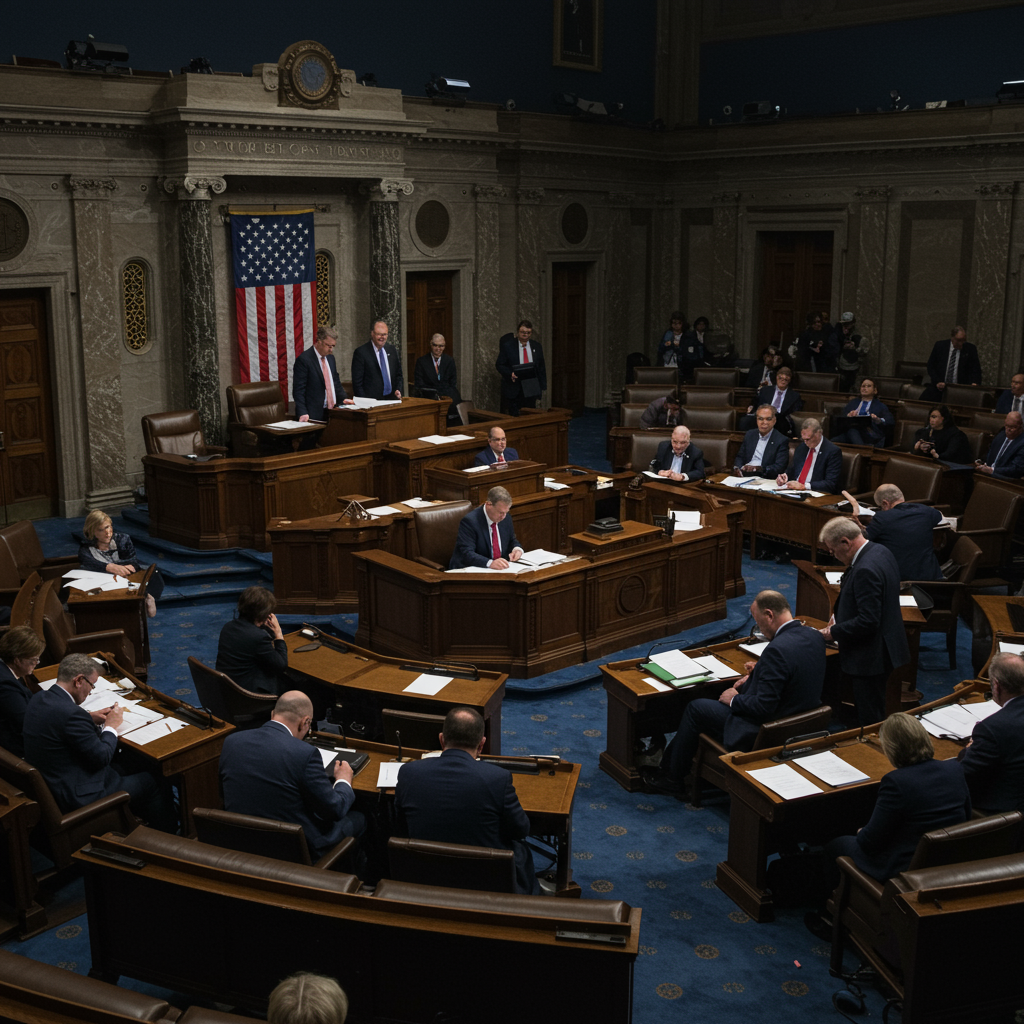

Washington, D.C. — The U.S. senate plunged into an extended overnight session this week, locked in a marathon “vote-a-rama” on President Donald Trump’s ambitious domestic policy package. This sweeping legislation, sometimes dubbed “One Big, Beautiful Bill,” represents a cornerstone of the administration’s agenda, proposing vast changes across taxation, spending, and social programs. The voting frenzy, which began early Monday morning, stretched well into Tuesday, turning the Senate floor into a late-night battleground for political maneuvering and substantive policy debates.

For senators, the vote-a-rama is a grueling, open-ended process allowing for an unlimited number of amendments. Republicans used the opportunity to fine-tune the bill before a final vote. Meanwhile, Democrats seized the moment to press their opponents on potentially sensitive issues, forcing recorded votes that could become potent material for future campaign ads. Senate Majority Leader John Thune indicated progress early Tuesday, noting they were “close,” but couldn’t predict an end time with several amendments still pending. This followed weekend delays, including a more than 12-hour tactic by Senate Democrats who required the entire bill to be read aloud on the floor.

The clock is ticking relentlessly. President Trump has set an ambitious deadline, demanding the bill reach his desk by the Fourth of July. However, even if the Senate successfully passes the package, it must still return to the House of Representatives. There, Speaker Mike Johnson faces growing unease and potential dissent among his own ranks regarding the bill’s specific provisions, casting significant doubt on its final passage through Congress.

