The U.S. stock market concluded Monday’s trading session on a high note. Major indexes surged, pushing the S&P 500 and Nasdaq Composite to fresh record highs. The Dow Jones Industrial Average also posted significant gains. This broad market rally capped a strong performance for the second quarter and the month of June. investors cheered positive developments on trade policy and growing optimism regarding potential Federal Reserve interest rate cuts.

Market Indexes Reach New Peaks

Stock indexes continued their upward momentum, extending a rally that has now lasted for several months. On Monday, the S&P 500 climbed approximately 0.5%. This pushed the benchmark index past the 6,200 mark, setting a new all-time record. The Nasdaq Composite, heavily weighted towards technology stocks, also advanced about 0.5% to reach its own historic peak. The Dow Jones Industrial Average gained around 275 points, or 0.6%, adding to the bullish sentiment. This performance built on impressive second-quarter results, where the S&P 500 rose nearly 11%, the Nasdaq soared 18%, and the Dow added 5%. June also saw solid gains, with the S&P 500 up 5%, Nasdaq 6.6%, and the Dow 4.3%. The market has shown remarkable resilience, recovering significantly from an early April dip.

Drivers Behind the Rally

Several factors contributed to the market’s positive trajectory. Easing geopolitical tensions, specifically a cease-fire between Israel and Iran, helped improve investor confidence. Progress on U.S. trade agreements also provided a boost. A notable development was Canada’s decision to withdraw its proposed digital services tax. This move came just ahead of the first scheduled payments and followed recent trade discussions. The withdrawal eased tensions with the U.S., which had threatened to end trade talks. This contrasted with the UK, which reportedly plans to keep its similar tax despite U.S. pressure. Another key driver is increasing optimism that the Federal Reserve may begin cutting interest rates in the coming months. Some analysts are now forecasting an earlier start to rate reductions.

Market Futures and Overnight Trading

Looking ahead to Tuesday’s session, Dow Jones futures, S&P 500 futures, and Nasdaq 100 futures traded with minimal changes overnight. Futures trading activity before the market opens doesn’t always dictate the direction of the regular session. However, it provides an early indication of market sentiment. Investors will be watching for follow-through on Monday’s gains.

Key Stock Movers in Focus

Individual stocks showed notable movements on Monday. Several prominent companies reacted to specific news or broader sector trends.

Technology and Growth Stocks

Palantir Technologies (PLTR) stock saw a significant jump, rising more than 4%. The data analytics company reportedly rejoined the IBD Leaderboard after a volatile period. This rebound was partly attributed to its resilience and inclusion in index rebalancings. Adding to its positive momentum, Palantir announced a partnership with Accenture. They plan to collaborate on AI-powered solutions, particularly for the federal government. Palantir remains a strong performer year-to-date among S&P 500 constituents.

Fellow “Magnificent Seven” stocks had mixed performance. Apple (AAPL) rallied 2%. This allowed shares to decisively regain their 50-day moving average. Reports suggested Apple might use external AI models from companies like OpenAI or Anthropic for a future version of Siri. This potentially shifts strategy away from purely in-house technology for this project. However, Apple also faced challenges; a U.S. judge denied its bid to dismiss an antitrust lawsuit alleging the company hinders rivals and consumer choice through its control over devices and app distribution.

Amazon (AMZN) shares declined 1.8% on Monday. Despite the dip, the e-commerce and cloud giant remained near buy range following a recent breakout. Alphabet (GOOGL) also saw a slight dip.

Tesla (TSLA) stock continued a losing streak, skidding another 1.8% on Monday. Shares pulled back towards key moving averages. The decline extended into extended trading hours after CEO Elon Musk posted criticism of a large spending bill on X (formerly Twitter). He described the bill, which increased the debt ceiling, as excessive. Investors are now keenly awaiting Tesla’s global second-quarter vehicle delivery and production data. This announcement is expected on Wednesday. Analysts surveyed by FactSet anticipate deliveries around 390,000 vehicles for the quarter. This figure would represent a 12% decrease from a year ago but a roughly 16% increase compared to the first quarter’s total.

