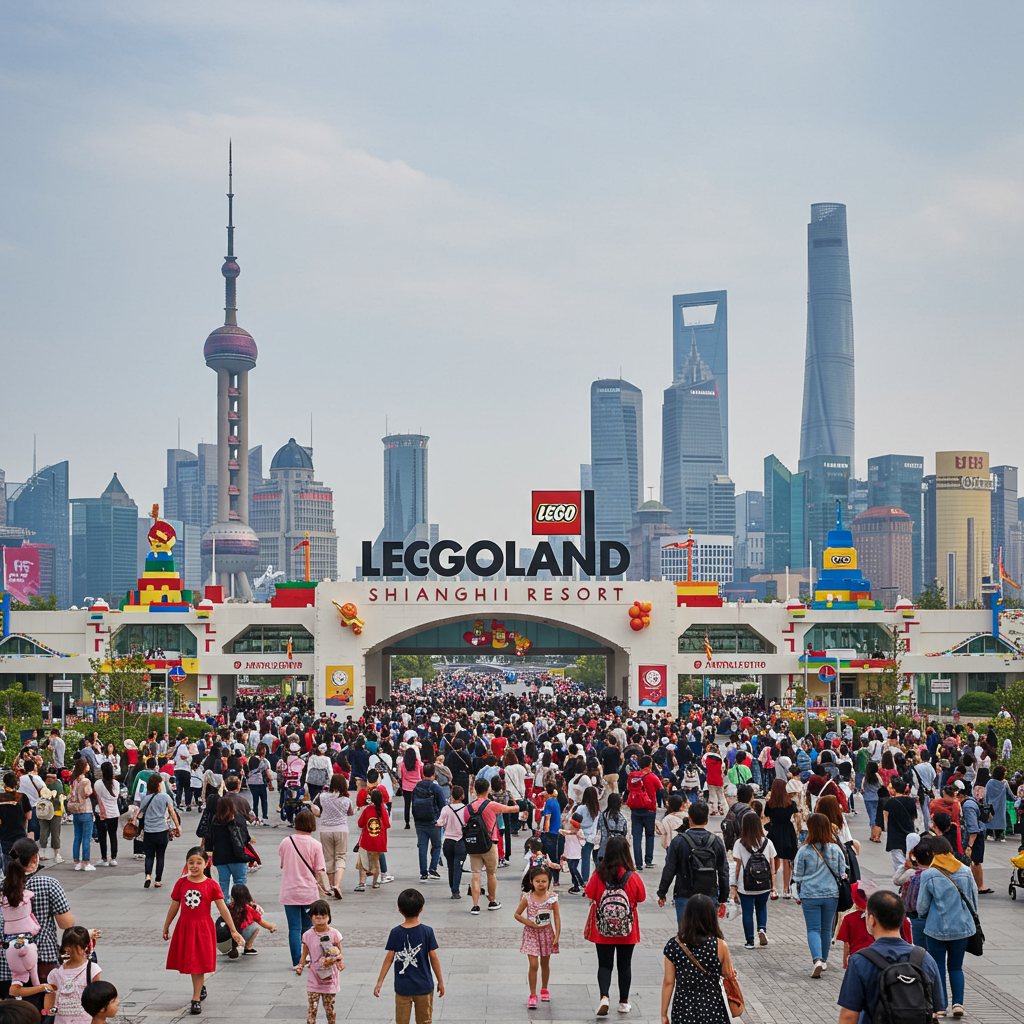

shanghai is now home to the world’s largest Legoland resort, a massive new addition opening its gates this week. This ambitious project by operator Merlin Entertainments arrives at a complex time for China’s amusement park market. Unlike the booming conditions that greeted Disneyland’s Shanghai debut in 2016, the landscape today is significantly different. The new Legoland Shanghai faces an uphill battle attracting the necessary crowds in an economy marked by more frugal consumer spending and intense competition.

Construction on the Legoland Shanghai Resort began during a period when Chinese tourism showed strong signs of rebounding after the pandemic. theme park tickets were selling out quickly during major holidays, signaling robust demand. However, market conditions have shifted. Today, amusement destinations across China are reportedly generating less revenue than they once did.

China’s Crowded Theme Park Landscape

China has experienced a significant surge in theme park development over the past decade. Fueled by a growing middle class and government support for tourism, both international giants and domestic players have invested heavily. This has led to what many analysts describe as a “glut” – an oversupply of parks vying for visitor attention and spending. Cities, especially major hubs like Shanghai, boast multiple large-scale entertainment options.