Key Amendments Shape the Package

Amidst the flurry of votes, several notable amendments were adopted early Tuesday morning, altering the bill’s text. Republican senator Joni Ernst of Iowa successfully introduced a measure barring federal funds from providing unemployment benefits to individuals earning over $1 million annually in wages. This amendment passed relatively easily, highlighting a focus on perceived fiscal responsibility.

Perhaps the most significant policy shift via amendment involved artificial intelligence regulations. Led by GOP Senator Marsha Blackburn of Tennessee, the Senate overwhelmingly voted 99-1 to strike language that would have prevented state and local governments from enforcing their own AI rules for a decade. This striking change was reportedly vital in appeasing concerns from some House Republicans, notably Representative Marjorie Taylor Greene, who had publicly warned she might oppose the bill otherwise. The near-unanimous vote underscored broad bipartisan agreement on preserving local regulatory authority over AI development.

Another adopted change targeted eligibility verification within the medicaid program. GOP Senator John Kennedy of Louisiana introduced an amendment to advance the deadline for this verification requirement by one year, moving it from January 1, 2028, to January 1, 2027. Senator Kennedy argued this simple change aimed to prevent continued benefit payments to deceased recipients. Democratic Senator Ron Wyden reportedly accepted the change via a voice vote, asking, “Why would anybody vote against this?”

The Battle Over Medicaid Funding

A major flashpoint throughout the legislative process, and particularly during the vote-a-rama, revolves around proposed changes to Medicaid. This crucial program provides health coverage to over 71 million low-income Americans, including vulnerable populations like children, seniors, and individuals with disabilities. Both the House and Senate versions of the bill propose what critics term “historic spending cuts” to Medicaid.

The legislation also includes provisions impacting the Affordable Care Act (ACA). Experts project these changes could significantly reduce enrollment in the landmark health reform law that Republicans have long sought to repeal or replace.

According to an analysis released over the weekend by the nonpartisan Congressional Budget Office (CBO), the Senate’s version of the bill is projected to have a more significant impact on health insurance coverage than the House version. The CBO estimated that the Senate bill would result in 11.8 million more people becoming uninsured by 2034, compared to 10.9 million under the House bill.

Deeper Cuts in the Senate Bill

Democratic Senator Ron Wyden, the ranking member on the Senate Finance Committee, cited CBO estimates indicating the Senate bill slashes federal support for Medicaid by a staggering $930 billion over a decade. This figure represents deeper cuts than the approximately $800 billion reduction projected under the House version of the package. This difference in proposed Medicaid cuts is a primary reason for the Senate bill’s larger estimated impact on the number of uninsured.

Beyond funding levels, the bills introduce significant structural changes. For the first time in Medicaid’s 60-year history, both chambers propose requiring certain able-bodied adults aged 19-64 to work to maintain their benefits. However, the specific requirements differ: the Senate version would apply the work requirement to parents of children aged 14 and older, while the House version would exempt parents of dependent children.

The bills also diverge on provisions related to how states help fund Medicaid. The Senate version would lower the cap on taxes states can levy on healthcare providers to support the program but would also increase reimbursement rates for providers, specifically in the 40 states (plus D.C.) that expanded Medicaid under the ACA. In contrast, the House bill would impose a moratorium on existing state provider taxes.

Bipartisan Concerns Emerge

The contentious nature of the Medicaid provisions sparked rare moments of bipartisan alignment. Several Republicans reportedly crossed the aisle during the vote-a-rama to support Democrat-offered amendments related to Medicaid and food stamps.

Alaska Republican Senator Lisa Murkowski, considered a key swing vote, voted with Democrats on multiple amendments affecting safety net programs and rural hospital support. This occurred despite leadership efforts to secure her support for advancing the bill earlier in the weekend.

Maine Republican Senator Susan Collins also voiced concerns, proposing an amendment aimed at boosting funding for rural healthcare providers by increasing taxes on very high earners ($25 million+ for individuals, $50 million+ for couples). While aimed at addressing a contentious provider tax issue, her amendment failed a procedural vote. Senator Collins expressed surprise that Democrats didn’t support her proposal, stating it would have passed easily with their backing. However, she maintained the amendment’s failure would not dictate her final vote on the overall package, emphasizing she needed to see the final version.

The Deficit Question: A Fight Over Scoring

A fundamental debate surrounding the bill’s impact centers on how its cost and effect on the federal deficit should be calculated. The first procedural vote taken Monday directly addressed this, focusing on the “baseline” used for accounting.

Republicans and the Trump administration pushed for a “current policy baseline.” This method assumes that certain expiring provisions of the 2017 Trump tax cuts will be extended permanently. Using this assumption significantly minimizes the projected deficit increase because it doesn’t count the cost of extending those tax cuts as new spending or lost revenue.

