragmentation diminishes the disproportionate cultural and media influence previously held by platforms like Twitter. While this may present challenges for businesses seeking to reach large audiences on a single platform, it is also presented by some as potentially beneficial, preventing one entity from holding too much power over online discourse.

This fragmentation in the social media space stands in contrast to the intense consolidation pressures observed in the AI domain. It suggests that the “winner-take-all” dynamics in Silicon Valley are not uniform across all sectors. While the AI race is driving a concentrated pursuit of dominance, other mature sectors may be evolving towards a more diverse and distributed landscape, adding complexity to the overall narrative of this new tech era.

What This Means for the Future of Tech

This extreme winner-take-all shift driven by the AI race presents both immense opportunities and significant challenges for the future of technology. The concentration of resources on AI could accelerate breakthroughs with profound implications, potentially leading to business efficiencies and advancements in critical fields like healthcare. However, the way this race is currently unfolding raises crucial questions about sustainability, equity, and the long-term health of the tech ecosystem.

The resource demands of AI infrastructure, particularly energy and water, pose pressing environmental concerns that require innovative and aggressive solutions beyond current company sustainability efforts. The stark talent divide creates a potential for a less diverse and more anxious workforce, where only a sliver of highly specialized individuals feels secure, potentially hindering broader innovation that often comes from diverse perspectives and collaborative environments across various roles.

Furthermore, the pursuit of dominance through potentially inflated valuations, fueled by competitive capital, raises questions about the stability of this boom. Historical parallels suggest that periods of intense private market optimism can lead to difficult adjustments later on, impacting investors, employees, and the overall funding landscape.

The fragmentation observed in areas like social media suggests that not all tech sectors will follow the same path. While AI may drive consolidation, other areas might splinter, leading to a more diverse online environment but also potentially diluting attention and influence.

Ultimately, the sustainability of this winner-take-all era depends on how the industry navigates these competing forces. Can companies transition to more sustainable infrastructure? Can the tech workforce adapt, or will the divide become irreparable? Will the market eventually adjust AI talent compensation, or will this two-tier system persist? The answers to these questions will shape not only Silicon Valley but the global technological landscape for years to come.

Frequently Asked Questions

What specific factors are driving the “winner-take-all” dynamic in Silicon Valley today?

Several key factors are intensifying this dynamic, primarily centered around the AI race. The extreme demand for a limited pool of elite AI talent leads to unprecedented compensation packages for a few, creating a stark salary divide within companies also undergoing mass layoffs. Additionally, the massive infrastructure needed to power AI (data centers) requires huge capital investment and consumes vast resources (energy, water), consolidating power among companies that can build and operate these facilities at scale. The competitive nature of AI development creates a belief that early dominance could lead to overwhelming market share, further driving aggressive investment and reinforcing winner-take-all pressures.

Where are the main impacts of the AI infrastructure boom being felt in the US?

The impacts are being felt locally in areas where large AI data centers are being built. While data centers generate significant tax revenue for municipalities, helping fund local services, they also place substantial strain on local resources, particularly electricity grids and water supplies needed for cooling. Towns must balance the economic benefits against these environmental and resource pressures. The total number of US data centers has quadrupled since 2010, illustrating the widespread geographical impact of this boom.

How is the current tech environment affecting career paths for non-AI tech workers?

The intense focus on AI and the associated cost-cutting measures are creating significant job insecurity and anxiety for many non-AI tech workers. Over 600,000 tech workers have been laid off since 2022 across the industry, including large companies like Microsoft. While specialized AI skills command high premiums, many other roles are being consolidated or eliminated. Employees express resentment about the vast disparity in compensation and worry that the industry’s focus on highly specialized senior AI talent makes it harder to develop skills and advance in other areas, potentially sidelining their current roles.