Attracting visitors requires significant investment in unique experiences and continuous innovation. Parks must compete not just on rides and attractions, but also on pricing, service quality, and the overall visitor experience. With consumers now more cautious about discretionary spending, the value proposition of a theme park ticket is under increased scrutiny. This presents a substantial challenge for newcomers like the Legoland Shanghai Resort.

Navigating a Frugal Consumer Climate

The current economic climate in China sees consumers prioritizing essential spending and being more hesitant about large leisure expenditures. This stands in contrast to the enthusiastic spending seen in the years following the 2016 Disneyland opening. At that time, a burgeoning consumer class was eager for new, high-quality entertainment experiences. While demand still exists, it is tempered by economic realities and a greater awareness of value.

Merlin Entertainments, as the operator of Legoland parks globally, brings significant expertise. However, adapting their global strategy to the specific nuances of the contemporary Chinese market will be critical. Understanding local consumer preferences, pricing sensitivity, and the competitive pressures from existing domestic and international parks is paramount. The sheer scale of the Shanghai Legoland offers potential advantages, but size alone does not guarantee success.

The success of theme parks in China often depends on their ability to become must-visit destinations that attract both local repeat visitors and tourists from other regions. Building brand loyalty and creating unique seasonal events or attractions can help drive attendance throughout the year, mitigating reliance solely on holiday peaks. Marketing efforts must effectively communicate the unique appeal of Legoland Shanghai amidst a sea of entertainment options.

Developing successful concession strategies, managing operational costs efficiently, and responding swiftly to market trends are also vital components. In a crowded market with price-sensitive consumers, operational excellence is not just about visitor experience; it’s crucial for financial viability. The performance of the new Legoland will be a key indicator of the health and potential of China’s current theme park industry.

The Competitive Edge: What Makes Legoland Shanghai Unique?

Legoland parks are known for their distinct focus on the beloved Lego brand, offering interactive experiences, detailed brick models, and rides themed around Lego universes. This strong brand identity provides a potential advantage. Unlike generic amusement parks, Legoland has a built-in fan base and a clear target demographic: families with young children. Highlighting these unique, brand-specific elements will be crucial in their marketing efforts in China.

Creating immersive lands based on popular Lego themes and offering building experiences can differentiate Legoland Shanghai from competitors. Many Chinese theme parks offer thrill rides or broad cultural shows. Legoland’s niche focus on creativity, imagination, and family interaction centered around building toys provides a specific appeal that other parks may not replicate. Successfully communicating this distinct value proposition is key.

Another factor influencing success is location and accessibility. The resort’s specific site in Shanghai will impact how easily visitors can reach it, both from within the city and surrounding areas. Integration with local transportation networks and potential package deals with accommodation will play a role in attracting and facilitating visits, particularly for families traveling with children.

Ultimately, the performance of Legoland Shanghai will serve as a test case for the current state of China’s theme park market. Its ability to thrive despite the crowded landscape and cautious consumer spending will offer valuable insights into the resilience and future potential of large-scale entertainment investments in the region. It highlights the evolving dynamics of consumer behavior and the increasing sophistication required to succeed in China’s competitive leisure industry.

Frequently Asked Questions

Why is the new Legoland in Shanghai called the world’s largest?

The Legoland Shanghai Resort is designated as the world’s largest Legoland park based on its reported size and scale upon opening. While specific dimensions weren’t detailed, this title implies it surpasses other Legoland locations globally in terms of area, number of attractions, or overall development scope. This scale is intended to offer a comprehensive experience to visitors.

What challenges does the Shanghai theme park market currently face?

The Shanghai and broader Chinese theme park market is currently challenged by a significant number of competing parks, creating an oversupply situation or “glut.” Additionally, recent shifts in consumer behavior mean people are spending more cautiously on discretionary entertainment like theme park visits, making it harder for parks to attract consistent large crowds compared to previous years.

How might Legoland Shanghai attract visitors despite market competition?

To succeed in a crowded market, Legoland Shanghai will likely focus on its unique brand identity centered around Lego. This includes offering exclusive Lego-themed attractions, interactive building experiences, and targeting families with young children specifically. Effective marketing highlighting its distinctiveness, strategic pricing, and potentially operational efficiencies will also be crucial.

In conclusion, the debut of the world’s largest Legoland in Shanghai marks a significant moment for Merlin Entertainments and China’s tourism sector. While leveraging a globally recognized brand, the park enters a highly competitive and economically sensitive environment. Its performance will be closely watched as an indicator of market resilience and the strategies needed for success in a mature, yet challenging, Chinese theme park landscape.

Word Count Check: 831