Robinhood Markets (HOOD) surged nearly 13%. The trading platform’s shares hit a new high, extending significantly past a previous buy point.

Other notable tech-related movers included Hewlett Packard Enterprise (HPE) and Juniper Networks (JNPR). Their shares soared after the Department of Justice approved HPE’s $14 billion acquisition of Juniper. The approval requires divestitures and open-sourcing of some technology. This deal aims to bolster HPE’s position in the AI market. MicroStrategy (Strategy), known for its substantial Bitcoin holdings, gained over 5%. The company announced another large purchase of Bitcoin, adding nearly 5,000 coins. This brings their total holdings to a significant amount, purchased as part of a long-term strategy through equity raises.

Financial Sector Strength

The financial sector showed strength following the Federal Reserve’s annual stress test results. Released late Friday, the tests indicated major U.S. banks are well-capitalized. They were found resilient enough to easily withstand a severe recession scenario. Shares of major banks like Goldman Sachs (GS), JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) all rose. Goldman Sachs and JPMorgan Chase reportedly reached all-time highs.

Other Notable Stocks

Shares of First Solar (FSLR) jumped 8.8%. While some federal tax credits for rooftop solar face potential changes, a proposed Senate bill includes taxes on imported renewable energy gear. This could benefit U.S. manufacturers like First Solar. Lithium miner Albemarle (ALB) fell 3.5%, continuing to reflect the prolonged slump in lithium prices despite industry cost-cutting efforts. Oracle (ORCL) shares surged about 5% to an all-time high. The company’s CEO highlighted a strong start to the fiscal year, driven by cloud deals. One deal is expected to contribute significantly to annual revenue in future years.

Economic Calendar and Market Outlook

Beyond individual stock stories, investors are monitoring upcoming economic data. The most significant report this week is Thursday’s jobs report from the Labor Department. Economists expect the unemployment rate to rise to 4.3% in June. This would mark a four-year high. Forecasters also anticipate a gain of 115,000 nonfarm jobs overall. The private sector is projected to add 125,000 jobs, while the government sector may shed 10,000. The stock market will be closed on Thursday for the July 4 holiday.

Market sentiment continues to be bullish. Technical analysis suggests the S&P 500 has resumed its long-term uptrend. Some analysts point to potential overhead price targets. Key support levels are also identified. With the market in rally mode, many advisors suggest investors look for strong stock breakouts past correct entries. Resources like IBD MarketSurge’s lists highlight stocks showing bullish patterns and nearing buy points.