The CBO, however, uses its standard “current law baseline.” This approach assumes existing laws remain in effect, meaning expiring provisions like the 2017 tax cuts lapse as scheduled at the end of the year. Under this traditional scoring method, the CBO projected the Senate bill would add nearly $3.3 trillion to the federal deficit over a decade – a substantially higher figure than the House-approved bill.

Why the Senate Bill Costs More

According to Marc Goldwein, a senior policy director at the Committee for a Responsible Federal Budget, a fiscal watchdog group, the Senate version is projected to be costlier under standard scoring primarily because it includes larger tax cuts while shrinking some of the spending cuts and revenue-raising measures present in the House bill.

For instance, the Senate bill proposes making permanent three corporate tax breaks included in the 2017 law. It also lessens the severity of proposed cuts to the food stamp program compared to the House version. As Goldwein put it, “They expand the giveaways and shrink the takeaways.”

Using the alternative “current policy baseline” favored by Republicans, a separate CBO estimate released Saturday night projected the Senate version’s cost over the next decade at a much lower figure: roughly $508 billion. The debate over which baseline to use highlights the significant difference in how lawmakers frame the bill’s fiscal responsibility.

Enduring the Overnight Session

As the vote-a-rama stretched through the night and into the early hours of Tuesday, senators found ways to pass the time and cope with the chilly chamber conditions. More than seventeen hours into the session, some were seen bundling up. Republican Senator Cindy Hyde-Smith of Mississippi wrapped herself in a pashmina, while Democratic Senator Elizabeth Warren of Massachusetts donned a hooded sweatshirt.

Senator Lisa Murkowski brought a large, fuzzy blanket to the floor, which Senator Susan Collins reportedly borrowed when Murkowski stepped away. Murkowski was also observed in an extended, over-30-minute conversation with Senate GOP Leader John Thune, likely discussing strategy and potential votes.

Senator John Cornyn of Texas, a noted reader, remained in his seat between votes, engrossed in a biography of William F. Buckley Jr.

The pace of amendment votes, which had slowed significantly during a lull for negotiations on upcoming measures, reportedly picked up around 2 a.m. ET as senators finalized which amendments would be brought forward next.

The Budget Reconciliation Path

The bill is being advanced using a special legislative maneuver known as budget reconciliation. This process bypasses the typical Senate requirement of 60 votes needed to overcome a filibuster, requiring only a simple majority (51 votes) for passage. With Republicans holding a 53-seat majority, they can afford to lose only three votes from their caucus without needing a tie-breaking vote from Vice President JD Vance, who remained present throughout the proceedings for that possibility.

The use of reconciliation underscores the Republican determination to pass this bill with minimal Democratic support, but it also places significant pressure on GOP leaders to maintain party unity. Potential Republican holdouts, including Senators Rand Paul and Thom Tillis, expressed concerns about the bill’s provisions, particularly the scope of Medicaid changes. Senator Tillis specifically argued that proposed Medicaid cuts beyond addressing waste, fraud, and abuse “betray our promise” and criticized the tight July 4 deadline as “artificial” and rushing the complex process.

Despite the procedural hurdles cleared and amendments adopted, uncertainty surrounding the final vote remains. Securing the necessary votes requires careful negotiation and pressure, with both Senate leadership and the White House, including President Trump himself, reportedly engaged in efforts to bring potential holdouts into line. As Senator Thune remarked on the challenge of vote counting, “Never, until we vote.”

Frequently Asked Questions

What is the “vote-a-rama” session happening in the Senate?

The vote-a-rama is a marathon, open-ended session in the U.S. Senate where senators can propose and vote on an unlimited number of amendments to a specific bill. It is often used under budget reconciliation rules. In this instance, it’s being used for President Trump’s domestic policy bill, allowing Republicans to make final tweaks and Democrats to force votes on politically sensitive issues.

What are the main proposed policy changes in President Trump’s domestic policy bill?

The bill is a comprehensive package aiming to significantly lower federal taxes, increase spending for defense and border security, and reduce funding for government safety-net programs like Medicaid and food stamps. It also includes proposed changes to the Affordable Care Act and provisions related to state artificial intelligence regulations and unemployment benefits.

How will the Senate bill’s proposed Medicaid changes affect health insurance coverage?

According to the Congressional Budget Office (CBO), the Senate version of the bill is projected to lead to 11.8 million more people being uninsured by 2034 due to deep cuts in federal funding for the program (an estimated $930 billion over a decade) and changes to the Affordable Care Act. Both the Senate and House versions also propose introducing work requirements for certain able-bodied adults receiving Medicaid benefits for the first time.

Conclusion

The Senate’s marathon vote-a-rama on President Trump’s sweeping domestic policy bill highlights the deep divisions and high stakes involved. As senators debated and voted through the night on contentious issues ranging from Medicaid cuts and work requirements to AI regulation and deficit calculations, the path forward remains uncertain. With a tight July 4th deadline looming and potential hurdles still present in the House, the final shape and fate of this significant piece of legislation hang in the balance, awaiting the climactic final vote.