Oil Market Reels: Prices Plummet as Middle East Tensions Ease

Global oil benchmarks experienced a sharp decline on Tuesday, tumbling by approximately 5% to reach their lowest levels in two weeks. This significant drop followed news that Israel had agreed to a ceasefire proposal with Iran, alleviating market fears surrounding potential supply disruptions in the volatile Middle East region, a critical area for global oil production.

Both key crude oil contracts felt the impact:

Brent crude futures fell by $3.82, or 5.3%, settling at $67.66 a barrel.

U.S. West Texas Intermediate (WTI) crude dropped $3.75, or 5.5%, to $64.76 per barrel.

These price movements mark a substantial shift after recent volatility driven by the conflict.

The Ceasefire Agreement: A De-escalation Catalyst

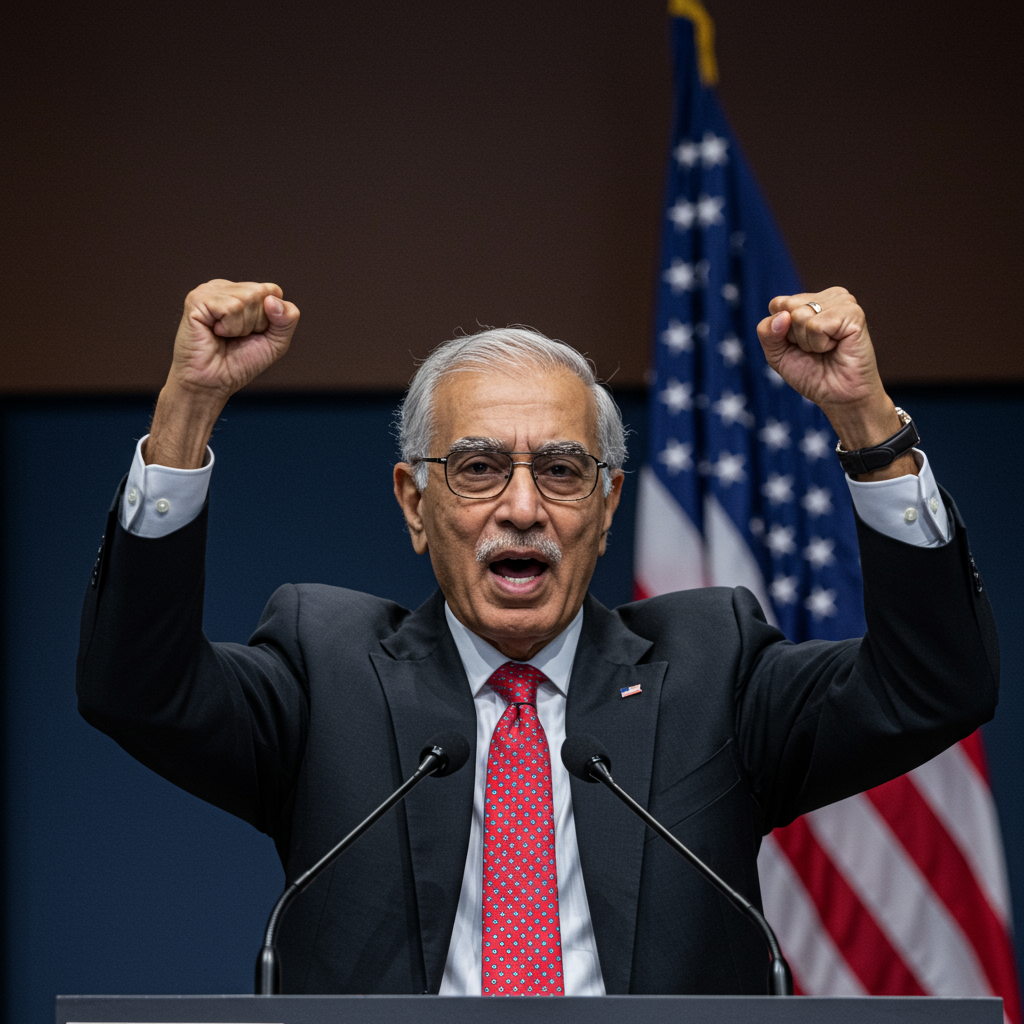

The catalyst for the market sell-off was the announcement of a ceasefire agreement facilitated by U.S. President Donald Trump. According to a statement from Prime Prime Minister Benjamin Netanyahu’s office, Israel agreed to Trump’s proposal after stating it had achieved its military objectives, specifically neutralizing Tehran’s nuclear and ballistic missile threats.

President Trump had previously announced the agreement on Monday, detailing a phased implementation: Iran was to begin the ceasefire immediately, followed by Israel after 12 hours. If peace holds, the 12-day conflict is slated to officially end after 24 hours. Trump characterized the agreement as a “complete and total” ceasefire aimed at ending hostilities between the two nations.

Why the Market Reacted So Sharply

The news of a potential de-escalation quickly unwound the “risk premium” that had been priced into crude oil during the height of the conflict.

Reduced Supply Disruption Fears: The primary driver was the significant reduction in concern over potential disruptions to oil supply from the Middle East.

Strait of Hormuz Relief: Investors had been particularly focused on the Strait of Hormuz, a vital chokepoint through which a substantial portion of the world’s oil supply passes. Fears that the conflict could impede traffic through this strait, potentially catapulting prices upwards, have now receded.

Potential for Increased Supply: Iran, a major OPEC producer, could potentially increase its oil exports if tensions ease and sanctions (or self-imposed limitations due to conflict) are relaxed, adding more barrels to the global market.

Market analysts echoed this sentiment. Priyanka Sachdeva, a senior market analyst at Phillip Nova, noted that if the ceasefire holds, investors might anticipate a “return to normalcy” in the oil market. She emphasized that the extent to which both sides adhere to the ceasefire terms will be crucial for future price movements.

Tony Sycamore, an analyst at IG, stated that the risk premium built into oil prices during the previous week’s conflict fears had “all but evaporate[d]” following the ceasefire news.

Context: Reversal from Recent Highs

The sharp decline comes just one session after both Brent and WTI had settled over 7% higher*, rallying to five-month peaks. That previous surge was fueled by heightened fears of a broadening conflict, particularly after the U.S. conducted attacks on Iran’s nuclear facilities over the weekend, bringing direct U.S. involvement into play.

Looking ahead, Sycamore also commented on the technical picture, suggesting that the overnight sell-off reinforced significant resistance levels for crude oil prices between approximately $78.40 and $80.77. He indicated that it would likely take a highly unexpected and detrimental supply event for crude oil to break through these price barriers.

For now, traders are taking a breather from the recent surge, reacting positively to the prospect of de-escalation in the Middle East.