Other Market Indicators

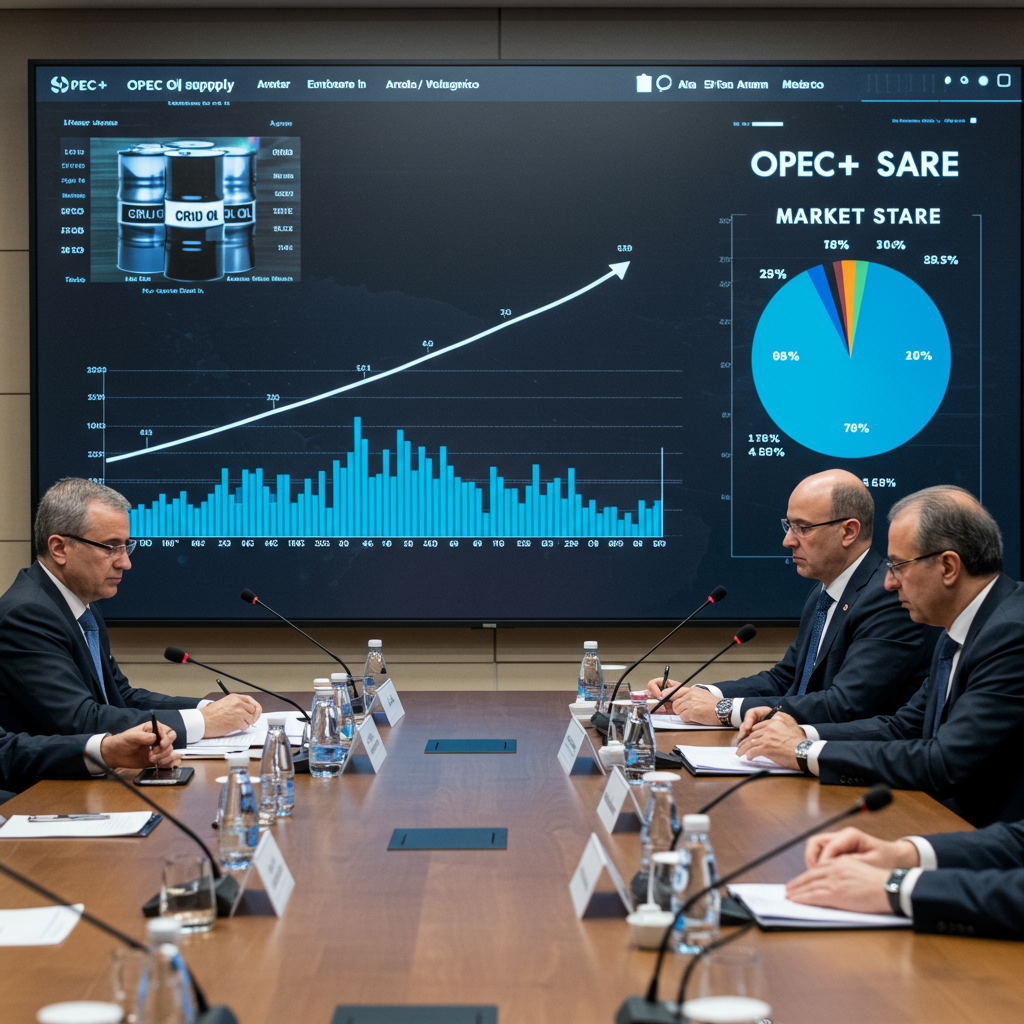

Alongside equity movements, other market indicators showed changes. The yield on the 10-year U.S. Treasury note ticked lower Monday. It settled around 4.23%, its lowest level since early May. Oil prices also eased. West Texas Intermediate futures settled near $65 a barrel, down slightly on the day. This represented a pause after prices had surged earlier due to geopolitical concerns. Gold futures were up 0.8%, trading around $3,315 an ounce. The U.S. dollar index fell to a three-year low. Bitcoin traded around $107,400, showing little change.

Frequently Asked Questions

Why Did the S&P 500 Hit a New Record High?

The S&P 500 reached a new record high primarily due to strong investor optimism fueled by multiple factors. Progress in U.S. trade talks, specifically Canada’s withdrawal of a digital services tax, eased market tensions. Additionally, hopes for potential interest rate cuts by the Federal Reserve in the near future boosted sentiment. Easing geopolitical concerns also contributed to a more positive outlook among investors.

How Did Trade News Impact the Stock Market Rally?

Trade news, particularly the decision by Canada to withdraw its proposed digital services tax just before its implementation, significantly influenced the stock market rally. This move was seen as easing trade tensions with the United States. Following discussions, both countries agreed to continue trade talks, reducing uncertainty. This positive development was cited as a key reason for the broad market rally on Monday, especially benefiting major indexes like the Dow Jones Industrial Average and S&P 500.

What Important Economic Reports Are Expected This Week?

The most anticipated economic report this week is the U.S. jobs report from the Labor Department. It is scheduled for release on Thursday. Economists are forecasting an increase in the unemployment rate to 4.3% for June. They also expect a net gain of approximately 115,000 nonfarm jobs for the month. This report provides crucial insight into the health of the labor market, which is closely watched by investors and the Federal Reserve.

This market activity reflects a dynamic environment influenced by economic data, corporate news, and global events. Investors are navigating these factors while observing key technical levels and awaiting upcoming reports that could signal the market’s next moves.